- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USDCAD: The Loonie to fall towards 1.3500, as the Bank of Canada prepares to lift rates 75 bps

USDCAD: The Loonie to fall towards 1.3500, as the Bank of Canada prepares to lift rates 75 bps

- Improvement in risk appetite due to speculations of a Fed pivot weakened the US Dollar.

- Worse-than-expected US economic data, namely consumer confidence, and housing data are headwinds for the USD, bolstering the CAD.

- The Bank of Canada is expected to hike 75 bps, but if it goes 50 bps, the USDCAD can rally towards 1.3700.

- If the USDCAD is neutral-to-upward biased, but a break below 1.3600 will send the pair towards 1.3500.

The US Dollar recovers some ground as Wednesday’s Asian Pacific session begins, following Tuesday’s trading session, characterized by risk appetite increasing as shown by US equities registering gains due to investors speculating that a Federal Reserve’s pivot is imminent, while the US Dollar weakened. Contrarily, the Canadian dollar was underpinned by expectations of the Bank of Canada’s (BoC) lifting interest rates by 75 bps at its monetary policy decision. Hence the USD/CAD is trading at 1.3626, above its opening price by 0.16%.

The US Dollar gets battered on risk-on mood, weaker consumer confidence, and falling US home prices

Besides US corporate earnings beating previous quarter reports, the US Dollar was hit by weaker-than-expected economic data. The Conference Board (CB) reported October’s Consumer Confidence, which ebbed due to increasing worries about inflation and a possible recession in the United States. The index fell to 102.5 from 107.8 in September and missed street analysts’ forecasts of 106.5. The USDCAD dived in the release, from around 1.3700, toward the 1.3620 area, as consumer confidence data added to weaker US housing market figures, revealed earlier.

The United States calendar revealed that the US housing market continues to cool down, weighed by the Federal Reserve’s monetary policy stance. The S&P CoreLogic Case-Shiller Index reported that prices in 20 large US cities tumbled 1.3% MoM in August, the most since March 2009. At the same time, the Federal Housing Finance Agence (FHFA), in a separate report, flashed that house prices rose by 11.9% YoY in August, though trailed by July’s 13.9% increases.

US Treasury yields dropped, weakening the USD and boosting the CAD

Meanwhile, US bonds rallied, which weighed on US Treasury bond yields. The US 10-year benchmark note rate plunged fourteen bps from around 4.22% toward 4.08%, weakening the greenback, as shown by the US Dollar Index (DXY). The DXY lost almost 1% on Tuesday, capitalized by Canadian dollar buyers, which extended the USDCAD losses toward its daily low of 1.3601.

The Bank of Canada is expected to hike 75 bps the bank rate

Aside from this, the Bank of Canada (BoC) monetary policy meeting looming bolstered the CAD. Given that the last BoC Consumer Survey showed that business sentiment softened and price pressures eased, inflation expectations remained high, as shown by the poll. Also, the Canadian Consumer Price Index (CPI) for September, a measure for inflation, rose by 6.9% YoY, above estimates of 6.8%, though lower than August’s 7.0%, justifying the need for higher interest-rate hikes by the BoC.

In Wednesday, the Canadian economic docket will feature the Bank of Canada’s monetary policy decision. On the US front, additional housing data, with September’s Building Permits, and New Home Sales, would add further downward pressure on the USD, which could be positive for the CAD.

USDCAD price forecast

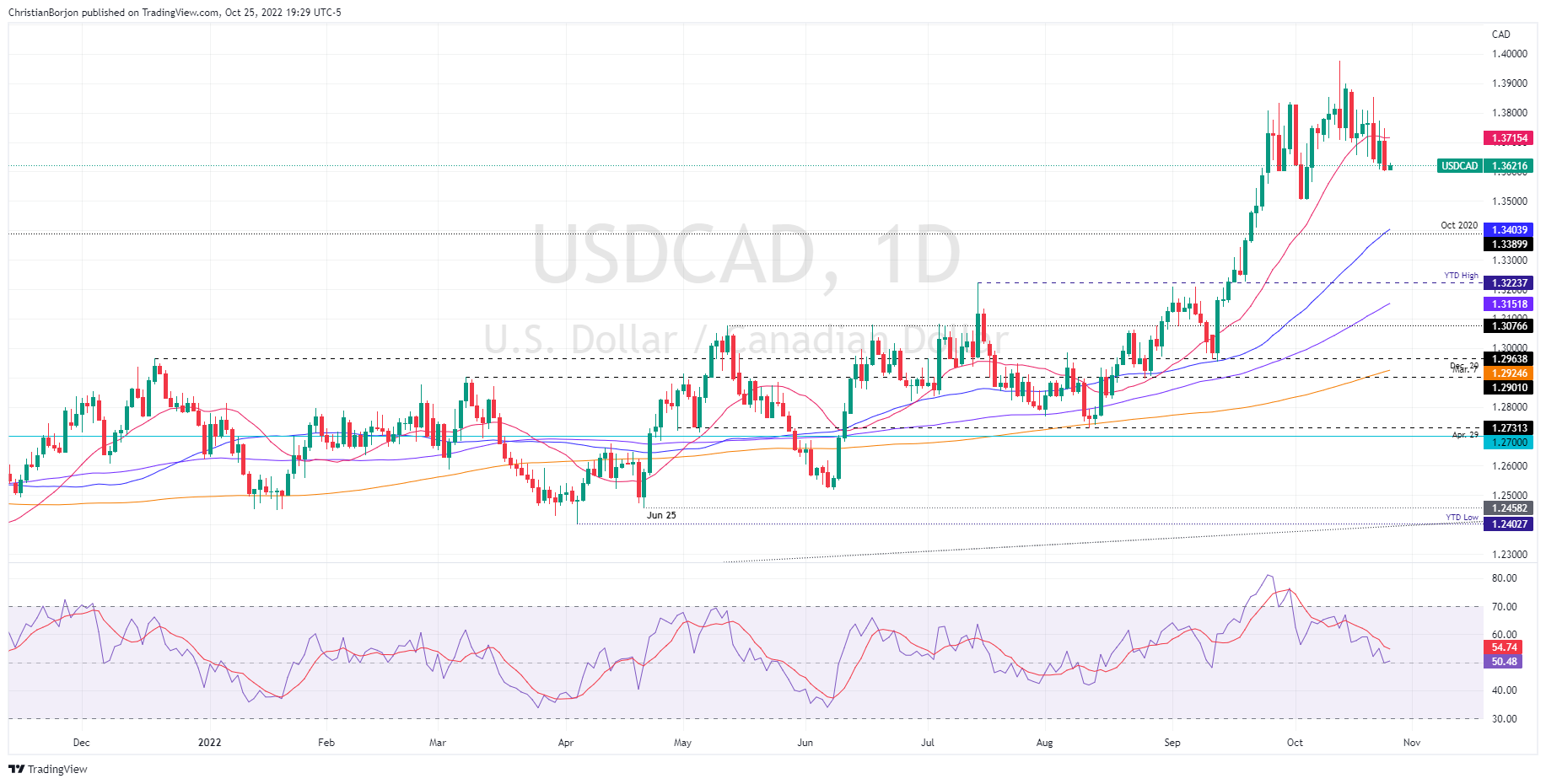

The USDCAD is neutral-to-upward biased, as shown by the daily chart. On Tuesday, the Loonie strengthened vs. the US Dollar as the exchange rate slumped below the 20-day Exponential Moving Average (EMA), hitting a fresh three-week low at 1.3600. Although the USD recovered some ground, it remains vulnerable to selling pressure, as the Relative Strength Index (RSI) at 50.43 extended its fall, aiming towards the bearish territory. That could mean sellers are gathering enough momentum to push the USDCAD towards the 1.3500 figure.

Key support levels lie at 1.3600, followed by the October 6 daily low at 1.3564, ahead of the 1.3500 figure. On the flip side, the USDCAD’s first resistance would be the 1.3700 mark, followed by the 20-day EMA at 1.3715 and October’s 25 high at 1.3747.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.