- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD bears pounce and take a massive bite out of the market

Gold Price Forecast: XAU/USD bears pounce and take a massive bite out of the market

- Gold bears move in on a critical area of support following a massive decline at the start of the week.

- The US dollar and yields have been relentless due to market sentiment surrounding the Fed narrative.

The gold price, as per the start of the week's pre-open analysis, Gold, the Chart of the Week: XAU/USD bears eye a run to key support near $1,675, US CPI eyed, has dropped significantly lower on Monday. Not only did the price take out $1,675, but it has also made a low of $1,665.77, taking on a key support area as the markets stay on the theme of a hawkish Federal Reserve.

The gold price dropped from a high of $1699.91 from the get-go this week, sliding in Asia and not looking back, pausing for only a brief hourly candle in European markets and at the open of New York forex trade at around $1,677. However, with an elevated US dollar and US yields reaching for blue skies, gold bulls had no choice but to capitulate, making way for a strong second wind from the bears during Wall Streets' first few hours of trade.

The yield on the 10-year US Treasury bond has made a high of 3.992%, surging in the last hour in what might be the last-ditch effort to breach the psychological 4.00% level having already cleared the prior week's highs. The next target beyond there is last month's high of 4.019%. In turn, the US dollar has reached a high of 113.333 after climbing from a low of 112.621 as per the DXY index which is now holding above both Friday's and last week's highs. It is worth noting that, speculators’ net long USD index positions recovered ground for the second consecutive week following a string of hawkish Fed speak. That said, net longs remained below recent averages which leaves room for further upside in the greenback.

The Fed is driving gold

As for the driver, the Fed sentiment, analysts at TD Securities, who have been advocating an imminent drop in the gold price for many weeks explain again that ''inflation's rising persistence suggests the Fed is unlikely to stop hiking preemptively.''

''A prolonged period of restrictive rates suggests traders should ignore gold's siren calls, as a sustained downtrend will likely prevail, while quantitative tightening continues to drive real rates higher. Indeed, a constant flow of hawkish Fedspeak has seen the upside momentum in gold ease in recent days.'' The analysts also cite important inflation data this week and remind their readers that ''there are plenty of catalysts which could see the focus shift back toward hawkish interest rate policy.''

In terms of Fed speakers, we have heard from both Chicago Fed President Charles Evans and, in more recent trade, Federal Reserve Vice Chair Lael Brainard. Evans said that the Fed needs to "carefully and judiciously" navigate to a "reasonably restrictive" policy rate, as reported by Reuters, while Brainard argued that US monetary policy has begun to be felt in an economy that may be slowing faster than expected. Both officals however, explained that "monetary policy will be restrictive for some time to ensure that inflation moves back to target over time," Brainard said. "Target rate needs to rise a bit above 4.5% by early next year and remain there as Fed takes stock," Evans argued.

Fed fund futures are now pricing in a 92% chance of a 75-basis-point hike at the next Fed meeting. Higher interest rates increase the opportunity cost of holding zero-yield bullion.

As for the rest of the week, we have the Fed minutes, US Consumer Price Index and Retail Sales. With regards to the two key events, firstly, the minutes, the analysts at TD Securities explained that '' the September dot plot revealed a higher-than-expected Fed Funds terminal rate of 4.625%, with a fairly even dot distribution around this level. The question is how much of this was reflected in the deliberations at the Sep meeting. The tone of these deliberations likely was more hawkish given core CPI inflation trends, upsetting the current dovish pivot markets narrative.''

Secondly, for CPI, the analysts said, ''core prices likely stayed strong in September, with the series registering another large 0.5% MoM gain. Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% MoM. Our m/m forecasts imply 8.2%/6.6% YoY for total/core prices.''

Gold technical analysis

As per the pre-open analysis, the price dropped significantly at the start of the week:

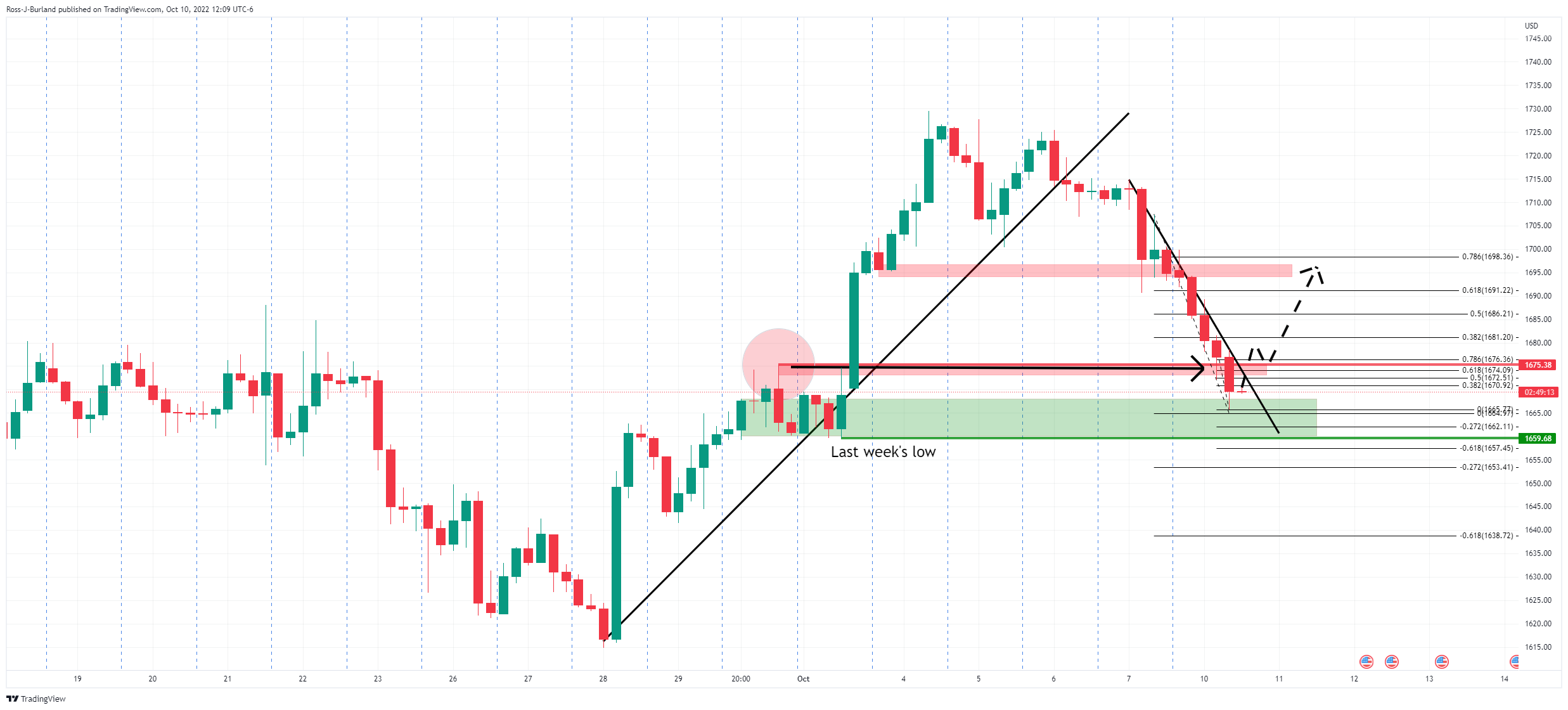

Gold H1 chart

The price has reached the start of the prior rally as follows:

As illustrated, the price has made its way into the forecasted support area but still has some way to go until reaching last week's low. A correction into the key Fibonaccis that has a confluence with the prior structure could result in an onward move in the yellow metal to test the weekly lows:

A move beyond that resistance structure, however, could have implications for a move deeper correction, as per the following 4-hour analysis:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.