- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY bears eye a breakout but bulls are holding the fort ahead of US CPI

USD/JPY bears eye a breakout but bulls are holding the fort ahead of US CPI

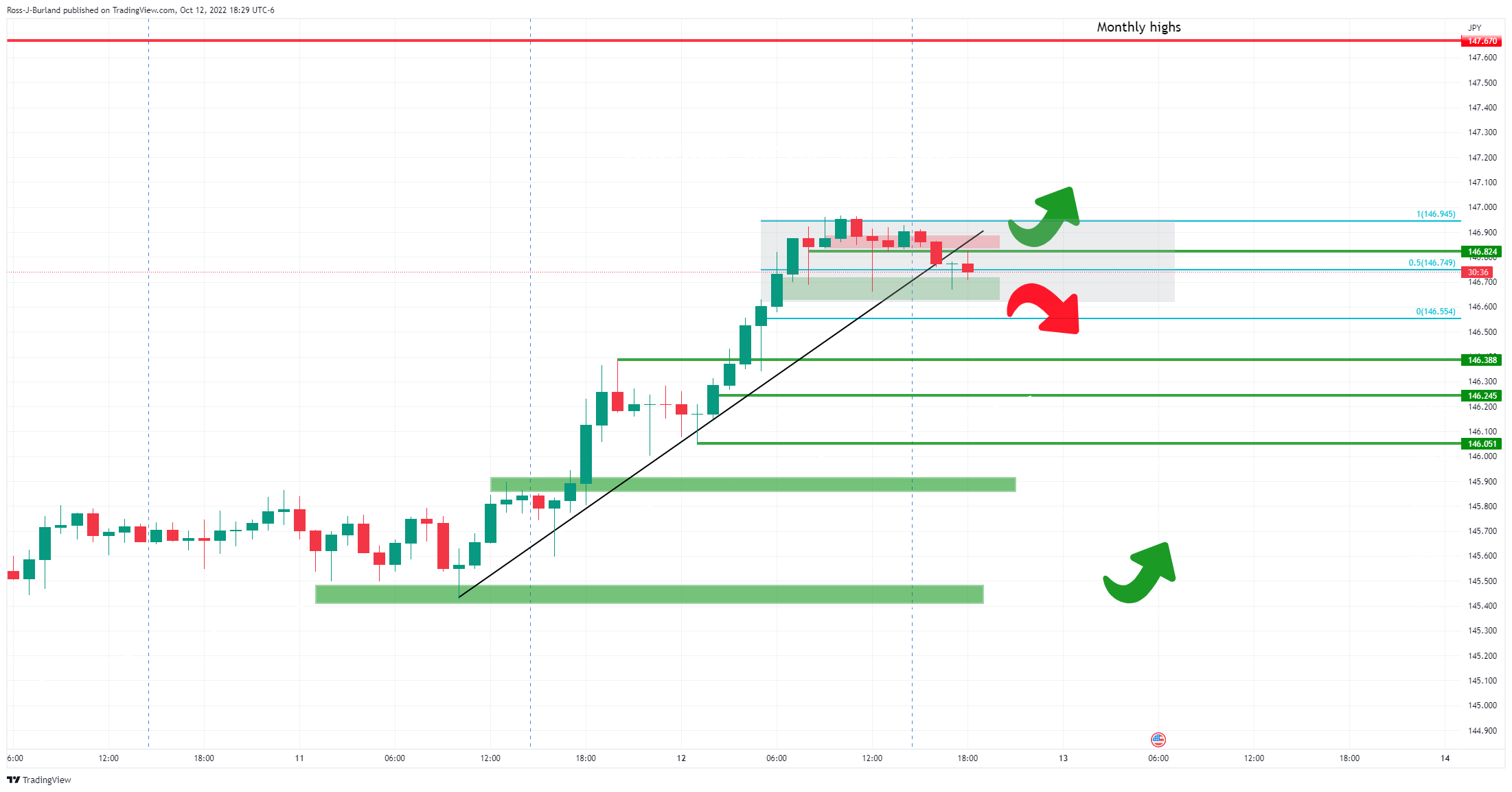

- USD/JPY is pressing below a key trend line support and horizontal structure.

- Bulls need to break into the 147s or face capitulation risks into the US CPI data while bears need to get below 146.66.

USD/JPY has been consolidating below the bull cycle lows for the best part of Wednesday's trade, stalling into and around the Federal Open Market Committee minutes that failed to move the needle significantly enough to put much of a dent into the bullish trend. At the time of writing, USD/JPY is trading between a low of 146.66 and 146.91 as Tokyo opens.

On Wednesday, the US dollar climbed to a fresh 24-year peak versus the yen despite the lofty levels that have some observers anticipating central bank intervention. Japan had staged its first yen-buying intervention since 1998 on September 22, when the dollar was at 145.90 yen. Nevertheless, traders were given the green light to sell the yen after Bank of Japan Governor Haruhiko Kuroda vowed to keep monetary policy loose in order to support an economic recovery. Kuroda said that the weak currency could be a benefit to the economy.

Meanwhile, the greenback pared gains after minutes from the last Federal Reserve meeting showed some dovish undertones. There was a hint of a pivot in the minutes, where "several participants noted that... it would be important to calibrate the pace of further policy tightening with the aim of mitigating the risk of significant adverse effects on the economic outlook," which sank the 10-year yield initially and weighed on the greenback, allowing the yen to strengthen to the low of the day before it weakened again. Overall, the Fed is seen to remain committed to raising interest rates in order to bring down inflation which continues to support USD.

Additionally, the greenback had been firm on the back of data that was released at the start of the day showing US producer prices increased more than expected in September. The producer price index for final demand rebounded 0.4%, above the forecast for a 0.2% rise. In the 12 months through September, the PPI increased 8.5% after advancing 8.7% in August.

For the day ahead, it is all about US inflation data. Consumer Price Index likely stayed strong in September, as analysts at TD Securities said, ''with the series registering another large 0.5% MoM gain. Shelter inflation likely remained strong, though we look for used vehicle prices to retreat sharply. Importantly, gas prices likely brought additional relief for the headline series again, declining by about 5% MoM. Our MoM forecasts imply 8.2%/6.6% YoY for total/core prices.''

USD/JPY technical analysis

The price is moving out of trendline support which puts the onus on the downside. However, if the bears can't get below the double bottom and horizontal support ahead of US CPI, then the risks will be tilted for an onwards bullish continuation and the data will determine the outcome of this phase of consolidation.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.