- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/CAD bulls seeking a test of 1.28 as oil bleeds out with a focus on Russian troops pulling back

USD/CAD bulls seeking a test of 1.28 as oil bleeds out with a focus on Russian troops pulling back

- USD/CAD bulls are making progress on a daily time frame for a test of 1.2800.

- Oil markets are vulnerable to the Russian premium dissolving.

- All eyes will turn to Canadian inflation with hawkish sentiment at BoC brewing.

USD/CAD has been trading between 1.27 the figure and 1.2774 on Tuesday, thrown around within the range on headlines related to the risk of a Russian invasion of Ukraine. initially, CAD rose against the greenback as fears eased that Russia would invade Ukraine. However, as noted in an article in Asia, USD/CAD traders turn to oil prices for direction, energy markets are in the driving seat.

A pullback in oil prices has dented the performance of the CAD after prices fell off seven-year highs early on Tuesday. In a signal that Russia may be open to a diplomatic solution in order to avert heavy economic sanctions it would otherwise suffer if it were to invade its neighbour, markets are relieved and the premium in oil is bleeding out.

West Texas Intermediate crude for March delivery was last seen down US$2.51 to US$92.95 per barrel, while April Brent crude, the global benchmark, was down US$2.28 to US$94.20.

Reuters reported, in relation to news in the Guardian, that ''after meetings in Moscow Monday between Russian President Vladimir Putin and German Chancellor Olaf Scholz, Russia said it is returning some troops station on the Ukrainian border to base. However, NATO Secretary-general Jens Stoltenberg told reporters on Tuesday that the alliance has yet to see any significant de-escalation from Moscow.''

As for the impact in the oil markets, nearly 5-million barrels per day of Russian oil exports are at stake. Russia could also weaponize its energy exports to prevent severe sanctions. This has led to a colossal bid in oil of late, sending prices to their highest since the autumn of 2014. However, as analysts at TD Securities argue, In turn, energy prices still appear tactically vulnerable to de-escalation in Russian-Ukrainian tensions.''

As for domestic data, Canadian Housing Starts fell 3% in January compared with the previous month. This was a weight for the currency ahead of Canada's inflation report for January, due on Wednesday. This is expected to

give more clues on the outlook for Bank of Canada interest rate hikes. The CAD has been befitting from prospects a rate hike next month, a move that will break the status quo that has been in place at the BoC since October 2018. Subsequently, in the anticipation of a more hawkish outlook at the central bank, Canadian government bond yields remain higher across the curve, tracking the move in US Treasuries. The 10-year was up 3.1 basis points at 1.937%, after touching on Friday its highest level in nearly three years at 1.961%.

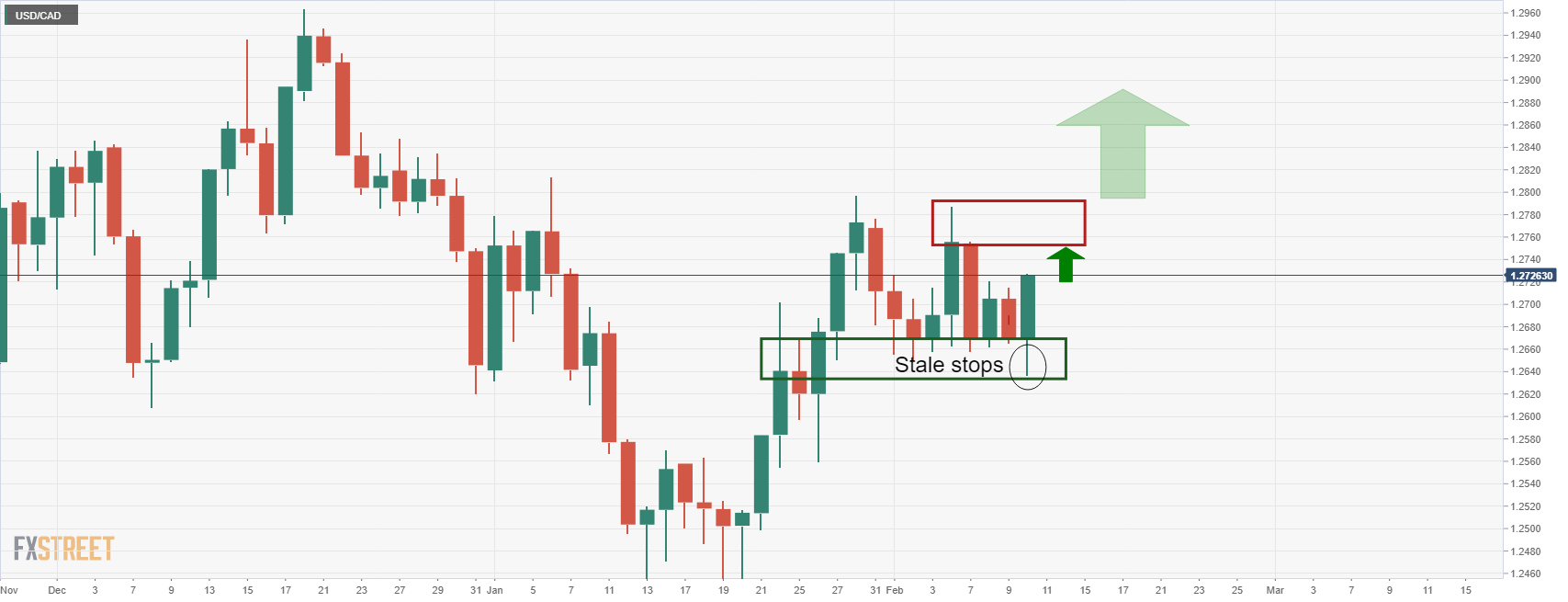

USD/CAD technical analysis

The outlook is bullish from an hourly perspective as follows:

The price has met a 50% mean reversion and is being held up at old resistance. This would be expected to lead to a fresh wave of demand to take the pair to fresh hourly highs.

From a more boarder perspective, as illustrated in the prior analysis as follows, the bulls still need to get over the line at 1.28 the figure:

USD/CAD bulls making progress

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.