- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- When is the UK inflation data and how could it affect GBP/USD?

When is the UK inflation data and how could it affect GBP/USD?

The UK CPIs Overview

The cost of living in the UK, as represented by the Consumer Price Index (CPI) for October, is due early on Wednesday at 07:00 GMT.

Given the recently released decline in jobless benefits claims and steady Unemployment Rate at 3.7% led by a shortage of labor, today’s data will be watched closely by the GBPUSD traders.

The headline CPI inflation is expected to soften by 10 basis points (bps) to 10.6% YoY figure versus 10.7% released for November while the Core CPI, which excludes volatile food and energy items, is likely to ramp further to 6.6% YoY during December, from 6.3% previous readouts. Regarding the monthly figures, the CPI is expected to remain steady at 0.4% amid softening energy prices.

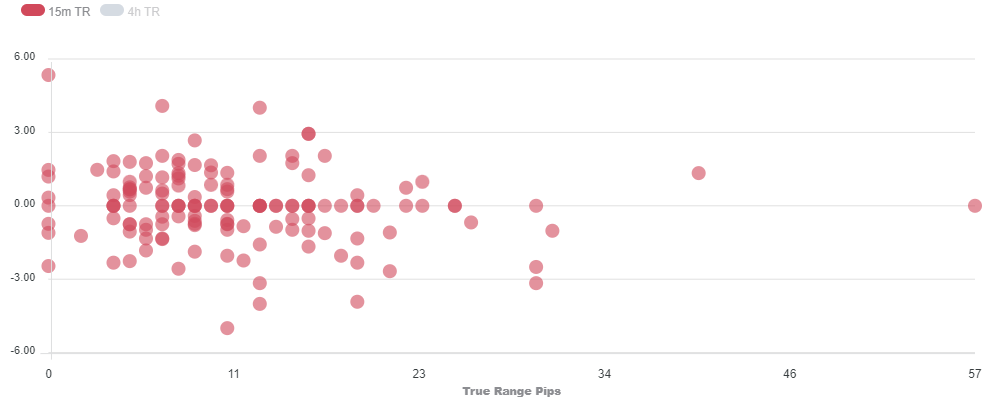

Deviation impact on GBP/USD

Readers can find FXStreet's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined around 20-pips in deviations up to + or -2, although in some cases, if notable enough, a deviation can fuel movements over 30-40 pips.

How could it affect GBP/USD?

Pound Sterling has been outperforming other risk-perceived currencies this week as rising wages in the United Kingdom region are passing all checks for a continuation of sheer policy tightening by the Bank of England (BoE). Unlike, other Western nations, the UK economy has not delivered any meaningful signs of deceleration in the inflationary pressures despite the continuation of hiking interest rates.

BoE Governor Andrew Bailey highlighted the risk of rising wage growth due to a shortage of labor as it could infuse fresh blood into the inflation rate. BoE’s Bailey claimed that inflation will start slowing down amid falling energy prices. However, he is still worried about rising wage growth, which could be a hurdle in decelerating inflation. He added that a major risk to BoE's central case for inflation coming down is the UK labor shortage.

Recently Financial Times, reported that the post-Brexit UK economy is highly responsible for the labor shortage, which has shifted the bargaining power in the favor of job seekers. The post-Brexit UK economy is facing a shortfall of more than 300,000 workers as the result of ending the free movement of labor with the European Union.

Technically, the cable is auctioning in a Rising Channel chart pattern on an hourly scale and is confidently sloping north to recapture a seven-month high at 1.2446. Upward-sloping 20-and 50-period Exponential Moving Averages (EMAs) at 1.2265 and 1.2242 respectively, add to the upside filters. The Relative Strength Index (RSI) (14) is oscillating in the bullish range of 60.00-80.00, which indicates that the upside momentum is active.

Keynotes

GBP/USD Price Analysis: Rising wedge, bearish RSI divergence lure sellers ahead of UK inflation

GBP/USD aims to recapture 1.2300 ahead of UK CPI data

About the UK CPIs

The Consumer Price Index released by the Office for National Statistics is a measure of price movements by the comparison between the retail prices of a representative shopping basket of goods and services. The purchasing power of GBP is dragged down by inflation. The CPI is a key indicator to measure inflation and changes in purchasing trends. Generally, a high reading is seen as positive (or bullish) for the GBP, while a low reading is seen as negative (or Bearish).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.