- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EUR/USD comes under pressure and retreats from daily highs near 1.0050

EUR/USD comes under pressure and retreats from daily highs near 1.0050

- EUR/USD sees its upside trimmed following tops near 1.0050.

- Germany, EMU final Manufacturing PMI were revised lower in August,

- US ISM Manufacturing next of relevance across the pond.

The single currency kicks in the new month on the back foot and forces EUR/USD to give away the initial bull run to the 1.0050/55 band on Thursday.

EUR/USD remains side-lined ahead of key data

EUR/USD now slips back to the negative territory after three consecutive daily advances on the back of further improvement in the greenback and some loss of momentum in the risk complex.

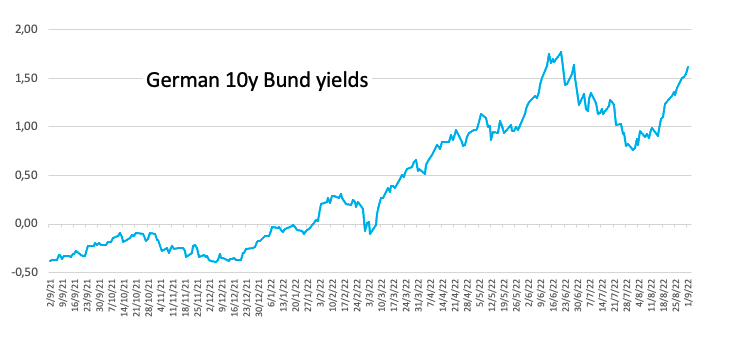

In the meantime, German 10y Bund yields keep intact its march north and already test the 2.90% region, an area last traded back in late June. The move in the German money markets mimics the one in the US cash markets, where yields remain on the rise across the curve.

In the meantime, market participants continue to closely follow the developments around the next moves by both the ECB and the Federal Reserve when it comes to interest rate hikes, all amidst the continuation of the hawkish tone from policy makers.

In the domestic calendar, final Manufacturing PMIs in Germany and the Euroland came a tad lower than the preliminary results at 49.1 and 49.6, respectively, for the month of August. In addition, the Unemployment Rate in the euro bloc ticked lower to 6.6% in July (from 6.7%). Earlier in the session, Germany Retail Sales contracted 2.6% in the year to July.

Across the ocean, all the attention will be on the release of the ISM Manufacturing for the month of August along with the final S&P Global Manufacturing PMI, July’s Construction Spending at the speech by FOMC’s R.Bostic.

What to look for around EUR

EUR/USD sees its upside compromised around 1.0050 on the back of the renewed bid bias in the greenback as well as the broad-based loss of traction in the risk-linked galaxy.

So far, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns, fragmentation worries and the Fed-ECB divergence. However, potential shifts to a more hawkish stance from ECB’s policy makers regarding the bank’s rate path could be a source of strength for the euro.

On the negatives for the single currency emerge the so far increasing speculation of a potential recession in the region, which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals.

Key events in the euro area this week: Germany Retail Sales, Final Manufacturing PMI, EMU Final Manufacturing PMI, EMU Unemployment Rate (Thursday) – Germany Balance of Trade (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian elections in late September. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, spot is losing 0.11% at 1.0041 and the breach of 0.9899 (2022 low August 23) would target 0.9859 (December 2002 low) en route to 0.9685 (October 2022 low). On the other hand, the next up barrier comes at 1.0090 (weekly high August 26) seconded by 1.0202 (high August 17) and finally 1.0214 (55-day SMA).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.