- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD bears are hunting down ambitious $1,825 target

Gold Price Forecast: XAU/USD bears are hunting down ambitious $1,825 target

- Gold price is tinkering on the edge of a collapse to $1,825.

- United States of America Consumer Price Index next week will be key for the Gold price.

Gold price was falling on Thursday in a US session sell-off that followed a spike leading into the cash open on Wall Street where heightened volatility led to the collapse of the Gold price. The US Dollar, despite the dovish take on the Federal Reserve, rallied which sank all ships on the day.

US Dollar rises despite dovish Federal Reserve comments

The US Dollar was lit up from the lows of 102.50 in the DXY index that measures the US Dollar vs. a basket of currencies. The Gold price tends to weaken in risk-off scenarios that have carried the US Dollar oy of the Federal Reserve sentiment-induced doldrums of late.

Markets are neither here nor there when it comes to a definitive notion around the Federal Reserve's outlook. The jury is still out as to whether there will indeed be a pivot in the second half of the year that has otherwise been borne out of some dovish rhetoric from the Federal Reserve's chairman, Jerome Powell of late.

In view of the strength of the US January Nonfarm Payrolls data, markets were expecting Federal Reserve's Jerome Powell to double down on his hawkish rhetoric. So, when he used the word ‘disinflation’ early on, this was a trigger for a relief rally in stocks and a dip in treasury yields.

However, the US Dollar and Gold price have been volatile on both sides of the sentiment and Powell described ‘disinflation’ as being in the very early stages. He also emphasised that “the base case for me is that…we’ll have to do more rate increases, and then we’ll have to look around and see whether we’ve done enough”. So, there is still the prospect of a higher terminal rate and that is weighing on the Gold price when it rallies.

''The discussions I’ve been having with clients definitely turned towards the possibility and implications of the Fed going well beyond the 5-5.25 peak everyone has been forecasting,'' Kit Juckes, an economist at Societe Generale said in a note.

''Glancing at the Bloomberg economists’ survey there are quite a few banks that think we’ll be at 5 ¼ well into 2024, but no-one has yet put down a 5 1/2 % peak, let alone something higher,'' he explained. ''The obvious answer is that a 5 ½% peak, instead of 5 ¼%, means little, but 6% increases the risk of the cycle ending messily. And that would support for the US Dollar and be bad for risk-sensitive currencies everywhere,'' he added.

Gold price, a case for lower

The Gold price would also be pressured in such a scenario. In fact, analysts at TD Securities are already calling for lower and argue that Gold price may well still be overbought.

Key notes

''Our tracking of positioning for the top traders in Shanghai gold has pointed to notable liquidations over the past weeks, but this cohort's gold length is now at sub-average levels relative to the last year,'' the analysts explained.

''This suggests the pace of Chinese selling could slow, leaving investors as the marginal buyer or seller. At the same time, however, we don't expect any downside flow from CTAs until prices break the $1,840/oz range. And, we argue that notable selling activity from CTAs will likely be elusive above the $1,800/oz mark,'' the analysts added.

''In contrast, the margin of safety against a marginal buying program is razor thin above $1900/oz. Discretionary money manager positioning also appears flat. Overall, this suggests that the slump in precious metals prices could be limited without data corroborating a more hawkish path ahead.''

Gold price, what's in store on the Economic Calendar?

It could be a turbulent week ahead with US Consumer Price Index, CPI, and Retail Sales.

US Consumer Price Index key for Gold price

CPI is expected to show headline inflation for January at 0.5% MoM and core inflation running at 0.3% MoM. ''If these numbers are achieved this would result in an easing of core inflation from 5.7% to 5.4% YoY and headline inflation from 6.6% to 6.2%,'' the analysts at ANZ Bank explained, noting also Retail Sales and manufacturing data er due.

''If we continue to see strength in these data, then it will be very difficult for Federal Reserve policymakers to signal anything other than a further tightening of monetary policy.''

Gold technical analysis

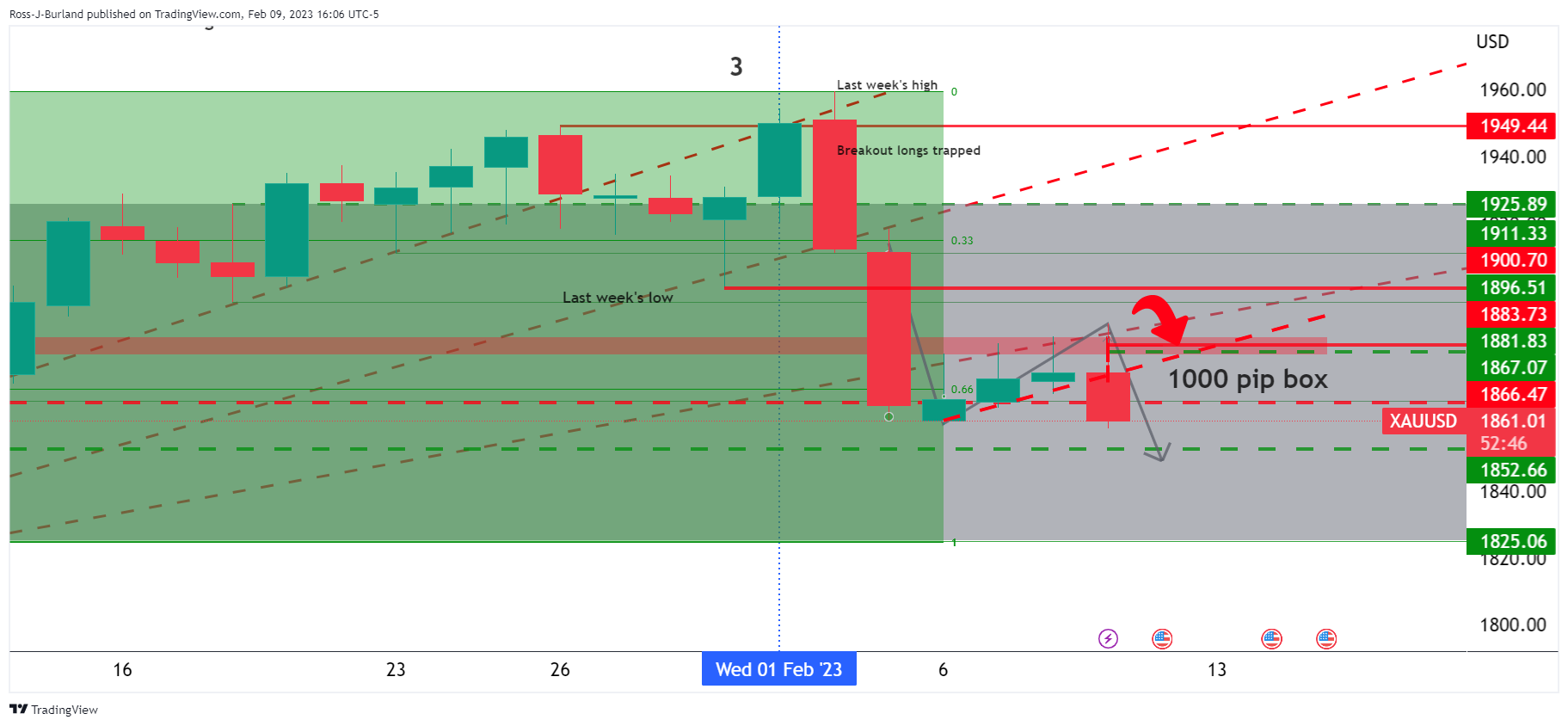

As per the prior Gold price analysis, where it was stated that The Gold price was correcting to a 38.2% Fibonacci retracement level within a 1000 pip box, the downside played out as follows:

(Before)

After:

The move this week in Gold price was forecasted at the start of the week's per-open analysis, an article that is produced each Sunday for the week ahead: Gold, the Chart of the Week: XAU/USD breakout traders triggered in, bear traps being laid down

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.