- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- US dollar bulls show up again during significant post-Fed volatility

US dollar bulls show up again during significant post-Fed volatility

- US dollar bulls move in again on a volatile day.

- The markets are attempting to price the Fed following its two-day meeting.

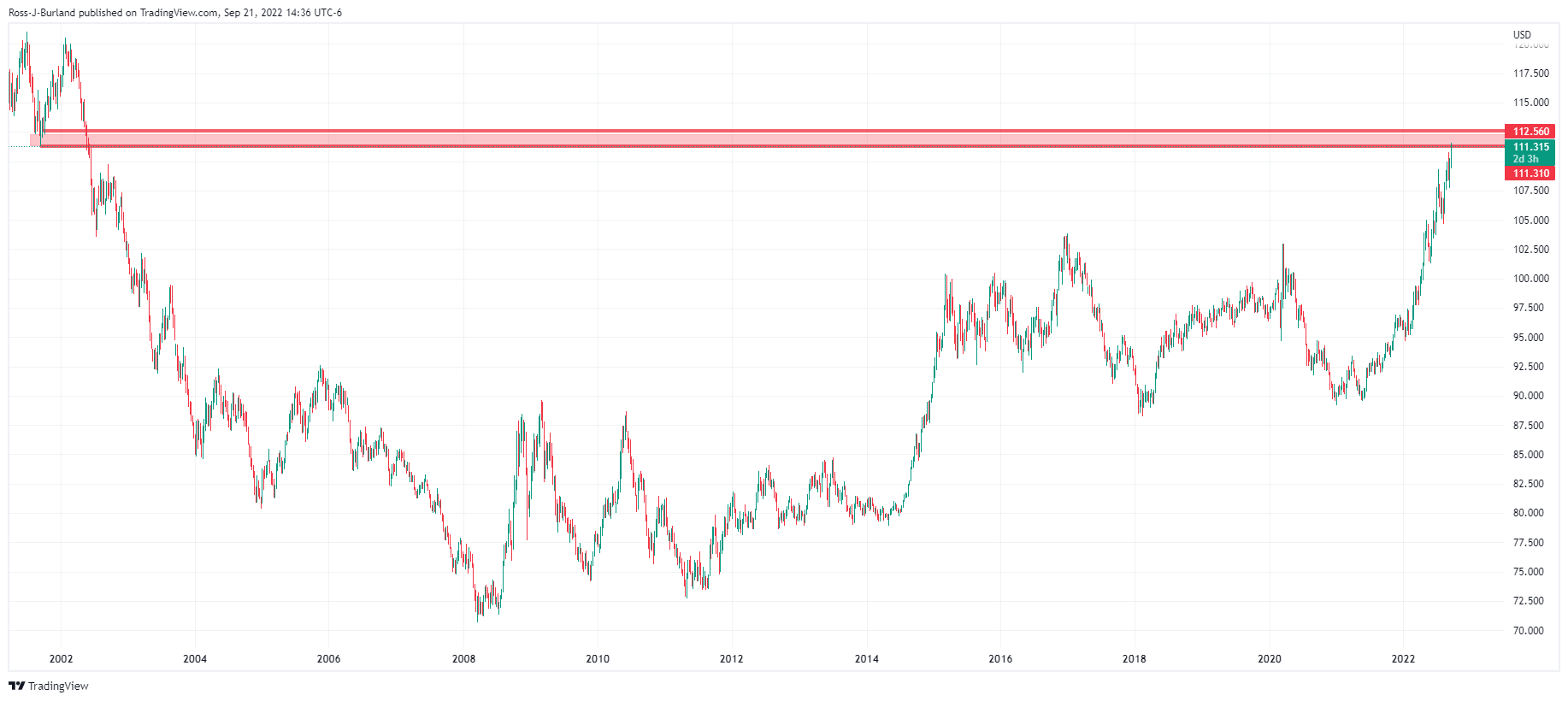

The US dollar has been moving like a yo-yo during the centerpiece event of the week which was the Federal Reserve on Wednesday. As measured by the DXY index, the price of the dollar vs. a basket of currencies has ranged between 111.57 and 110.612, initially spiking on the Fed announcements before dropping and recovering again in a 78.6% retracement of the range. At the time of writing, DXY is trading at 111.30, 1.00% higher on the day.

The US dollar has been in demand on Wednesday on two main counts. The expectations for higher rates and the decision by Russian President Vladimir Putin to mobilize more troops for the conflict in Ukraine had already pushed the dollar to a two-decade high before the Fed announced its hawkish projections following a 75bps rate hike, as expected.

Fed key takeaways

- US Federal Reserve interest rate decision +75 bps vs +75 bps expected.

- Target Range stands at 3.00% - 3.25%.

- Interest Rate on Reserves Balances raised by 75Bps to 3.15% from 2.40%.

- The policy vote was unanimous.

- Fed anticipates ongoing hikes will be appropriate, prepared to adjust policy as appropriate.

- Board members are highly attentive to inflation risks and strongly committed to returning inflation to 2%.

- Recent indicators point to modest growth in spending and production.

- Ukraine war creates additional upward pressure on inflation, weighing on global economic activity.

- Inflation remains elevated, reflecting pandemic-related imbalances, and higher food & energy.

- Job gains have been robust, the unemployment rate has remained low.

- The median forecast shows rates 4.4% at end-2022.

- Futures after FOMC decision imply traders see 89% chance fed raising rates at another 75bps at the November meeting.

Fed chairman presser

Meanwhile, Fed's chairman, Jerome Powell has been speaking to the press:

-

Powell speech: MBS sales not something I expect to be considering in near term

-

Powell speech: There is no painless way to bring inflation down

- Powell speech: No one knows if we will get a recession

-

Powell speech: Just moved into lowest levels of what we consider restrictive today

-

Powell speech: Dot plot projections do not represent plan or commitment

-

Powell speech: No grounds for complacency on inflation

-

Powell speech: Economy does not work without price stability

The markets are anticipating for the US dollar to stay strong but some analysts argue that the greenback is significantly overvalued. After all, since the beginning of the year, the dollar index has soared by nearly 16% in the biggest yearly percentage gain since 1972.

"We expect the U.S. dollar to remain firm in the short run but we remain reluctant to factor in additional, sustained US dollar gains from here and we think it would be complacent to dismiss out-of-hand downside risks here," said Shaun Osborne, chief FX strategist, at Scotiabank in Toronto.

DXY technical analysis

From a near-term perspective, if the bears commit at the 78.6% ratio, then there are considerable arguments for a downside scenario. The trendline support could come under pressure and if this gives, we will see key 110.50 under pressure again. On the other hand, from a weekly perspective, the bias is to the upside towards 112.50:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.