- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- AUD/USD bulls are moving in again within bullish territory ahead of GDP

AUD/USD bulls are moving in again within bullish territory ahead of GDP

- AUD/USD bulls driving higher, but a correction could be on the cards.

- The GDP data today will be keenly eyed for further clues as to the path of interest rates in Australia.

At 0.7183, AUD/USD is near the highs of the Asian session pre-Tokyop open and 0.15% higher and moving up from a session low of 0.7171 to a recent high of 0.7184. The Australian dollar was hit during Tuesday's business following a bullish open on Monday in positive territory as the greenback bounced back to life on soaring US yields.

Renewed global inflation fears lifted the US counterpart, but positive economic data in Australia pointed to steady growth and kept selling contained which is making the basis for higher prices for the sessions ahead. Australian first-quarter Gross Domestic Product (GDP) data is due today and partial indicators on Tuesday suggested growth despite a fall in net exports. Better-than-expected Chinese factory activity data is also a helping hand, however, investors remain cautious because the figures indicated activity was shrinking in May following a steep contraction in April.

For today's data, Westpac has upgraded its forecast for Australian first-quarter GDP, now seeing it 0.6% higher than in the previous quarter, instead of 0.2%, and 2.9% higher than a year earlier. ''A softer print in activity is anticipated given the disruptions associated with omicron and severe flooding in NSW and Qld. Consumer spending and public demand are expected to add to growth, while business investment and housing should remain subdued.''

The data will be closely watched by central bank observers. Australian inflation hit a 20-year high in the first quarter and the Reserve Bank of Australia lifted its benchmark cash rate to 0.35% in May. Markets are priced for another hike to 0.6% next week and more to around 2.5% by year's end.

As for the greenback, the US dollar was broadly stronger overnight. The dollar was supported by demand for safe havens as hawkish comments from a US Federal Reserve official rattled investors' nerves. Fed Governor Christopher Waller said the Fed should be prepared to raise interest rates by a half percentage point at every meeting from now on until inflation is decisively capped.

Consequently, the analysts at Brown Brothers Harriman explained that WIRP suggests 50 bp is fully priced in for June and July. ''However, a third 50 bp that was fully priced in for September is now about 50% priced in vs. 35% last week. After September, two more 25 bp hikes are fully priced in and a third is partially priced in that would take the Fed Funds ceiling to between 3.0-3.25%.''

This has fuelled a bid in the greenback. The US Dollar Currency Index (DXY), which measures the greenback against six other major currencies, was on pace for its best one-day gain in nearly two weeks. The dollar index, is higher by about 6.4% for the year, but was down 1.4% for May for its worst monthly loss in a year. The dollar index has not closed below its 50-day moving average since mid-February but has drifted closer to it over the last several sessions.

Meanwhile, President Joe Biden told Fed Chair Jerome Powell on Tuesday that he will give the central bank the space and independence to address inflation as it sees fit.

- Biden and Powell to discuss inflation, US dollar on a knife's edge

The Nonfarm Payrolls and other important survey data will be reported. We get the regional Fed manufacturing surveys wrap-up and May ISM manufacturing PMI will be reported tomorrow and is expected at 54.5 vs. 55.4 in April.

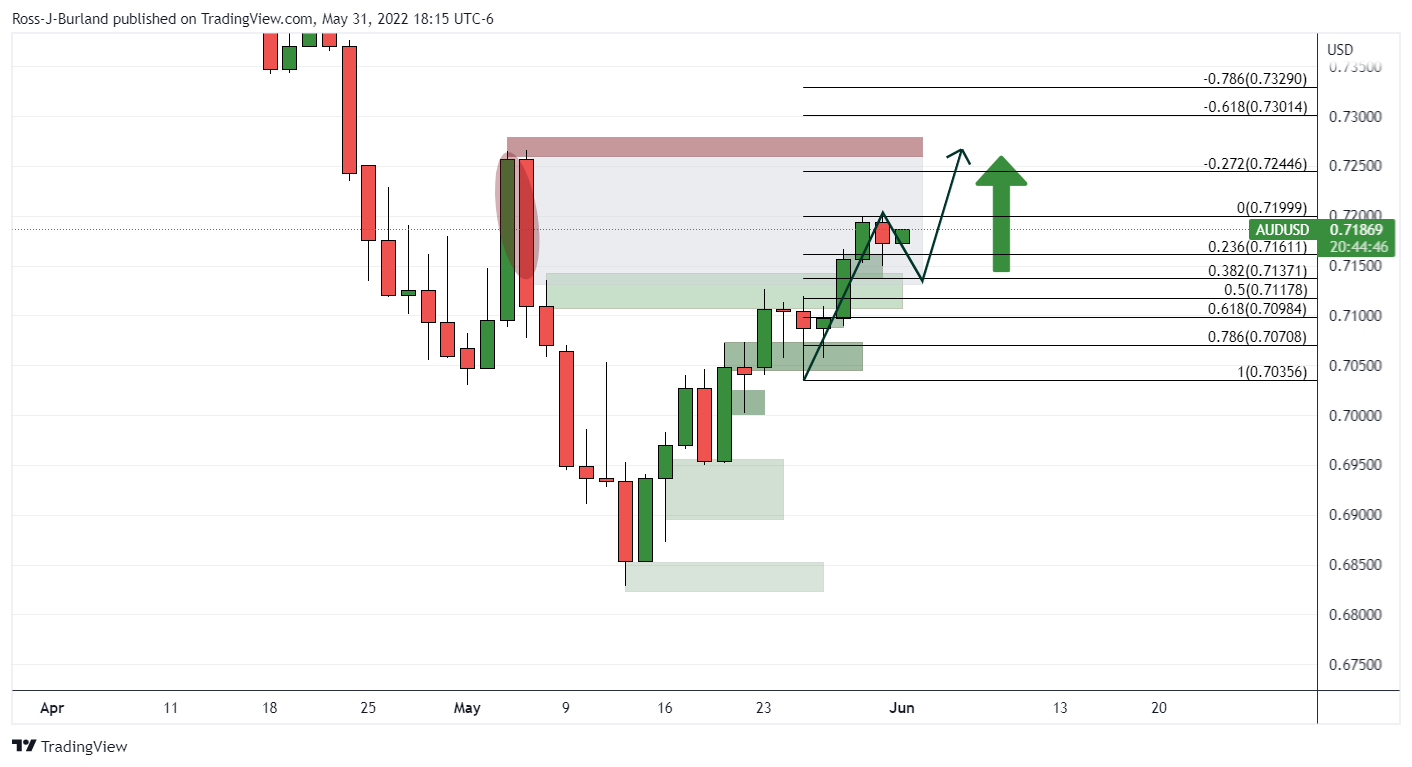

AUD/USD technical analysis

The price had been respecting the support structures in a pursuit of the price imbalance between recent highs and the May 4 highs at 0.7266. The price would be expected to mitigate this area of imbalance with relative ease:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.