- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD bulls eye a move into the $1,850s but are up against daily resistance

Gold Price Forecast: XAU/USD bulls eye a move into the $1,850s but are up against daily resistance

- Gold is stalling on the bid in a period of consolidation at daily resistance but the bulls are accumulating at hourly support.

- The markets will look to further UIS data seeking an insight into the rate-hiking path of the Fed.

At $1848.13, the gold price is flat in the session so far as markets consolidate the rise in the greenback that climbed higher due to a bid in US Treasury yields as global inflation worries flared anew. Gold prices also rose from a two-week low on Wednesday as investors looked toward the safe-haven metal amid worries over an increase in inflation, although a stronger dollar capped the yellow metal at daily resistance.

While bullion is considered a hedge against inflation and a safe haven during times of economic uncertainty. However, higher interest rates increase the opportunity cost of holding gold and boost the dollar. The risk sentiment has been on tenterhooks and stocks fell broadly on worries over aggressive tightening risks. Asian exchanges traded choppily overnight, while European bourses edged lower on the continent. In the US, the dollar index DXY, which measures the currency against six major peers, climbed to 102.71 and stalled near there, extending Tuesday's gains. US stocks fell as strong US manufacturing and job openings data reinforced the need for aggressive Fed funds rate hikes.

The Institute for Supply Management's manufacturing index unexpectedly rose in May, climbing to 56.1 last month from 55.4 in April. Consequently, the Dow Jones Industrial Average fell by 0.5% to 32,813.23, the S&P 500 declined by 0.8% to 4,101.23 and the Nasdaq Composite was 0.7% lower at 11,994.46 despite all of the indexes opening the session in the green. The US 10-year yield lifted 9.3bps to 2.937%. As such, the gold price picked up a safe haven bid, despite the spectre of further rate hikes.

''For the time being, gold prices have managed to sustain elevated levels with consensus positioning still heavily tilted to the long-side despite a hawkish Fed narrative,'' analysts at TD Securities noted. ''What has kept gold bugs from capitulating? We see evidence that the pandemic has reinvigorated discretionary trading in gold, leaving 'Other Reportables' to play a larger role in speculative markets.''

''This cohort has yet to capitulate, but with gold prices below their bull-market defining trendline and without conviction that the Fed could blink, these traders represent the greatest risk for a liquidation vacuum as we exit the pandemic regime. A break below $1800/oz could catalyze additional CTA liquidations which we expect will further weigh on gold,'' the analysts argued.

Meanwhile, investors are also looking ahead to US Nonfarm Payrolls and more inflation data that will help traders and investors to gauge the Fed's next move and give insight into the economic outlook.

''Employment likely continued to advance firmly in May but at a more moderate pace after consecutive job gains at +428k in March and April. Employment in the household survey likely rebounded after printing negative in April,'' the analysts at TD Securities argued.

''We expect this to lead to a drop in the Unemployment Rate to a post-COVID low of 3.5%. We also look for wage growth to remain steady at 0.3% m/m (5.2% YoY).''

Gold technical analysis

The gold price is meeting resistance n the weekly chart at a key 38.2% Fibonacci retracement level as follows:

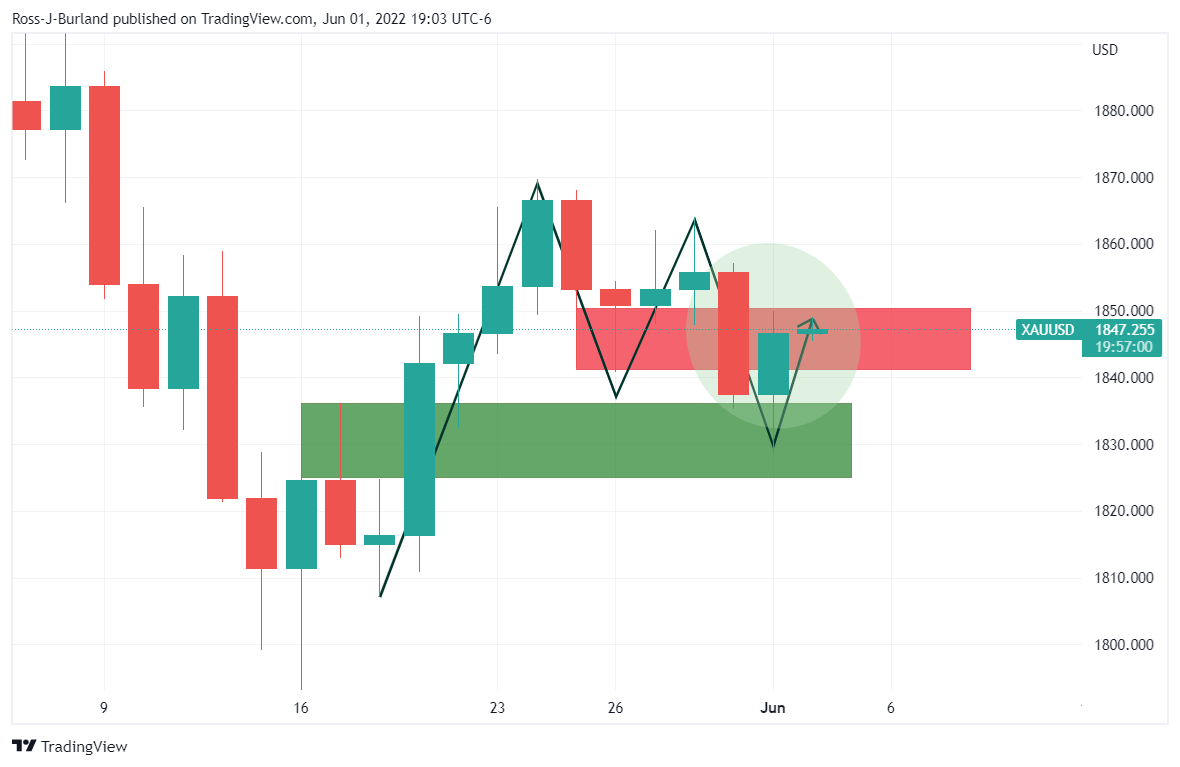

However, in the prior analysis, it was noted that there were prospects of a bullish move on the daily chart as follows:

''From a daily perspective, the price is forming an M-formation while on the way to completing the test of the neckline of the prior W-formation.''

''This makes for prospects of some meanwhile consolidation in the days ahead, with the price potentially trapped between the two opposing necklines acting as support and resistance.''

From an hourly perspective the bulls are moving in from a 38.2% % Fibonacci and eye the $1,851 prior highs:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.