- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price gains traction as US yields retreat ahead of Fed rate decision

Gold Price gains traction as US yields retreat ahead of Fed rate decision

- Gold Price staged a decisive recovery following the two-day drop.

- XAUUSD closes in on strong resistance that aligns at $1,840.

- US T-bond yields' reaction to Fed policy decisions could impact gold's valuation.

Gold Price made a sharp U-turn from the monthly low it touched at $1,805 on Tuesday and climbed above $1,830 on Wednesday. The near-term technical outlook suggests that sellers remain on the sidelines for the time being but XAUUSD could find it difficult to attract buyers unless it manages to clear $1,840.

US T-bond yields retreat

After having gained nearly 10% this week, the benchmark 10-year US Treasury bond yield reversed its course on Wednesday and was last seen losing more than 3% on a daily basis. The US Dollar Index is also pulling away from the multi-decade high it set at 105.65 on Tuesday, helping XAUUSD preserve its bullish momentum ahead of the FOMC's highly-anticipated policy announcements.

Also read: Gold Price Forecast: XAUUSD could stage a solid comeback on dovish Fed rate hike.

Gold Price set to react strongly to Fed

The Federal Reserve is expected to hike its policy rate in June. Although the market consensus points to a 50 basis points (bps) rate increase, reports from earlier this week suggested that a 75 bps hike was likely at this meeting. According to the CME Group FedWatch Tool, markets fully price in a total of 150 bps rate increase at the next two meetings. A hawkish policy decision should boost yields and weigh on gold and vice versa. Previewing this event, "a "buy the dip" in stocks has now turned into one for the US dollar," said FXStreet Analyst Yohay Elam. "The Fed decision on June 15 will likely include several gut-wrenching twists, and I think the dollar would be able to stomach every move and come out on top."

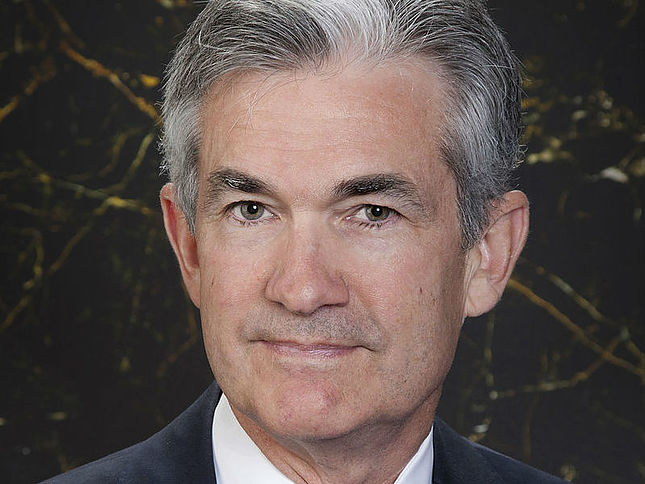

FOMC Chairman Jerome Powell

The European Central Bank (ECB) held an emergency meeting to address the fragmentation issue on Wednesday. "The Governing Council decided that it will apply flexibility in reinvesting redemptions coming due in the PEPP portfolio, with a view to preserving the functioning of the monetary policy transmission mechanism," the ECB stated. XAUEUR gained more than 1% with long-term German government bond yields falling sharply and provided an additional boost to positively-correlated XAUUSD.

Earlier in the day, the upbeat macroeconomic data releases from China eased concerns over gold's demand outlook mid-week. On a yearly basis, Industrial Production in China grew by 0.7% in May, surpassing the market expectation for a contraction of 0.7%. Additionally, Retail Sales fell by 6.7% in the same period, which was better than analysts' estimate for a decrease of 7.1%.

In the meantime, Retail Sales in the United States fell by 0.3% on a monthly basis in May, the US Census Bureau reported on Wednesday. Other data revealed that the Federal Reserve Bank of New York's Empire State Manufacturing Index improved to -1.2 in June from -11.6. Following the mixed US data, Wall Street's main indexes remain on track to open in positive territory, possibly limiting the dollar's upside.

Gold Price technical outlook

Gold Price climbed above $1,830 during the European trading hours on Wednesday and the Relative Strength Index (RSI) indicator on the daily chart rose toward 50, suggesting that buyers are looking to take control. On the upside, however, the 200-day SMA forms significant resistance at $1,840. In order to attract additional buyers, XAUUSD needs to flip that level into support. In that scenario, additional gains toward $1,850 (20-day SMA) and $1,860 (static level) could be witnessed.

On the other hand, strong static support seems to have formed at $1,810. If the dollar rally picks up steam on a hawkish Fed rate outlook, gold could test this level and eye $1,800 (psychological level) next.

Gold Price Report: What's next for commodity prices?

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.