- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- AUD/USD banging its head on the ceiling, NFP could be the adjudicator

AUD/USD banging its head on the ceiling, NFP could be the adjudicator

- AUD/USD bulls are running into a ceiling of resistance as commodities rise.

- The Ukraine crisis is intensifying, pressuring oil prices higher again.

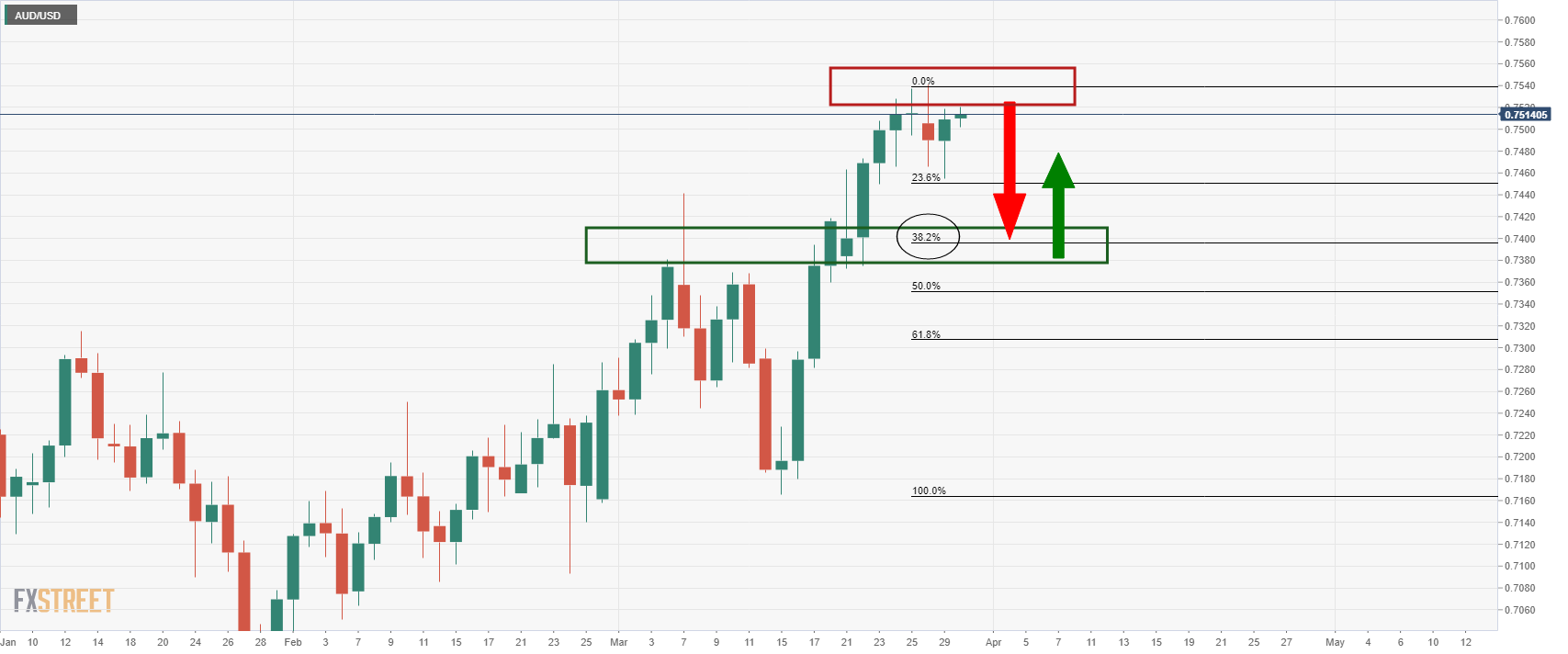

AUD/USD has been stuck in a tight range on the day as the price attempts to move higher to test the resistance on the daily chart, but without conviction so far. At the time of writing, AID/USD is trading at 0.7508 and has chopped between 0.7502 and 0.7536 range so far.

The commodities markets have been given another boost by the prospects of the Ukraine crisis dragging on for longer. The prospects of a cease-fire have been dashed by the latest comments by key officials involved in the war.

The Kremlin on Wednesday has said there was no sign of a breakthrough yet. Ramzan Kadyrov, who is a powerful head of the Russia's republic of Chechnya, said on Wednesday that Moscow would make no concessions in its war in Ukraine and that Kremlin negotiator Vladimir Medinsky had been wrong to suggest otherwise.

Both the Ukraine Defence Ministry and the Polish Deputy Prime Minister crossed the wires and stated that Russia is preparing for a new attack in Ukraine. All indications are that we are facing a long war, Aljazeera Tweeted, quoting the Polish PM. A Ukraine Defence Ministry spokesperson expressed a view that the Russian military continues to aim to take control of Mariupol, a strategic city in the east, saying that a major withdrawal is not taking place, and Russia is ready to resume attacks.

Indeed, on Wednesday, Russian forces bombarded the outskirts of Kyiv and the US administration had warned on Tuesday they were sceptical of Russia’s vow to curtail its military assault on Ukraine, ending the day with a note of caution after hours of peace talks between the two sides appeared to make some headway.

As a consequence, equities ticked down and oil bounced as doubts grew over Russia’s intentions in Ukraine. The Thomson Reuters CRB Index rallied 2.2% with West Texas Intermediate crude in the spot market breaking $108bbl in New York trade. This in turn is supporting the Aussie.

Market pricing remains very responsive to sudden shifts in sentiment and the onset of quarter and month-end is an additional hurdle for markets to contend with. The end of the week's data will be important in this regard to determine whether the US dollar can continue to run higher on both positive economic data and central bank prospects in the face of higher interest rates and a wave of mounting inflation pressures.

On Friday, US Nonfarm Payrolls data will take centre stage as a meanwhile distraction to the Ukraine crisis this Friday. ''Employment likely continued to advance in March following two strong reports averaging +580k in Jan and Feb,'' analysts at TD Securities said.

''That said, we expect some of that boost to fizzle, though to a still firm job growth pace of +350k. Indeed, job gains should lead to a new drop in the unemployment rate to a post-COVID low of 3.7%. We also expect wage growth to slow to a still firm 0.3% MoM pace.''

AUD/USD technical analysis

The price is testing the resistance in the daily chart but is yet to move in to mitigate that imbalance from the bullish rally on the daily chart. Therefore, the bears will be looking for a move to test at least 38.% Fibonacci retracement area that correlated with the prior resistance at the start of March near 0.74 the figure.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.