- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USDJPY: The USDJPY consolidates ahead of the BoJ policy decision

USDJPY: The USDJPY consolidates ahead of the BoJ policy decision

- Better-than-expected United States economic growth bolstered the USD against most G8 currencies, except the Japanese Yen.

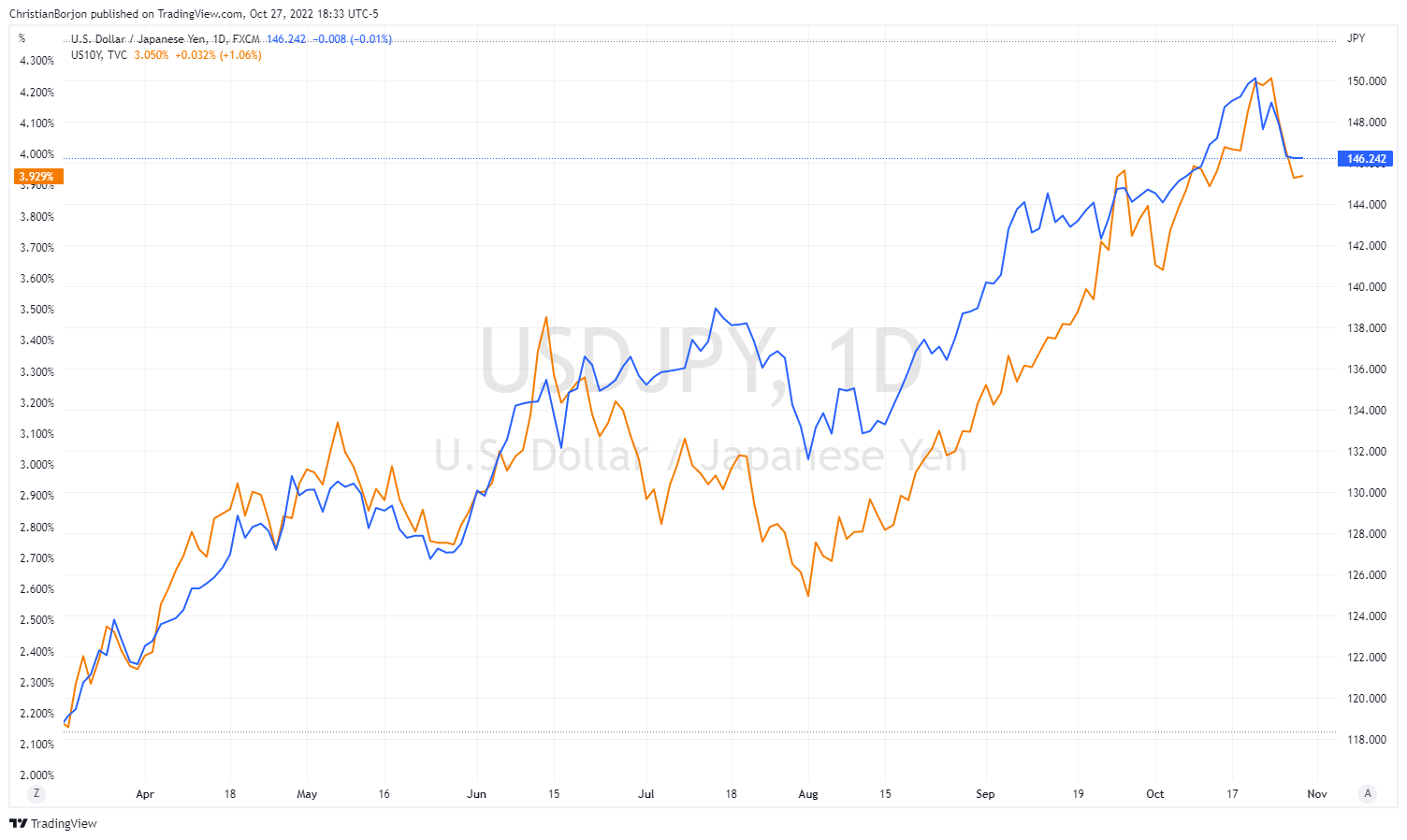

- The path of the US 10-year Treasury yield dictates the trend of the USDJPY due to its high correlation.

- The Bank of Japan’s (BoJ) monetary policy could rock the boat if the BoJ shifts to a neutral stance.

- USDJPY is still upward biased, though its trend is at the mercy of the US 10-year T-bond yield trend.

The USDJPY barely slumps as the Asian Pacific session begins, following a trading day where a strong US Dollar spurred by positive data from the United States was not enough to derail the Japanese Yen, which held to gains, even though they were minimal, as delineated by the USDJPY sliding 0.04%. Also, a looming monetary policy decision by the Bank of Japan (BoJ) in the docket bolstered the JPY. The USDJPY is trading at 146.20, down by 0.05%.

US data bolstered the USD, but not against the JPY

During the New York session, the US Department of Commerce reported that the United States economy grew faster than estimated. The Gross Domestic Product (GDP) for the third quarter jumped by 2.6%, smashing forecasts of 2.6%. Even though it emphasizes the economy’s resilience, it would not deter Federal Reserve’s officials from tightening monetary conditions.

In the same report, consumer spending weakened, a cheered signal by Fed officials, as they intend to cool down the economy, with data reporting a deceleration from Q2’s 2% to 1.4% in the last quarter.

Additionally, labor market data added to the US Dollar strength, with Initial Jobless Claims for the week ending on October 22 increased by 217K but lower than 220K foreseen and above the previous week’s 214K. Even though US data was positive, it was offset by US Durable Goods Orders for September, which expanded 0.4% MoM, less than 0.6% estimates, showing that inventories are building up.

The USDJPY reaction to US data releases was muted due to the influence of the US Treasury yields.

US Treasury bond yields slide

In the meantime, speculations about a possible Federal Reserve’s pivot are meandering around the financial markets throughout the week, with traders beginning to price in a less hawkish Fed. The US 10-year bond yield plunged 36 bps weekly from its highs at 4.289% to 3.929%, a headwind for the USDJPY. The positive correlation between the USDJPY and the US 10-year bond yield would likely boost or weigh on the US Dollar and the Japanese Yen.

Correlation between the US10-year bond yield and the USDJPY

The Bank of Japan’s monetary decision looming

On Friday, the Bank of Japan (BoJ) would reveal its monetary policy decision. The BoJ is expected to hold rates unchanged at -0.10%, and would likely stick to its Yield Curve Control (YCC) around 0.25%, aimed to keep its ultra-loose monetary policy stance intact.

Such policy was aimed at bringing the Japanese economy out of a deflationary scenario, which so far has been achieved, as shown by the inflation report, namely the Consumer Price Index (CPI) for August, hitting the 3% YoY threshold. But the BoJ Governor Haruhiko Kuroda remains firm in his stance. However, the market has continued to test the JGB 10-year yield during the last month, as investors speculate that the BoJ could pivot from a dovish to a neutral stance sooner rather than later.

USDJPY Price Forecast: Technical outlook

The USDJPY is still upward-biased despite ongoing interventions by the BoJ in the FX markets. If sellers want to regain control, they will need to break below the October 5 daily low at 143.84 so that the USDJPY can challenge the 50-day Exponential Moving Average (EMA). Even though the Relative Strength Index (RSI) dived towards the 50-midline, it remains in positive territory; hence, the buyers are in control.

USDJPY key resistance levels lie at the 20-day EMA at 146.98, followed by 147.00 and the October 26 daily high at 148.41. On the flip side, the USDJPY’s first support would be the 146.00 mark. The break below will expose the weekly low at 145.10, which, once cleared, will expose the previously mentioned 50-day EMA at 143.83.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.