- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD prints three-day uptrend beyond $1,870 support – Confluence Detector

Gold Price Forecast: XAU/USD prints three-day uptrend beyond $1,870 support – Confluence Detector

- Gold price grinds higher past $1,870 support confluence during three-day winning streak.

- Sluggish US Dollar, downbeat Treasury bond yields keep XAU/USD buyers hopeful.

- Gold buyers cheer mixed Fed talks, US President Biden’s unimpressive SOTU and China-linked hopes.

- Light calendar emphasizes risk catalysts for fresh impulse.

Gold price (XAU/USD) remains firmer for the third consecutive day as buyers cheer a sustained rebound from the short-term key support surrounding $1,870 amid sluggish markets. Adding strength to the XAU/USD rebound could be the US Dollar’s lack of momentum, as well as a pullback in the Treasury bond yields.

The reason for the aforementioned US catalysts, namely the USD and yields, could be linked to the Federal Reserve (Fed) Chairman Jerome Powell’s hesitance in defending the hawks even as the US jobs data came in firmer. Also fueling the Gold price is the latest upward revision of China’s growth forecasts by the global rating agency Fitch. Earlier in the day, news of an upward revision to the global central banks’ buying of Gold to record-high levels seemed to have favored the XAU/USD bulls. It should be noted that US President Joe Biden’s State of the Union (SOTU) speech failed to impress market players despite marking an attempt to please voters ahead of next year’s elections.

Given the lack of major data/events ahead of Friday’s US consumer-centric numbers, the central bank talks and previously stated risk catalysts could entertain Gold traders.

Also read: Gold Price Forecast: XAU/USD bulls seem to lack conviction on the road to recovery

Gold Price: Key levels to watch

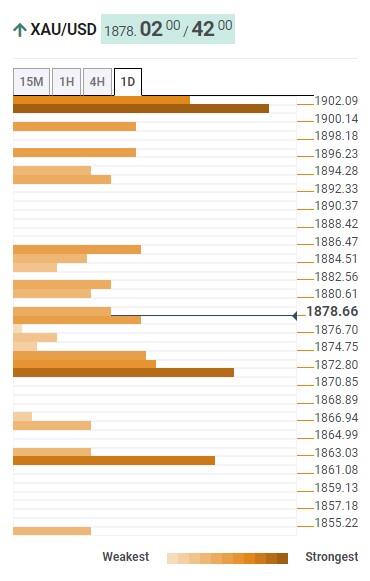

The Technical Confluence Detector shows that the Gold price manages to remain firmer after crossing two important support levels, suggesting further advances towards the $1,902 key hurdle comprising Pivot Point one-day R3 and Fibonacci 38.2% on one month.

Ahead of that, Fibonacci 23.6% and 38.2% on weekly formation can test the Gold buyers around $1,885 and $1,900 in that order.

It’s worth noting that the XAU/USD run-up beyond $1,902 enables the buyers to challenge the latest swing high surrounding $1,960.

On the flip side, Fibonacci 61.8% on one-day and one-month joins the previous low and SMA10 on four-hour (4H) to restrict the metal’s immediate downside near $1,870.

Following that, a convergence of the previous weekly low, Pivot Point one-day S1 and lower band of the Bollinger on one-day acts as the last defense of the Gold buyers around $1,860.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.