- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD holds below $2,000 with peace talks eyed

Gold Price Forecast: XAU/USD holds below $2,000 with peace talks eyed

- Gold consolidates the mid-week volatility, holding below $2,000.

- The gold price fell from a significant level on the weekly chart.

- Eyes are now on US CPI data as the next potential catalyst and Ukraine crisis developments.

Gold suffered heavily amid better risk sentiment on Wednesday. The precious metal fell back below $2,000/oz after it had reached a 19-month high at the start of the week.

Spot gold fell 3.3% to $1,976 per ounce, snapping a rally that took it near the August 2020 all-time high. U.S. gold futures settled down 2.7% at $1,988.20. The reversal was driven by profit-taking as well as a sharp drop in oil prices that gave the green light for buyers to pick up bargains in the stock markets on stocks that had otherwise been hammered by concerns over sanctions on Russia.

Fighting continued as a Russian airstrike badly damaged a children's hospital in the besieged Ukrainian port city of Mariupol on Wednesday. However, risk sentiment improved as oil prices fell heavily after the United Arab Emirates said the OPEC member would support boosting output. Brent oil plunged from $131.50bbls to a low of $105.91bbls. At the start of the week, the price had reached a high of $138.03bbls in a market in disarray due to the supply disruptions caused by sanctions imposed on Russia as a result of the conflict.

Peace talks that could crack the door open to a permanent cease-fire

On Thursday, Foreign Minister Sergey V. Lavrov of Russia is expected to meet his Ukrainian counterpart, Dmytro Kuleba, in Turkey, in the highest-level talks between the two countries since the war began on Feb. 24.

The New York Times reported that ''in recent days, the language has shifted, with the Kremlin signaling that Mr. Putin is no longer bent on regime change in Kyiv. It is a subtle shift, and it may be a head-fake; but it is prompting officials who have scrambled to mediate to believe that Mr. Putin may be seeking a negotiated way out of a war that has become a much bloodier slog than he expected.''

President Recep Tayyip Erdogan of Turkey, whose top diplomat has held a total of 10 calls with Mr. Lavrov and Mr. Kuleba since the start of the war, said on Wednesday that the meeting between Sergey V. Lavrov and Dmytro Kuleba could “crack the door open to a permanent cease-fire.”

Oil price key for gold

The rally in oil has been a massive cause for concern as markets assess whether the global economy is in for either a stagflationary or inflationary shock. ''The war in Ukraine has significant and obvious implications for commodities prices. But, will implications for inflation be more persistent than for growth? Certainly, global central banks fear one channel of self-reinforcing inflation in particular — inflation expectations could be de-anchored if the shock permeates into the world's psyche,'' analysts at TD Securities explained in that regard.

''Direct implications of the conflict on growth are more limited in the US, but indirect implications could be more relevant as ongoing disruptions to supply chains could have a spillover effect, while inflation is also likely to act as a tax on consumers,'' the analysts added.

''If the shock simultaneously dents consumer sentiment, the Fed will have to walk a tight-rope between its unemployment and inflation targets. In turn, for the time being the market has concluded that the Fed will remain nimble as to not tip the US economy into a recession, but the subsequent rate path and the path for quantitative tightening are less clear.''

''In this context, gold bugs are more likely to benefit from a subsequent rise in central bank demand for gold, having observed the events unfold as potential vulnerabilities for national accounts.''

Gold technical analysis

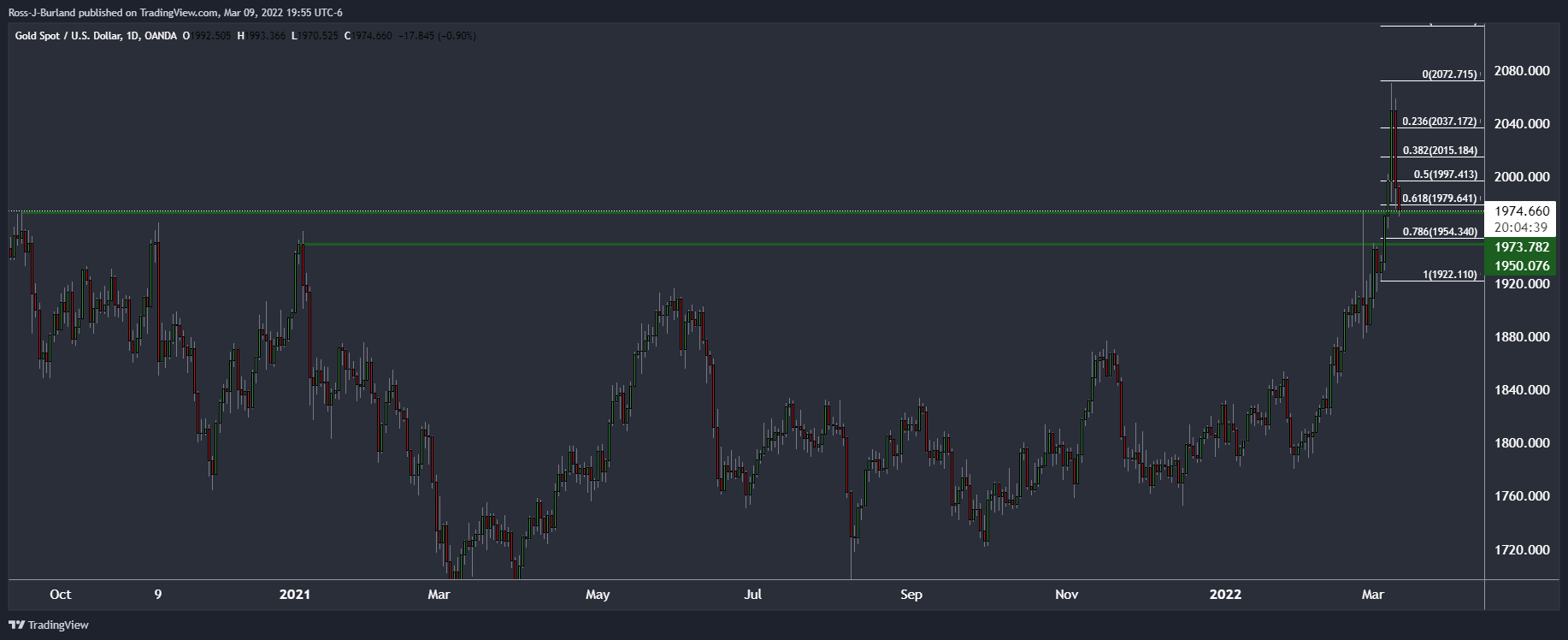

The price of gold has fallen to a familiar area of resistance that is currently acting as support. While the drop was of a magnitude on a single day that could not have been predicted, it did fall from a level previously marked as being significant:

Gold Price Forecast: XAU/USD holds below a key technical -61.8% golden ratio

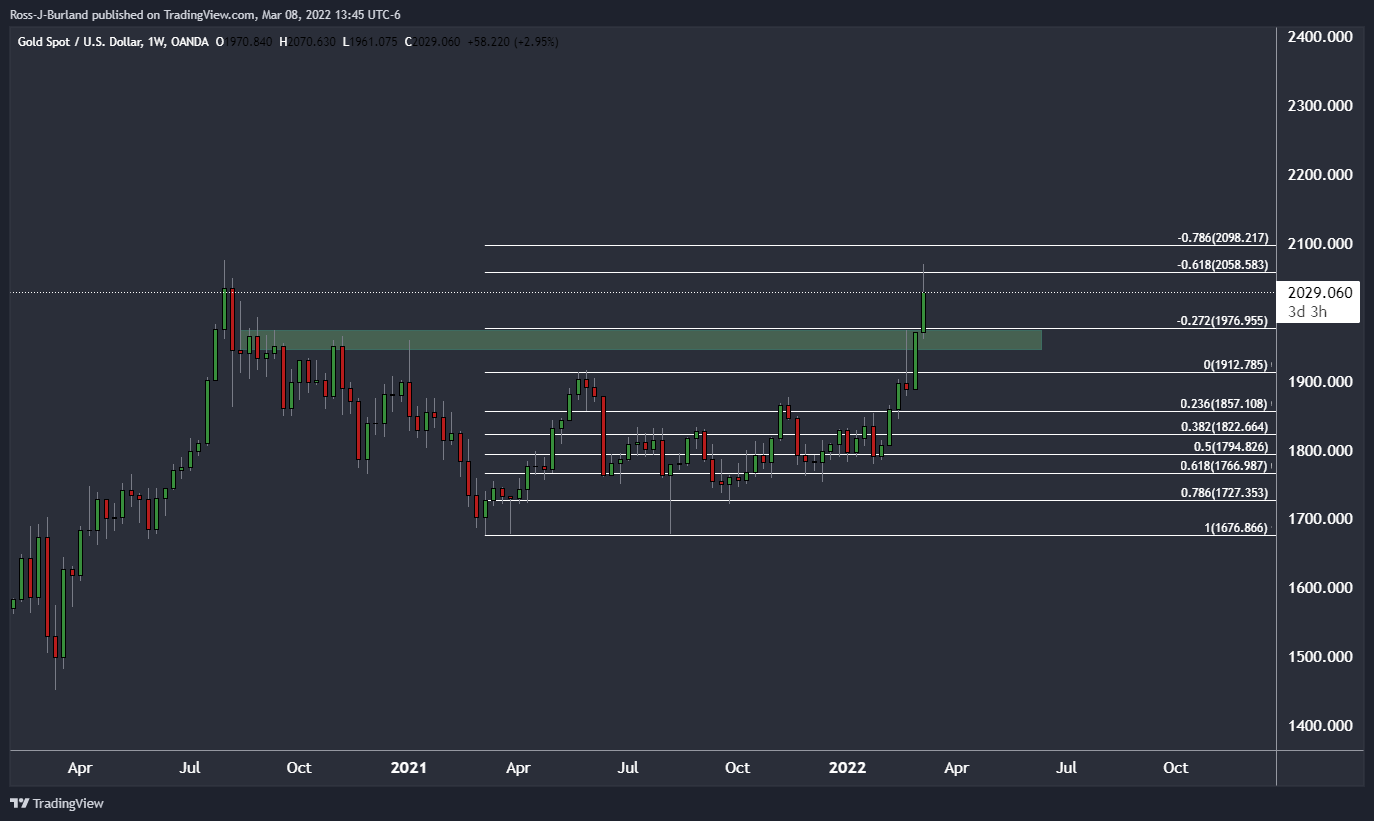

Gold weekly chart

''The weekly chart shows that the price has reached a -61.8% golden ratio of the 2021 range.''

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.