- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- AUD/JPY Price Analysis: Bears take up arms to challenge the bulls at critical levels

AUD/JPY Price Analysis: Bears take up arms to challenge the bulls at critical levels

- AUD/JPY bears sink in their teeth and are plenty hungry.

- The Ukraine crisis has been turned up a notch and the cracks in risk sentiment and flowing through to the yen.

As per the prior analysis of AUD/JPY, as illustrated in the following article that warned of prospects of a turn in risk appetite due to blatant prospects of escalated tensions surrounding, the Ukraine crisis has started to play out as warned:

- If Russia does invade Ukraine, this could finally spark off the crash 'puts' have been telegraphing

AUD/JPY structure and a blueprint for potential price trajectory were drawn out on the daily chart with a bearish bias as follows:

AUD/JPY, daily chart, prior analysis

''If there is going to be a meaningful move in sentiment, the forex markets risk barometer, AUD/JPY, that is retesting the daily counter-trendline, could be shaken out of its tree in the coming days. Eyes will be on whether it can take out the recent lows of 82.12: ''

AUD/JPY live market analysis

Meanwhile, although we saw a secondary breach of the resistance in Asia and European sessions amidst a market that continued to price more benign outcomes of the crisis, the price has indeed succumbed to the growing angst:

Given the latest escalation of the Ukraine crisis, it would only be fair to forecast a more extreme outcome in price action that might be representative of the grave troubles that lie ahead for the global economy. After all, the volatility on the pair today has seen the price move between a range of 80 pips, most of which occurs in the first half of the New York session.

What is key to acknowledge on the daily chart is the prospect of today's close leaving an accompanying double top wick, similar in length to that of 10 Feb. If the price is to react to the news feeds just as it did on Feb 10, when UK Foreign Secretary Liz Truss and Russian FM Sergey Lavrov held fruitless talks, in the first signs that diplomacy was never going to be an option, then it wouldn't be too ambitious to expect a similar 2% follow through to the downside in the coming days.

-

USD/JPY's Price Analysis: Weekly and daily pin bars are highly bearish

If there risk sentiment continues to be beaten down into the end of the week, taking into consideration the bearish market structure in USD/JPY as well, along with a less hawkish outlook for the Reserve Bank of Australia, then we could see the makings of a bearish structure below the counter trendline once again resulting in a bearish M-formation, as illustrated on the drawings above. The key levels in this respect are 83.05, 82.50 and 82.12 with 81.50 as the longer-term, target.

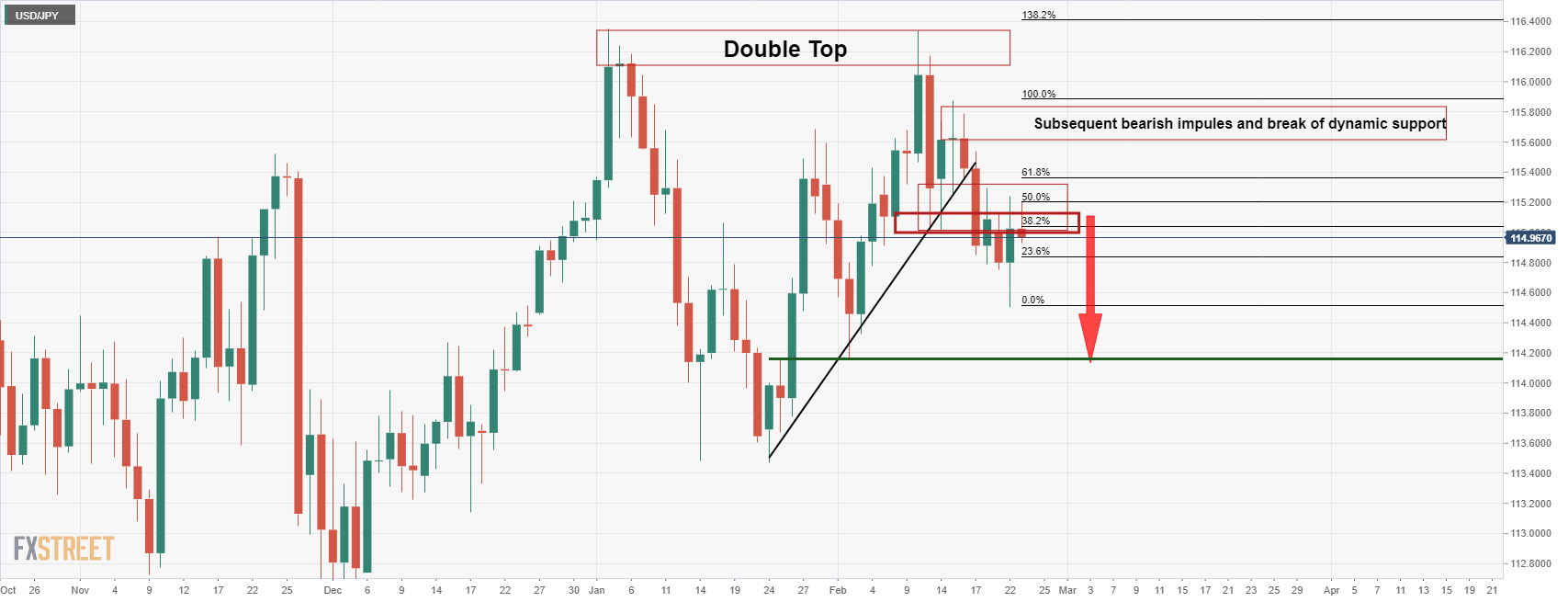

USD/JPY daily chart

''The above analysis, as per USD/JPY's Price Analysis: Weekly and daily pin bars are highly bearish, illustrates the bearish bias given the series of bearish events in price action since the double top was accompanied by a bearish engulfing close on Feb. 11. We have since seen a break of the trendline support and retests back into the cluster of offers below 115.30.

The price is failing there and near a 50% mean reversion of the bearish impulse that broke the dynamic support. This leaves the attention on the downside towards 114.20 for the days ahead as the last defence for much lower levels.''

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.