- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EUR/USD keeps the downside well and sound and targets 0.9500

EUR/USD keeps the downside well and sound and targets 0.9500

- EUR/USD extends the leg lower to the 0.9530 region.

- The dollar climbs to fresh cycle tops vs. its rival currencies.

- ECB Lagarde reiterated that further rate hikes are coming.

Bears remain well in control of the sentiment around the European currency and force EUR/USD to print new 2022 lows near 0.9530 on Wednesday.

EUR/USD drops to new lows near 0.9530

EUR/USD so far navigates the seventh consecutive session in the negative territory, down at the same time for third consecutive week and the fourth straight month.

The intense upside in the dollar keeps the pair and the risk complex in general under heightened pressure in response to the broad-based consensus among investors that the Federal Reserve will keep the current aggressive normalization process for longer than expected.

The daily decline in spot comes in tandem with another high in the German 10-year bund yields, which trade close to the 2.30% for the first time since November 2011. In the same line, US yields in the belly and the long end of the curve reach fresh multi-year peaks.

Earlier in the session, Chair Lagarde reiterated that the ECB is expected to raise rates further in the upcoming gatherings. Her colleague Holzmann hinted that the bank could even raise rates past the neutral level in case of need, while member Rehn opened the door to a significant rate increase in October.

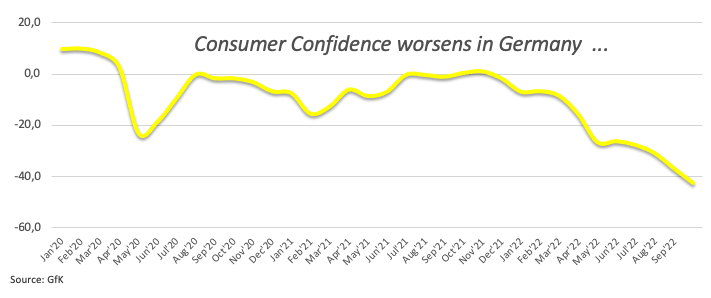

In the euro calendar, confidence consumer gauges in Germany, France and Italy deteriorated from the previous readings at -42.5, 79 and 94.8, respectively.

Across the pond, MBA Mortgage Applications, flash Goods Trade Balance and Pending Home Sales are due seconded by speeches by FOMC’s R.Bostic, J.Bullard, M.Bowman, C.Evans and Chief Powell

What to look for around EUR

EUR/USD remains under heavy pressure against the backdrop of the unabated rally in the greenback and recorded new lows near 0.9530 earlier in the session.

In the meantime, price action around the European currency is expected to closely follow dollar dynamics, geopolitical concerns and the Fed-ECB divergence. The latter has been exacerbated further following the latest rate hike by the Fed and the persevering hawkish message from Powell and the rest of his rate-setters peers.

Furthermore, the increasing speculation of a potential recession in the region - which looks propped up by dwindling sentiment gauges as well as an incipient slowdown in some fundamentals – adds to the sour sentiment around the euro

Key events in the euro area this week: Germany GfK Consumer Confidence, ECB Lagarde (Wednesday) – EMU Final Consumer Confidence, Economic Sentiment, Germany Flash Inflation Rate (Thursday) – EU Emergency Energy Meeting, Germany Retail Sales, France, Italy, EMU Flash Inflation Rate, Germany Unemployment Change, Unemployment Rate (Friday).

Eminent issues on the back boiler: Continuation of the ECB hiking cycle. Italian post-elections developments. Fragmentation risks amidst the ECB’s normalization of its monetary conditions. Impact of the war in Ukraine and the persistent energy crunch on the region’s growth prospects and inflation outlook.

EUR/USD levels to watch

So far, the pair is retreating 0.40% at 0.9556 and faces the immediate contention at 0.9535 (2022 low September 28) ahead of 0.9411 (weekly low June 17 2002) and finally 0.9386 (weekly low June 10 2002). On the upside, a break above 1.0050 (weekly high September 20) would target 1.0197 (monthly high September 12) en route to 1.0253 (100-day SMA).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.