- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- US dollar back on top for start of the week, 105.50 eyed

US dollar back on top for start of the week, 105.50 eyed

- US dollar bulls are moving back in and eye 105.50s.

- The market's sentiment is fickle which plays into the hands of the greenback.

- US data will be critical this week with NFPs and Fed minutes eyed.

The US dollar was in demand at the start of the new month and quarter for its safe-haven status, dragging a number of rivals back down to earth. The euro fell to a low of 1.0365 vs the greenback from a high close to the 1.05 area and the Aussie sank to fresh cycle bear lows at 0.6763.

Tighter monetary expectations in the face of higher in inflation are feeding a bid into the greenback due to the demand for US assets which has sent the benchmark 10-year US Treasury yields to one-month lows. The US 10-year yield dropped 8.5 basis points to 2.89%.

Nevertheless, US equity benchmarks were higher in the first session of the third quarter, recouping some of the ground lost in Thursday's session finished up the worst first half-seen in decades. The Dow Jones Industrial Average added 1.1% to 31,097.26, the S&P 500 was also up by 1.1% to 3,825.33, and the Nasdaq Composite was around 1% higher at 11,127.85. For the week, the Dow was 1.3% lower, the S&P 500 dropped 2.2%, and the Nasdaq fell 4%.

in data, which hampered down the risks of recession sentiment in global markets showed that the Institute for Supply Management's US manufacturing index fell to 53 from 56.1 in May, compared with expectations of 54.5. This was the weakest since June 2020, when the world was in the throes of the COVID-19 pandemic.

As a consequence, a flight to safety sent the US 10-year yield dropped 6.8 basis points to 2.91% as traders await the outcome of this week's minutes of the Federal Reserve's June meeting when it raised interest rates by 75 basis points. This was the most in almost three decades, amid concern that further projected rate hikes in the Fed pipeline are likely to tip the economy into a recession.

For the week ahead, Nonfarm Payrolls will be key and the data is expected to show that Employment likely continued to advance firmly in June but at a more moderate pace after three consecutive job gains of around 400k in March-May, the analysts at TD Securities said. ''High-frequency data, including Homebase, still point to above-trend job creation. We also look for the UE rate to stay unchanged at 3.6% for a fourth straight month, and for wage growth to remain steady at 0.3% MoM (5.0% YoY).''

The minutes of the fed's June meeting will also be eyed. ''Persistent high CPI inflation and nascent signs of de-anchoring inflation expectations forced the Fed to amp the pace of rate tightening. The meeting minutes are likely to offer further colour around the Fed's more hawkish reaction function,'' the analysts at TD Securities said.

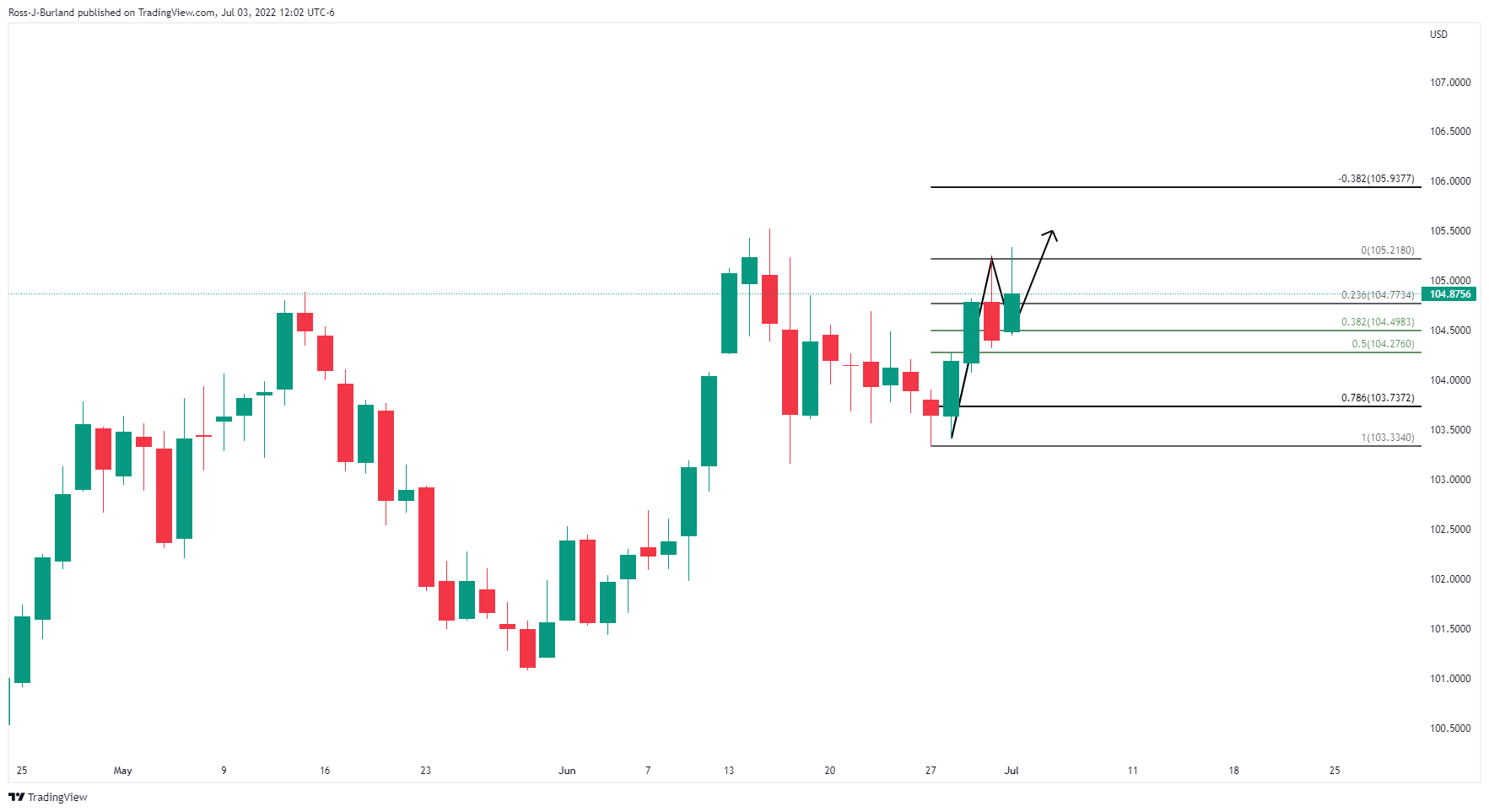

DXY daily chart

The bulls have made their move from key ratios along the Fobo scale and from near a 50% mean reversion. Eyes are on a move to test 105.50 for the weekend ahead for a daily extension towards bull cycle highs.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.