- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD bears firming at critical 38.2% Fibo daily resistance

Gold Price Forecast: XAU/USD bears firming at critical 38.2% Fibo daily resistance

- The price of gold is trying to correct from daily support.

- Bullish correction eyed towards M-formation neckline but bears lurk at a daily 38.2% Fibo.

- US CPI was regarded as a meanwhile relief for financial markets.

At the time of writing, the gold price is some 0.8% higher and correcting from daily support located in the lows of the day at $1,832.07. At $1,853.40, gold is close to the day's highs of $1,858.30. The markets have been centred around US inflation on Wednesday when the Consumer Price Index was released earlier in the North America session.

While the US inflation data reinforces a hawkish sentiment from the Federal Reserve and justifies front loading called for by the Fed's chairman, Jerome Powell, markets were relieved that the data showed a decline in CPI on an annual basis.

CPI climbed 8.3%, higher than the 8.1% estimate but below the 8.5% in the prior month. Also, the index rose just 0.3% last month, the smallest gain since last August, the Labor Department said on Wednesday, versus the 1.2% MoM surge in the CPI in March, the most significant advance since September 2005.

The dollar index, DXY, moved sharply off its lows on the knee jerk as the data came in higher than expected, so it was unlikely to cause the Federal Reserve to adjust its aggressive path of monetary policy. DXY, which hit a four-session low of 103.37 ahead of the report, immediately strengthened to a session high of 104.13 in the wake of the data.

However, the rally came in short of the 20-year high of 104.19 reached on Monday and traders were quick to move in again and sell the US dollar to a fresh season-low of 103.372 before making its way back towards the session highs in a firm but slow bullish drift.

US stocks back under pressure

Markets have digested the data that shows that inflation has slowed, and underlying price pressures remain elevated which is weighing on investor sentiment and US stocks.

''The fact that the CPI is driven by rents and services implies that price pressures are entrenched and may manifest in upward pressure on wages too,'' analysts at TD Securities argued. ''This likely means gold traders will expect the Fed to step up their hawkish signals.''

The Dow Jones Industrial Average fell 0.8% giving up earlier gains. The S&P 500 slid 1.3% after increasing 0.5% earlier in the session. The Nasdaq Composite dropped 2.5% and is currently extending intraday declines while the 2-year yield increased to 2.857% and is aligned closely with Federal Reserve's interest rate policy.

''The positive surprise in core prices will not be favourable for currencies not named the US dollar. We think the market is far too premature in reducing the Fed's optionality set for tightening. This should leave the USD resilient for now,'' analysts at TD Securities said.

The bearish outlook for gold

''Given that positioning is still tilted to the long end of exposure, continued higher-than-expected price prints could easily send gold below $1,830/oz in the not too distant future. Higher nominal and real rates along with less liquidity due to QT are the likely financial market catalysts driving gold,'' the analysts at TD Securities explained.

''If prices dip below the $1,830s support levels, technicians could pull the yellow metal down toward the $1790s fairly quickly.''

Gold technical analysis

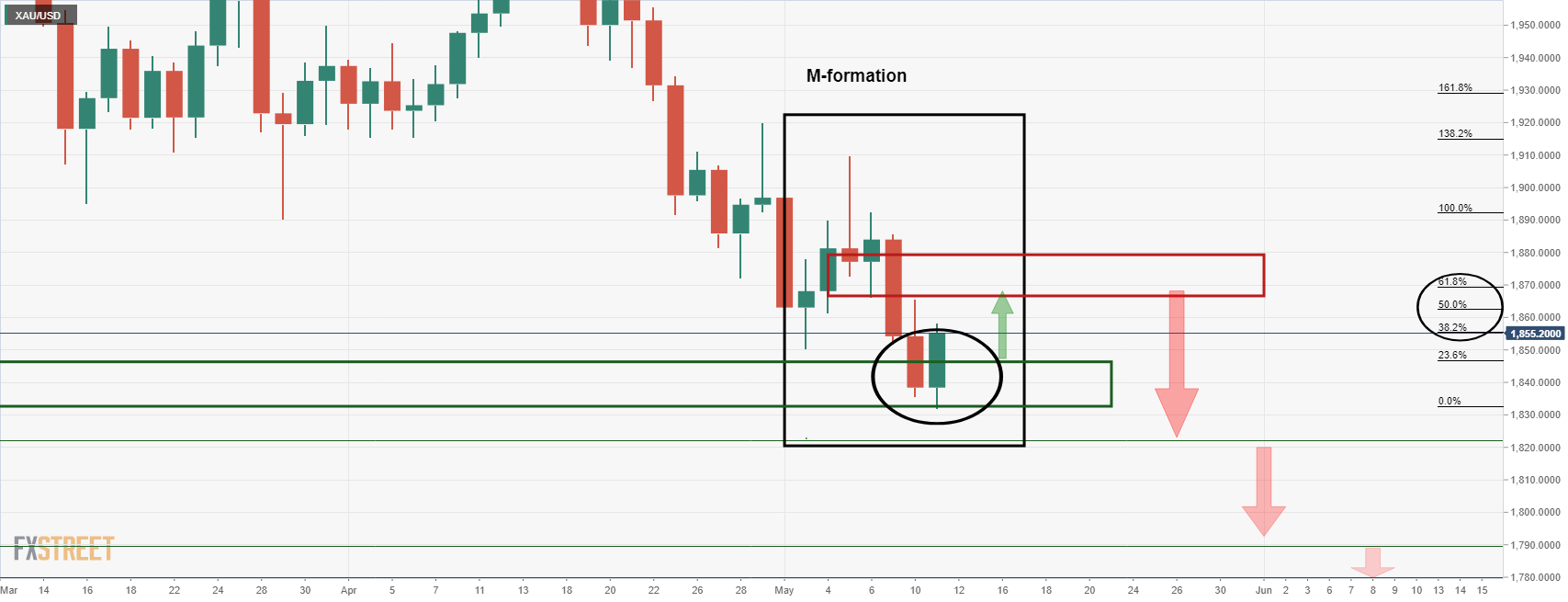

Gold prices had perked up on the news and were moving in on a the M-formation's neckline as follows:

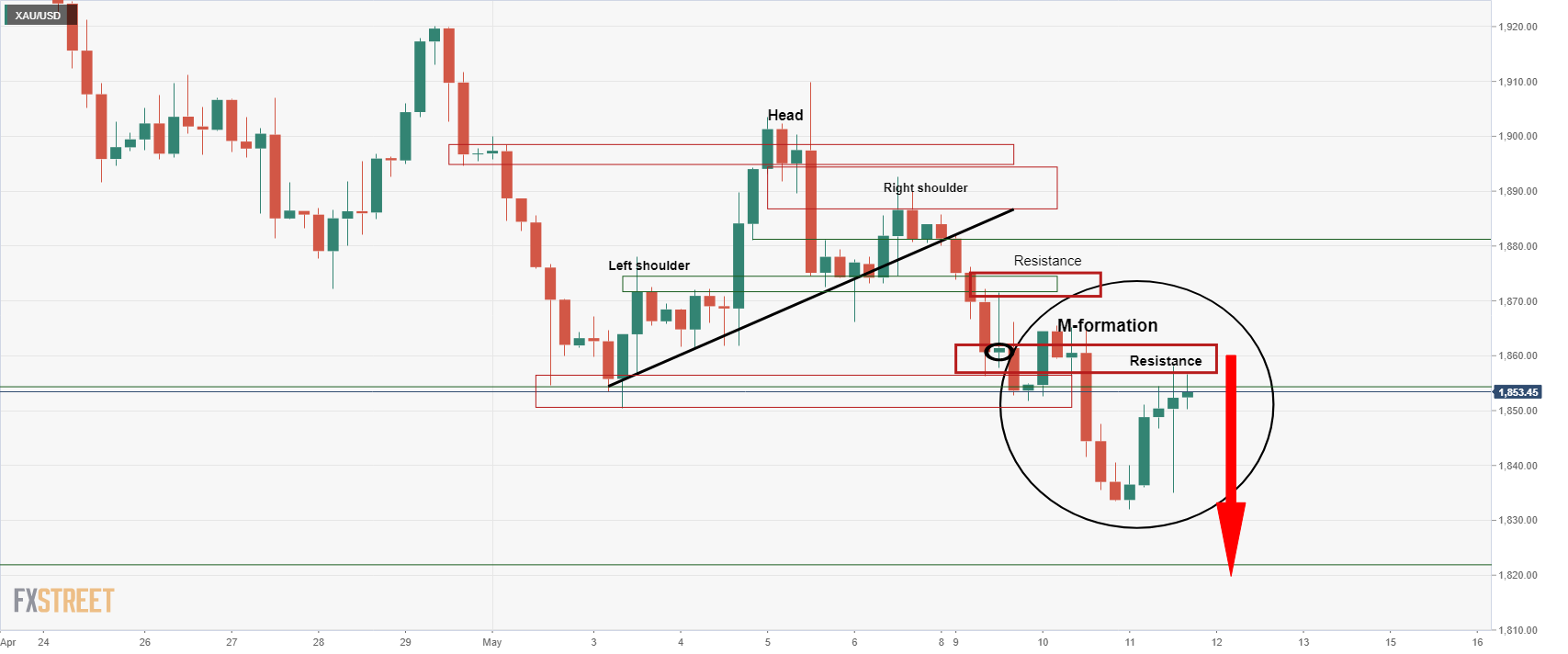

The above charts are daily charts and following a break of a 38.2% Fibonacci resistance at the current highs of the day, there would be prospects of a move into the 50% and 61.8% ratios that align with the M-formation's neckline. However, the 4-hour chart could put up some resistance in the way there:

The 4-hour chart has formed an M-formation also and the resistance of the neckline could lead to a downside continuation. This marks a 38.2% Fibonacci retracement on the daily chart as well.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.