- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EURUSD steady around 1.0080 post-US hot inflation above 9%

EURUSD steady around 1.0080 post-US hot inflation above 9%

- EURUSD snaps two days of losses, regaining some ground on a weak US dollar.

- The US Consumer Price Index expanded at 1.3% in May, the highest since 2005.

- Interest rate differentials between the Fed and the ECB will give the upper hand to the greenback.

EURUSD rebounds after an intraday dive below parity at around 0.9997, for the first time in 20 years, and is staging a recovery during Wednesday’s North American session, sparked by a hot US inflation report revealed by the US Department of Labour, which lifted the major towards the daily high at around 1.0122, before sliding back below the 1.0100 mark. At the time of writing, the EURUSD is trading at around the 1.0080 area, up 0.50%.

EUR/USD bounces off parity on soft US dollar

Sentiment-wise, investors remain pessimistic, as shown by global equities tumbling across the board. in the meantime, the US Dollar Index, a measurement of the greenback’s value against a basket of six currencies, slumps by 0.30%, underpinned by falling US Treasury yields, and is sitting at 107.827. Also, recession fears loom as the US 2s-10s yield curve remains inverted for the seventh consecutive day, at -0161%.

Also read: EUR/USD: Panic takes over post-US CPI data

Inflation in the US rises

US Inflation breaks above 9%

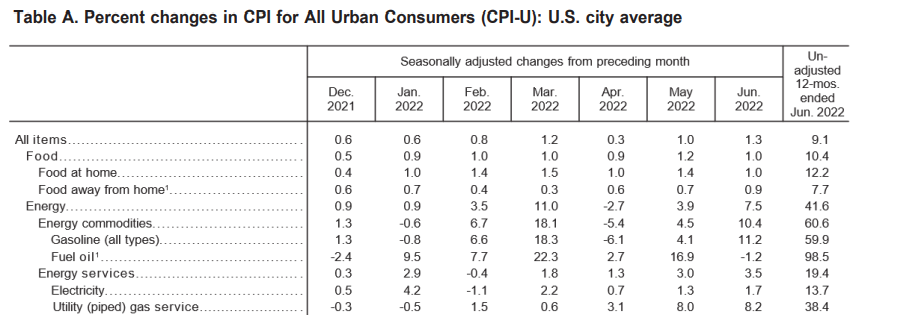

On Wednesday, the US Bureau of Labor Statistics reported that June’s Consumer Price Index (CPI) topped estimations of 8.8% YoY and rose by 9.1% YoY in May. Regarding the so-called core CPI, which excludes volatile items like food and energy at 5.9%, lower than in May but higher than estimated. The main contributors to the jump in inflation were gasoline, shelter, and food, as shown by the US CPI report.

Inflation split by components

Federal Reserve to hike 100 bps?

In the meantime, the US inflation report has fueled the possibility of a jumbo rate hike by the Federal Reserve. The short-term interest rates (STIRs) money market futures show that traders have fully priced a 75 bps rate hike by the July 26-27 meeting. However, the odds of a 100 bps rate hike lie at 82%, leaving the door open for a jumbo move due to the stickiness and persistently high inflation.

Germany’s inflation report wound not deter the ECB

Earlier during the European session, Germany’s inflation, as measured by the Harmonised Index of Consumer Prices (HICP) rose 8.2% YoY, aligned with the estimated and prior release. Albeit easing fears of higher readings, odds of the European Central Bank (ECB) hiking rates remain fully priced a 25 bps, but chances of a 50 bps have been increasing of late to 58% odds, as shown by STIRs.

ECB vs. Fed interest rate differentials, a headwind for the EURUSD

In July, both banks, the ECB and the Federal Reserve will host their monetary policy meetings. Currently, the ECB’s deposit rate lies at minus 0.50%, while the US Federal Reserve’s Federal funds rate (FFR) is at 1.75%, bolstering the appetite for the greenback. With expectations of the ECB hiking 25 bps and the Fed to move at least by 75 bps, differentials would widen further, to -0.25% (ECB) vs. 2.50% (Fed), meaning that the greenback would keep the upper hand, opening the door for further selling pressure on the EURUSD.

EURUSD Price Technical outlook

EURUSD remains heavy, as shown by the daily chart, with the daily moving averages (DMAs) residing well above the exchange rate. Nevertheless, due to the pair’s price action overextending to the downside and the Relative Strength Index (RSI) in oversold conditions indicates that the EURUSD might print a leg-up before launching another assault below the parity.

Therefore, the EURUSD first resistance would be the 1.0100 figure. Brak above will expose the July 11 high at 1.0183, followed by a test of the 1.0200 figure. On the flip side, the EURUSD’s first support would be parity. A breach of the latter would expose December 2002 lows around 0.9859.

Elliott Wave trading strategies: DAX 40, FTSE 100, STOXX 50, Dollar Index, EUR/USD [Video]

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.