- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- RBA Statement: RBA jacks up its forecasts for inflation

RBA Statement: RBA jacks up its forecasts for inflation

The Reserve Bank of Australia's Monetary Policy Statement is out as follows offering updates in this quarterly release:

Reuters reports that Australia's central bank on Friday warned inflation was heading to three-decade highs requiring further hikes in interest rates that would slow growth sharply, making it tough to keep the economy on an "even keel".

''In its quarterly Statement on Monetary Policy, the Reserve Bank of Australia (RBA) jacked up its forecasts for inflation, downgraded the outlook for growth and foreshadowed an eventual rise in unemployment.

Yet even with further increases in rates, inflation was not expected to return to the top of its 2-3% target range until the end of 2024, pointing to a long period of pain ahead.''

"It is seeking to do this in a way that keeps the economy on an even keel," said RBA Governor Philip Lowe in the introduction to the 66-page statement.

"The path to achieve this balance is a narrow one and subject to considerable uncertainty."

Key notes

- Ready to do what is necessary to bring inflation back to 2-3% band.

- Seeking to restrain inflation while keeping economy on an even keel, this is a narrow path.

- Board expects to take further steps to normalise policy, but not on a pre-set path.

- Rate rises necessary to create more sustainable balance between demand and supply.

- Risk that high inflation gets built into wage and price setting behaviour.

- Inflation broad based but medium, long-term inflation expectations remain anchored.

- Rising cost of living, higher rates and falling house prices to weigh on economy.

- RBA downgrades outlook for economic growth, revises inflation forecasts sharply higher.

- Forecasts based on analyst, market pricing assume rates reach 3% by end 2022, decline a little by end of 2024.

- CPI inflation seen at 7.75% end 2022, 4.25% end 2023 and 3% end 2024.

- Trimmed mean inflation seen at 6% end 2022, 3.75% end 2023, 3% end 2024.

- GDP growth seen at 3.25% end 2022, 1.75% end of 2023, 2024.

- Unemployment seen at 3.25% end 2022, 3.5% end 2023, 4% end 2024.

- Wage price index seen at 3.0% end 2022, 3.6% end 2023, 3.9% end 2024.

- Around 60% of firms in liaison program expect wages to be high over year ahead.

- Many employers report they intend to increase headcount further but finding it hard to get workers.

- Risks to the global outlook are skewed to the downside given synchronised policy tightening.

AUD/USD update

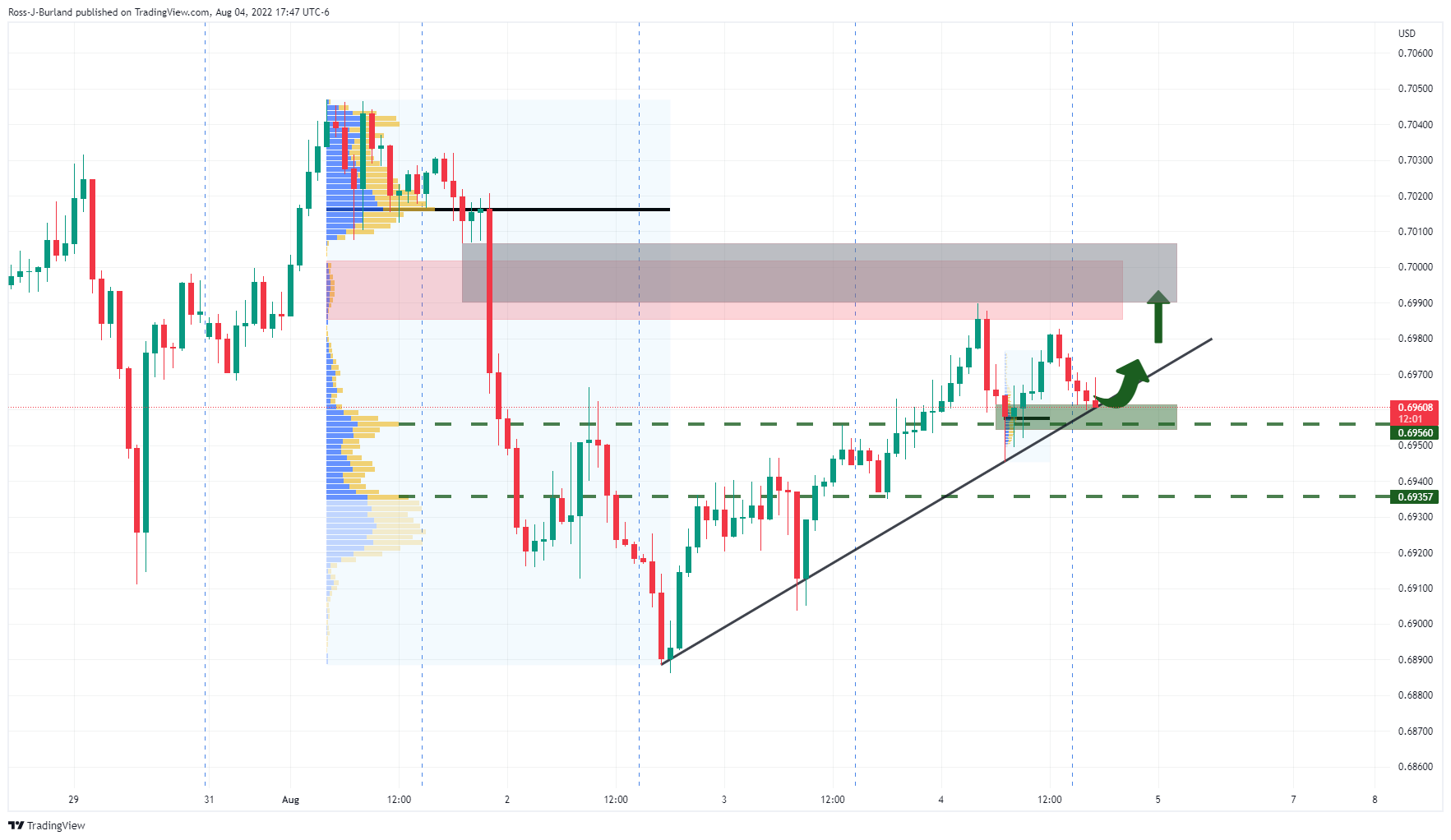

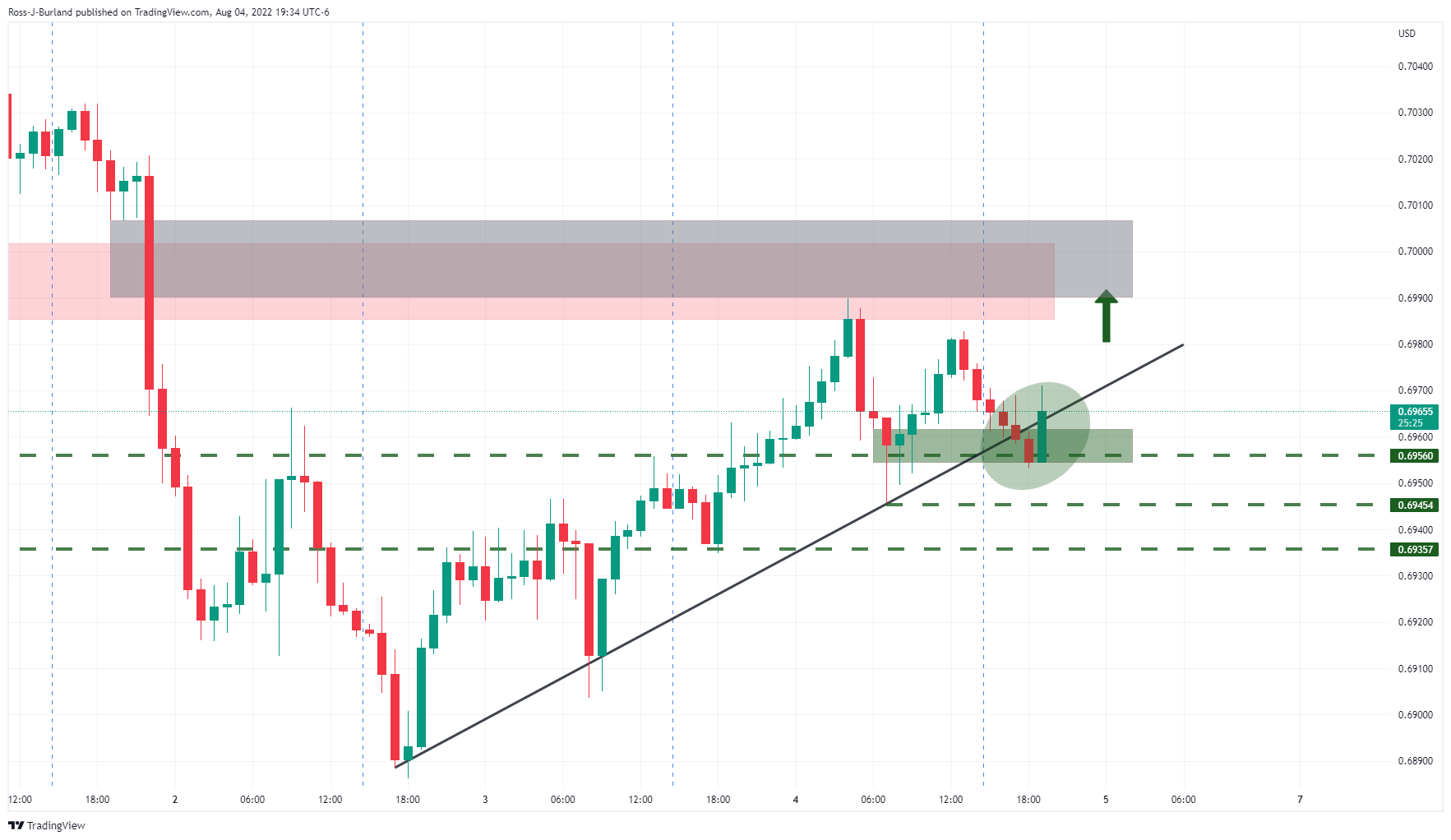

As per the pre-event technical analysis, AUD/USD Price Analysis: Bulls and bears battle it out at critical hourly support, the bulls are moving in at a key hourly level of support:

Update...

About the RBA Monetary Policy Statement

The RBA Monetary Policy Statement is released by the Reserve bank of Australia reviews economic and financial conditions, determines the appropriate stance of monetary policy and assesses the risks to its long-run goals of price stability and sustainable economic growth. It is considered as a clear guide to the future RBA interest rate policy. Any changes in this report affect the AUD volatility. If the RBA statement shows a hawkish outlook, that is seen as positive (or bullish) for the AUD, while a dovish outlook is seen as negatvie (or bearish).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.