- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- NZDUSD corrects, but trapped longs up high point to further downside

NZDUSD corrects, but trapped longs up high point to further downside

- NZDUSD bears could be about to sink in their teeth again.

- Central bank sentiment is the key driving force as the US Dollar attempts to correct.

NZDUSD has corrected the session's sell-off. The bird rallied from a low of 0.6064 and is testing 0.6120 towards the close on Wall Street. However, longs are still trapped up high near the pair's strongest levels in nearly three months.

The day was mixed on Thursday and two-way business made for a range of between 0.6064 and 0.6167. The US Dollar was supported by stronger-than-expected US Retail Sales data on Wednesday and hawkish remarks from Federal Reserve speakers. However, sentiment and Fed rhetoric have been mixed as data continues to conflict from one day to the next, clouding the path for interest rates.

Tuesday's producer price inflation data was below expectations and this mirrored last week's cooler-than-expected consumer price inflation, signaling that it was not a one-off. This in turn has been fueling hopes that the US Federal Reserve can slow aggressive rate hikes that had sent the US Dollar higher. However, Fed Governor Christopher Waller came to the bull's rescue again when he said the Fed will still need increases into next year although. St Louis Fed President James Bullard spoke at the start of the New York day and said rates should lift to at least 5%-5.25% which is 25bp higher than he previously stated. He also indicated that rates will need to be between 5 to 7% to be sufficiently restrictive to curb inflation.

The US dollar index, DXY, and US yields were firmer on the hawkish sentiment. DXY was recently up 0.4% sitting at 106.70 and between the day's range of 106.1 and 107.24. The 2-year yield sat comfortably around 4.45% and 2% higher on the day. Nev3ertheless, there was a late session dip in both US yields and the greenback which made way for a recovery in the Kiwi.

RBNZ to hike 75bps

Domestically, stubbornly high inflation expectations reinforced the case for more aggressive rate hikes from the Reserve Bank of New Zealand. The latest central bank survey showed that inflation expectations moved higher across the curve and the market is pricing higher rates, expecting a larger increment of 75 basis points next week after delivering a half-percentage point increase in October. RBNZ officials have been outspoken of late, explaining that high inflation and a tight labor market in the country call for demand to be cooled, though they flagged downside risks to the global economy.

NZDUSD technical analysis

As per the prior sessions' bearish thesis, NZDUSD bears eye a break below 0.6130, the pair dropped to target:

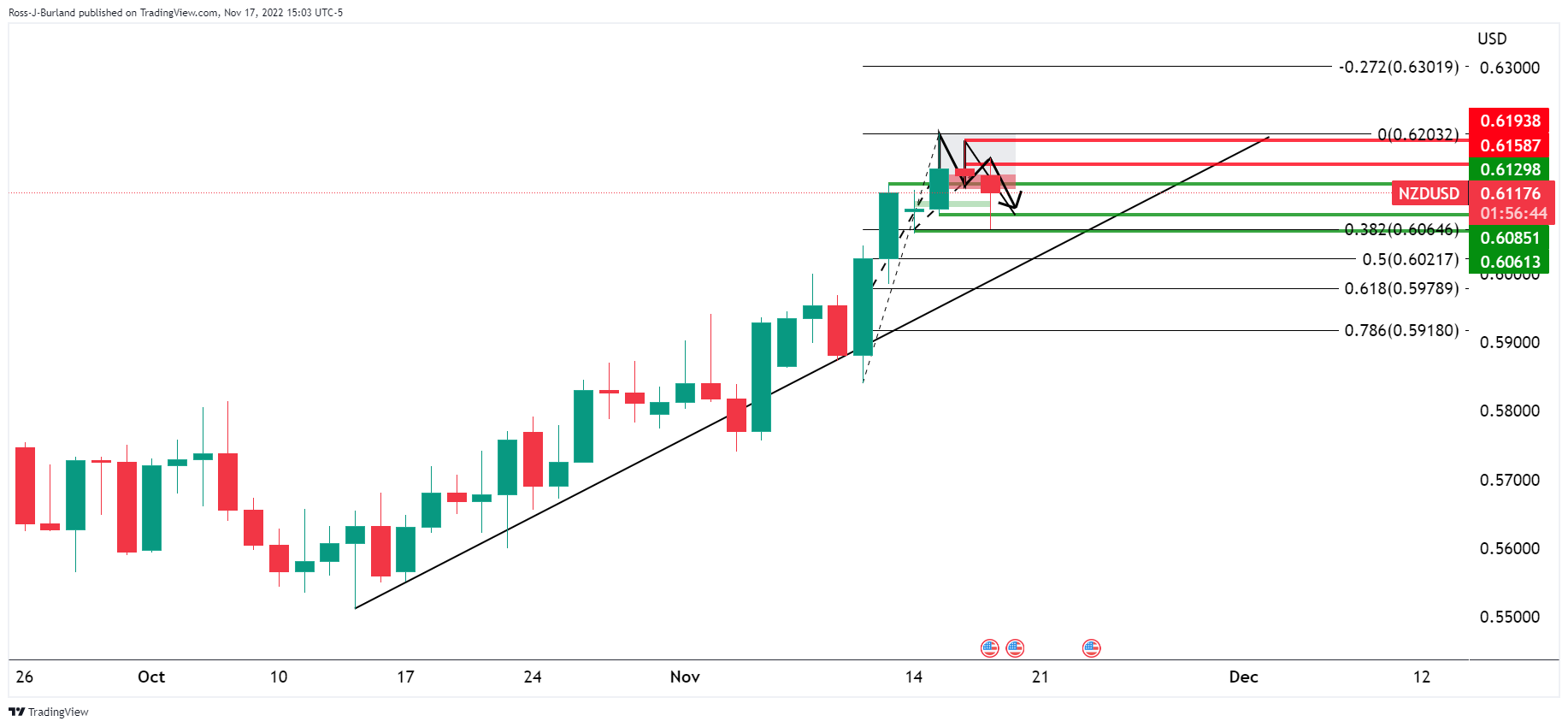

Prior analysis:

The price was topping out on the time frames as per the hourly chart above and the 4-hour chart below:

On the 4-hour chart, however, there were prospects of a triple-top scenario as illustrated above.

NZDUSD update

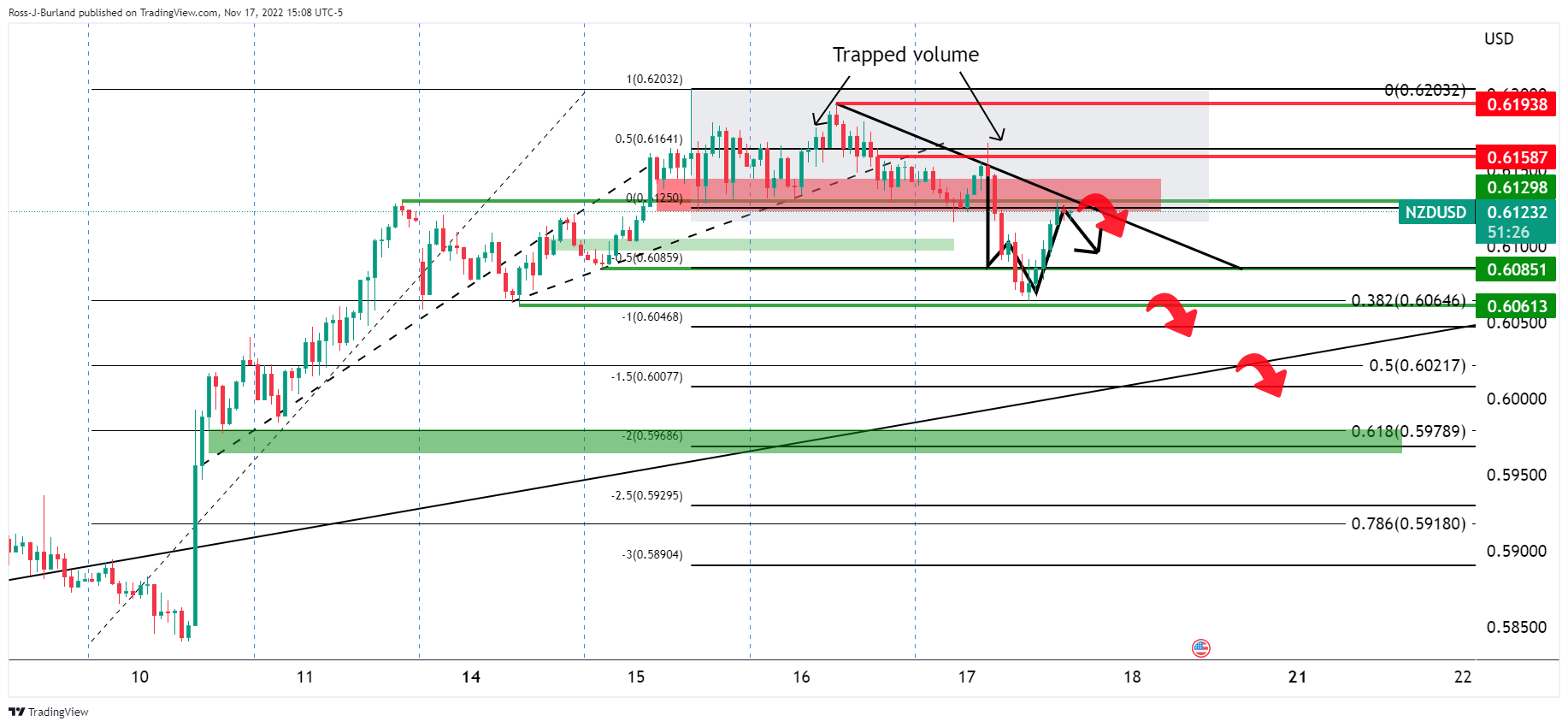

H4 H&S played out.

As illustrated, the H&S played out but the daily 38.2% Fibonacci has supported a bounce back into the breakout territory. However, this might just give the trapped longs up top a lifeline and their subsequent breakeven stop losses could eventuate a move to the downside again when coupled with fresh sellers taking advantage of the discount:

With the price on the front side of the bearish trendline, the W-formation is a reversion pattern that would be expected to be a drag on the recent rally. A retest of the lows could see a push below and on to the 61.8% golden ratio that aligns with prior support in a 200% measured expansion of the trapped volume up top.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.