- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY bears commiting to the move following the Fed, testing key supports

USD/JPY bears commiting to the move following the Fed, testing key supports

- USD/JPY is on the verge of a break of daily and hourly support.

- The Fed has dialled back 75bps rate hikes which has weighed on the US dollar.

At 129.18, USD/JPY is higher by 0.1% and has moved between a low of 129.04 and 129.54 so far. However, the bears are moving in at the time of writing to challenge a significant hourly support structure as the US dollar continues to be pressured following the Federal Reserve.

The US dollar and US Treasury yields were under pressure following the Federal Reserve interest rate decision, statement and the Fed chair's presser. The US 2-year Treasury yield fell by some 5% to a low of 2.612%.

After hiking by 50bps today and formally starting quantitative tightening as the Fed seeks to get a grip on inflation, Jerome Powell gave the green light to a series of additional 50bp hikes but said 75bps was not something that was being considered.

The Federal Reserve is now "highly attentive" to inflation risks and amid “robust” job gains "ongoing increases" in the Fed funds rate will be "appropriate".

The Fed is starting quantitative tightening and the following is the press release with the Fed's plans for reducing the size of the balance sheet was released showing $47.5bn per month that will start on June 1st before getting to a "max" of $95bn in September:

The Committee intends to reduce the Federal Reserve's securities holdings over time in a predictable manner primarily by adjusting the amounts reinvested of principal payments received from securities held in the System Open Market Account (SOMA). Beginning on June 1, principal payments from securities held in the SOMA will be reinvested to the extent that they exceed monthly caps.

For Treasury securities, the cap will initially be set at $30 billion per month and after three months will increase to $60 billion per month. The decline in holdings of Treasury securities under this monthly cap will include Treasury coupon securities and, to the extent that coupon maturities are less than the monthly cap, Treasury bills.

For agency debt and agency mortgage-backed securities, the cap will initially be set at $17.5 billion per month and after three months will increase to $35 billion per month.

The downside in the greenback following the announcements as the Fed delivered the expected 50bp hike was exacerbated when Powell took 75bps rate hikes off the table. This is giving risk appetite a boost and the euro is making a case for a significant multi-week correction that could take place between now and the next meeting in June.

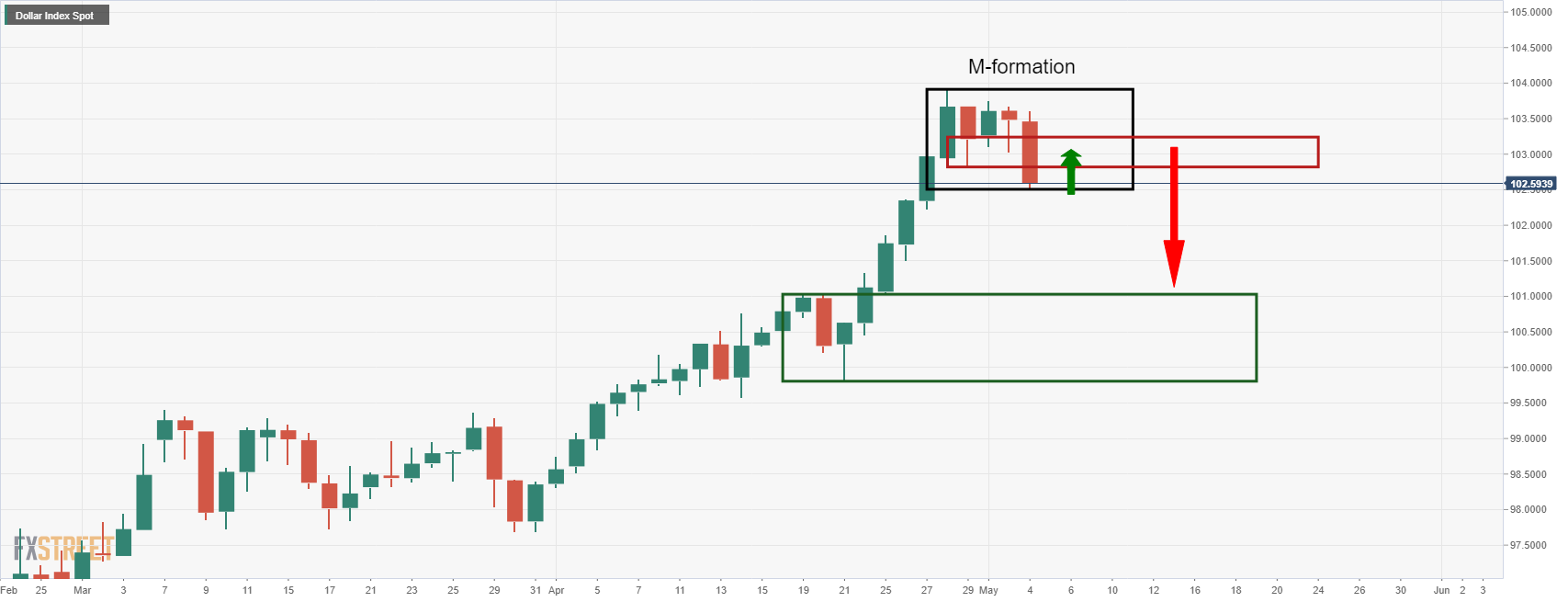

DXY technical analysis

As a consequence, the DXY index which is calculated by factoring in the exchange rates of six foreign currencies vs. the greenback is set up for a move that could extend as far as 101.00 in the coming days/weeks:

The M-formation is a bullish reversion pattern where the price would be expected to retest the neckline, prior to a more significant move to the downside and towards the old resistance structure. However, much will depend on this week's Nonfarm Payrolls data.

''The US payrolls likely stayed solid in April, posting a similar net job gain to that of March,'' analysts at TD Securities said. ''That would be consistent with a gradual slowing of job creation following the 600k average in the six months prior to March. We look for wages to have advanced 0.3% MoM.''

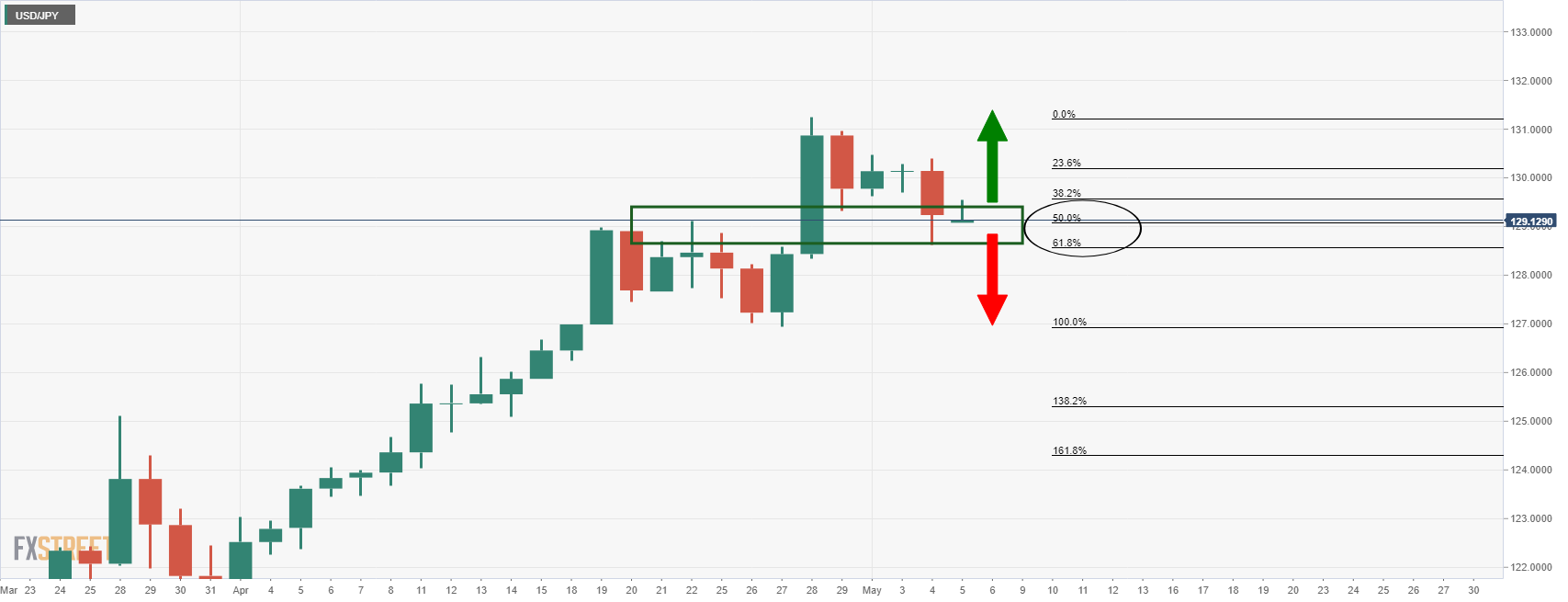

USD/JPY technical analysis

The price is taking on the daily support in a 61.8% ratio correction as illustrated above. However, the hourly support, as below, needs to give if the bears are going to make a break for it. Failures could lead to a bullish continuation in due course.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.