- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- When are the UK jobs and how could they affect GBP/USD?

When are the UK jobs and how could they affect GBP/USD?

UK Jobs report overview

Early Tuesday, the UK’s Office for National Statistics (ONS) will release the February month Claimant Count figures together with the Unemployment Rate in the three months to January at 07:00 AM GMT.

Given the expectations of another rate hike by the Bank of England (BOE), coupled with the upbeat economic growth and inflation fears, today’s jobs report becomes crucial to recall the GBP/USD pair buyers. Also highlighting today’s employment numbers is the cable’s recent corrective pullback from a 16-month low.

The UK labor market report is expected to show that the average weekly earnings, including bonuses, in the three months to January, rise to 4.6% from the previous figures of 4.3%, while ex-bonuses, the wages are seen remaining intact around 3.7% during the stated period.

Further, the ILO Unemployment Rate is likely to ease to 4.0% from 4.1% for the three months ending in January. It’s worth noting that the Claimant Count Change figures may have to cross the -31.9K previous readings to keep buyers hopeful.

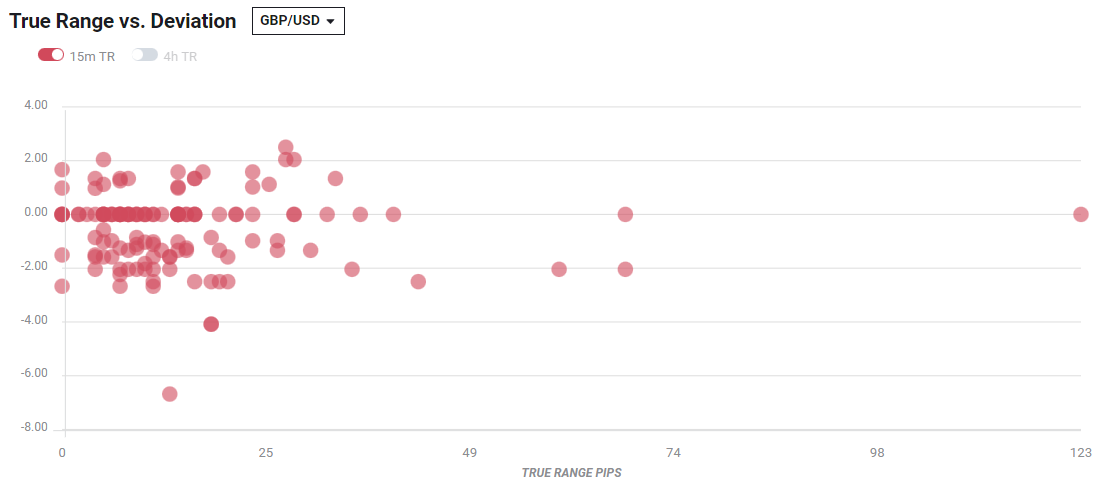

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 60-70 pips.

How could they affect GBP/USD?

GBP/USD cheers softer USD, as well as cautious optimism in the market, to portray a rebound from the lowest levels since November 2020 heading into Tuesday’s London open.

While the recent improvement in British economic growth and firmer inflation data keeps pushing the BOE towards more rate-hikes, today’s employment data need to stay in line to keep the GBP/USD buyers hopeful.

As a result, Westpac says, “The UK’s recovery should continue to edge the ILO unemployment rate lower in January (market forecast: 4.0%).

Even so, major attention is given to the Fed’s rate-hike and hence any disappointment from the UK’s jobs report will be enough to recall the GBP/USD bears.

Technically, the 1.3000 psychological magnet challenges short-term GBP/USD declines ahead of a downward sloping trend line from April 2020, around 1.2950 by the press time. However, recovery remains elusive until crossing 2021 bottom of 1.3160.

Key notes

GBP/USD eyes below 1.3000 on Russia-Ukraine war escalation amid China’s aid to Moscow

GBP/USD Price Analysis: Bulls on the sidelines, watching how the week plays out

About UK jobs

The UK Average Earnings released by the Office for National Statistics (ONS) is a key short-term indicator of how levels of pay are changing within the UK economy. Generally speaking, the positive earnings growth anticipates positive (or bullish) for the GBP, whereas a low reading is seen as negative (or bearish).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.