- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAUUSD dives due to risk-on impulse, high US bond yields

Gold Price Forecast: XAUUSD dives due to risk-on impulse, high US bond yields

- Gold price recedes from $1770s as US bond yields climb.

- Overall US dollar strength and a risk-on impulse, headwinds for gold.

- Gold Price Forecast (XAUUSD): Sellers’ failure at $1787 sent the pair stumbling towards the $1750 area.

Gold price slides from around $1770s highs due to high US Treasury yields spurred by Fed policymakers reiterating that they are not done hiking rates, despite the ongoing slowdown in the US economy. Nevertheless, money market futures are still pricing in a 50 bps rate hike in September, while odds of a 75 bps increase lie at 80%. At the time of writing, XAUUSD is trading at $1757.36.

XAUUSD drops as sentiment improves, and Fed commentary

Global equities remain firm one hour after the New York ringing bell. The US House Speaker Nancy Pelosi’s trip to Taiwan finished without casualties yet. July’s US ISM Non-Manufacturing PMIs surprised economists, beating expectations, with the index increasing by 56.7 from 55.3 in June, data showed Wednesday. The services reports contradict Monday’s Manufacturing report, which showed production is slowing its pace, so demand for goods is down due to consumers’ shift to services.

Fed speakers pushed vs. dovish tilt

Since Tuesday, Fed officials reiterated the Fed’s commitment to bring inflation to the 2% target, led by San Francisco Fed Daly, saying that “we are still resolute and completely united” in getting inflation down. Following suit, Cleveland’s Fed Mester said that she needs to see “compelling evidence” of prices getting lower, while Chicago’s Evans commented that “50 bps are reasonable” and added that 75 bps might be needed as data comes out.

On Wednesday, the St. Louis Fed President Bullard said the Q2 slowdown was more concerning than Q1. By the year’s end, Bullard wants to lift the Federal funds rate (FFR) to 3.75-4.00%.

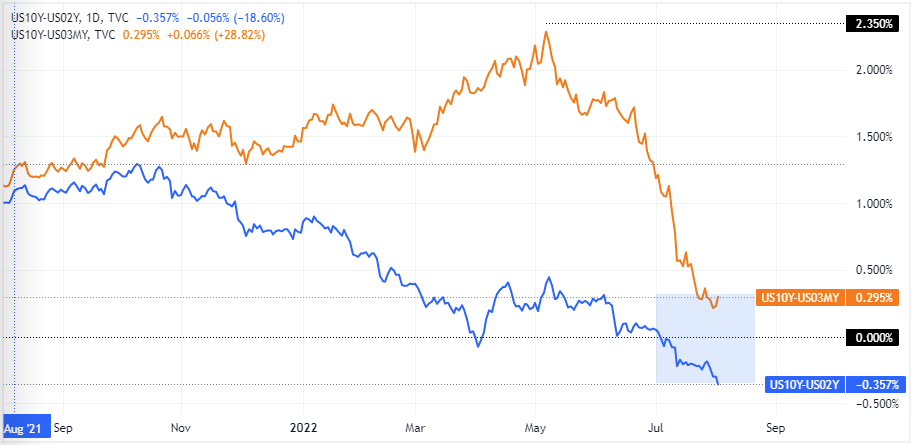

Meanwhile, US Treasury yields are rising sharply, led by 2s, while the US 10-year benchmark note coupon is yielding just 2.801%, compared with the former at 3.151%. So the US 2s-10s yield curve inversion further deepened to -0.346%, as investors have positioned ahead of an impending US recession.

US 2s-10s yield curve inversion

Underpinned by firm US bond yields, the greenback is rising, as shown by the US Dollar Index, gaining 0.34%, at 106.711. The buck has recovered some strength in the last few days, bolstered by safe-haven flows amidst geopolitical jitters.

What to watch

The US calendar will feature Initial Jobless Claims, alongside further Fed officials crossing wires.

Gold Price Forecast (XAUUSD): Technical outlook

Still, XAUUSD is neutral-to-downward biased. Buyers’ failure to crack the May 16 low-turned-resistance at $1787.03 was a solid ceiling level as sellers stepped in, dragging prices to their daily low at $1755.00. However, the XAUUSD downtrend could be capped around the 20-day EMA at $1731.65.

Therefore, XAUUSD’s first support would be the July 29 low at 1752.27. Once cleared, gold will dive to the 20-day EMA. Otherwise, if gold buyers stepped in, their first resistance would be $1772.77.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.