- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU runs to fresh daily highs in risk-off themes

Gold Price Forecast: XAU runs to fresh daily highs in risk-off themes

- Gold moves higher for a fresh daily high on Wednesday.

- Risk-off is the theme and safe-haven flows are benefitting the gold price.

The price of gold is higher in mid-week trading as US stocks fell sharply following Moscow's plans to switch its natural gas sales to some countries to roubles. This has sent oil prices and tensions higher in global financial markets. At the time of writing, the gold price is trading near the highs of the day at $1,947.25. The yellow metal rallied from a low of $1,915.64 earlier in the day and is set on a fresh daily high and a bullish close.

Responding to Western sanctions that have hit Russia's economy hard, President Vladimir Putin said Moscow will seek payment in roubles for gas sales from "unfriendly" countries, while its forces bombed areas of the Ukrainian capital Kyiv a month into their assault

Prices for commodities such as oil and wheat have climbed as tensions in Ukraine have escalated, putting additional upward pressure on already high inflation due to supply chain bottlenecks. Rising inflation has led many central banks, including the US Federal Reserve, to take measures to rein in prices, such as by raising interest rates. However, gold can also benefit from the safe-haven flows amid the uncertainties surrounding the war.

''Market participants are keenly watching US 10-year rates as they approach a trend-channel that has served multi-decade-long resistance. In this context, gold prices have remained incredibly resilient despite the explosive price action in rates markets following Chair Powell's comments,'' analysts at TD Securities explained.

US 10-year yield trend channel

The above chart illustrates the trend channel as the 10-year yield move sin towards 2.5%.

''While rates markets are now pencilling in higher odds for a 50bp hike in May, gold markets could be reflecting a growing cohort of participants interpreting the Fed's hiking path as being behind the curve on inflation, as the Fed moves too slowly and cautiously to tame inflation,'' the analysts at TD Securities said

''In this context, gold prices once again narrowly avoided catalyzing a massive CTA liquidation program last session, but the margin of safety remains low. Such a liquidation event would raise risks that safe-haven buyers could offload length in a vacuum concurrently with massive CTA liquidations. Fortunately, Shanghai traders have seemingly ended a period of liquidations and have meaningfully added to their gold in recent trading sessions.''

Gold technical analysis

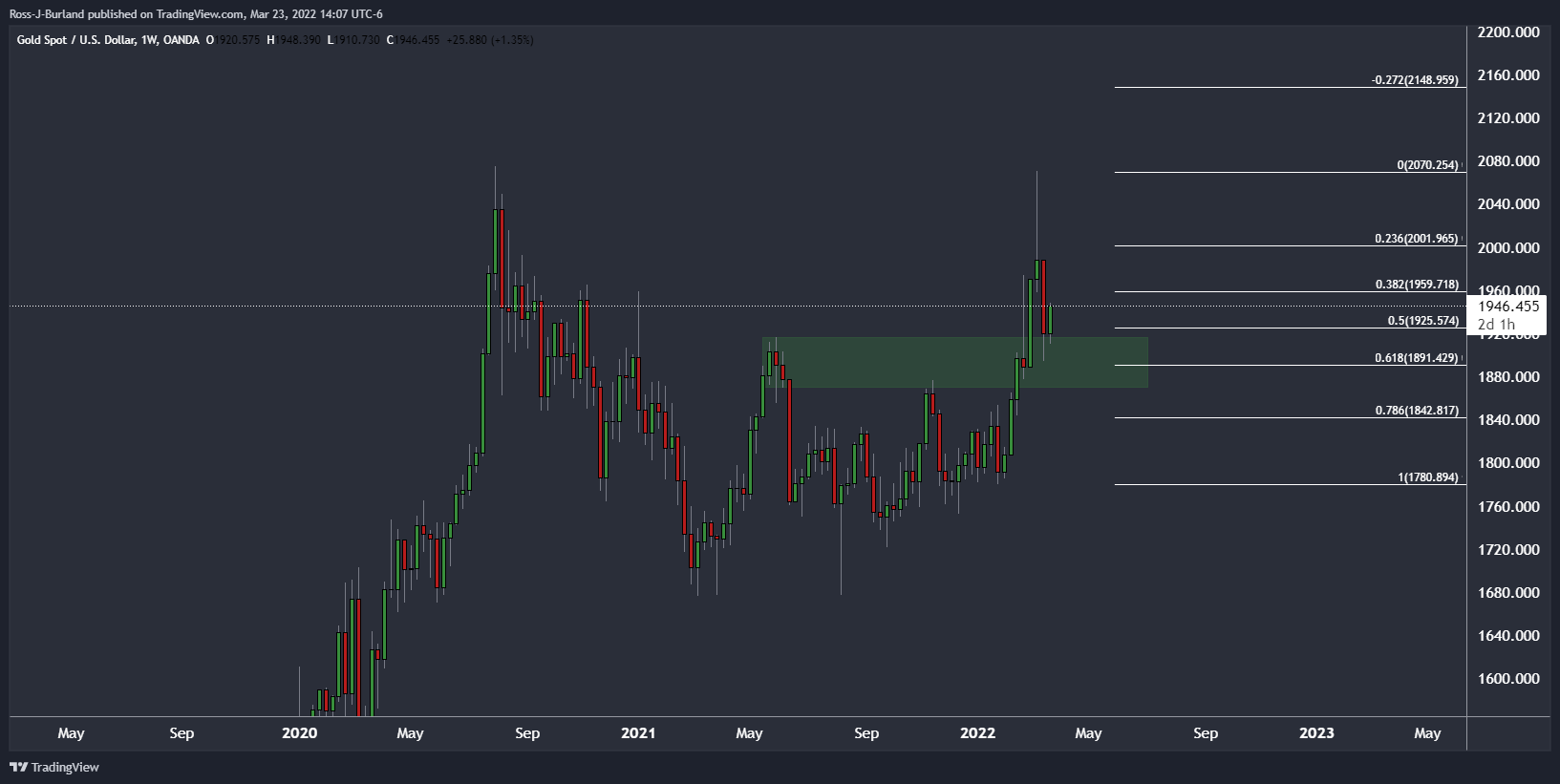

The price is completing a 50% mean reversion of the monthly bullish impulse, as illustrated on the weekly chart where the price meets the prior highs and support block. This could see demand move in again and an extension of the upside in the comings weeks.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.