- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Breaking: FOMC Minutes sink the US dollar a touch despite inflation risk skewed to the upside

Breaking: FOMC Minutes sink the US dollar a touch despite inflation risk skewed to the upside

The Federal Open Market Committee minutes have been released which are so far sending the US dollar DXY index a touch softer. The softness in the greenback come as there were no discussions on larger rate hikes.

At the May 3-4 meeting, the Fed hiked rates from the expected 50 bp to 1.0% and laid out plans for aggressive Quantitative Tightening to begin in June.

FOMC Minutes

- All participants at the Federal Reserves May policy meeting agreed a half-percentage-point interest rate hike was appropriate; 'most' Judged such hikes appropriate at the next couple of meetings, minutes from May 3-4 meeting show.

- All Fed participants agreed the US economy was 'very strong,' labour market was 'extremely tight' and inflation was 'very high,' minutes show.

- Participants agreed fed should 'expeditiously' move monetary policy toward a more neutral stance, and that a 'restrictive' stance on the policy may well become appropriate, minutes show.

- Fed participants saw the Ukraine conflict, china's covid lockdowns posing 'heightened risks,' with particular challenges to restoring price Stability while maintaining a strong job market, minutes show.

- Many participants judged faster removal of policy accommodation would leave the fed 'well-positioned' to assess later this year What further adjustments were needed, minutes show.

- Fed participants emphasized that they were 'highly attentive' to inflation risks and agreed those risks were skewed to the upside, minutes show.

- All participants supported plans to reduce the size of the Fed's balance sheet; 'a number' said after the runoff was well underway, it would be appropriate to consider sales of mortgage-backed securities, and minutes show.

- Participants said Q1 2022 GDP decline contained 'little signal about subsequent growth,' and they expected real GDP would grow 'solidly' in Q2 and be near or above trend for the whole year.

Meanwhile, analysts at Brown Brothers Harriman said, ''our base case remains for another 50 bp hike in September that takes the Fed Funds ceiling up to 2.5%, which many consider close to neutral. However, it’s worth noting that odds of a 50 bp move in September have fallen to less than 50% now from fully priced in at the start of May.''

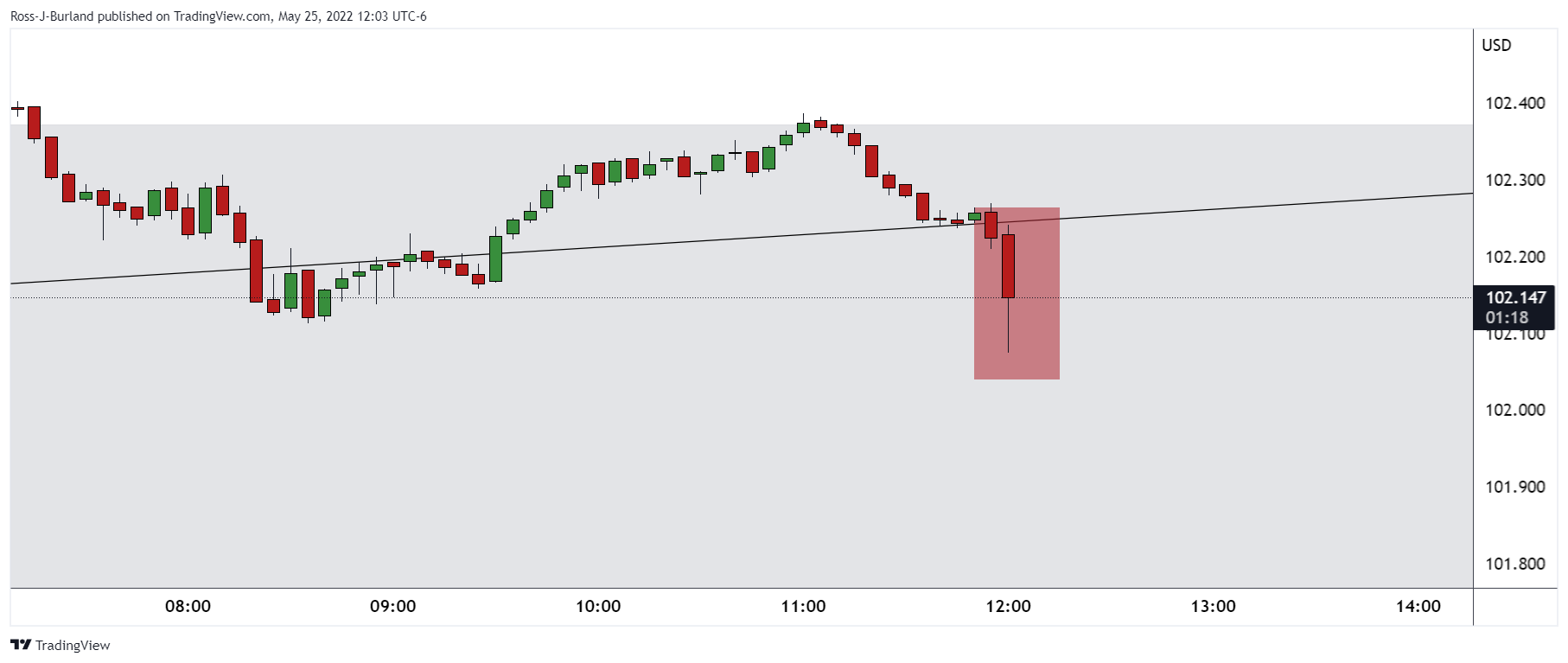

DXY reaction so far...

This was the knee jerk reaction that propelled the euro higher from support as follows, in accordance with the pre-event analysis:

EUR/USD technical analysis

Prior analysis:

For the minutes and sessions ahead, the pair could be based here and result in a higher correction from support:

The softness in the greenback come as there were no discussions on larger rate hikes.

About the FOMC minutes

FOMC stands for The Federal Open Market Committee organizes 8 meetings in a year and reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. FOMC Minutes are released by the Board of Governors of the Federal Reserve and are a clear guide to the future US interest rate policy.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.