- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY grinds sideways with a bearish bias if below 131.80

USD/JPY grinds sideways with a bearish bias if below 131.80

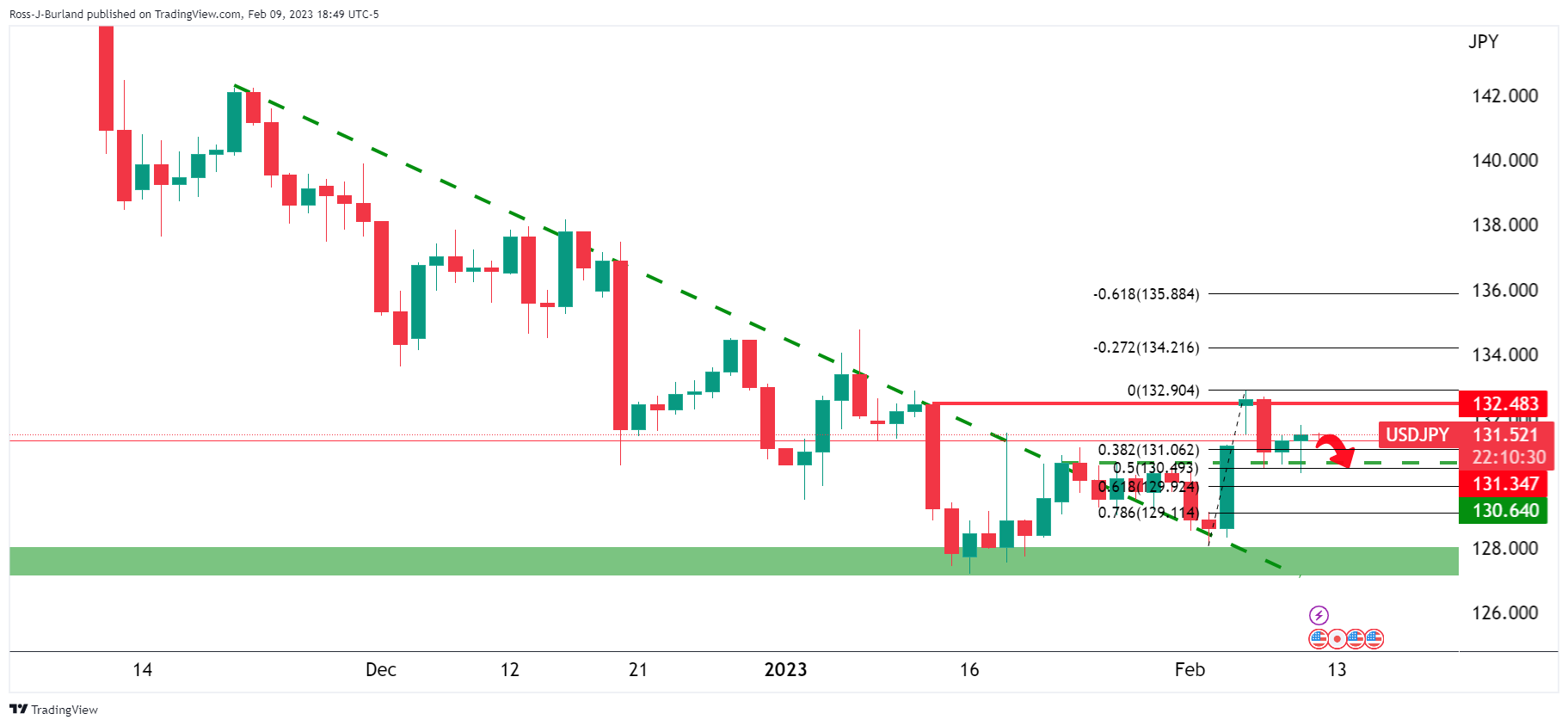

- USD/JPY has prospects of a move 131.00 while below 131.80.

- On the other hand, if above 132.00, there could be further strength in London with 132.20/50 eyed.

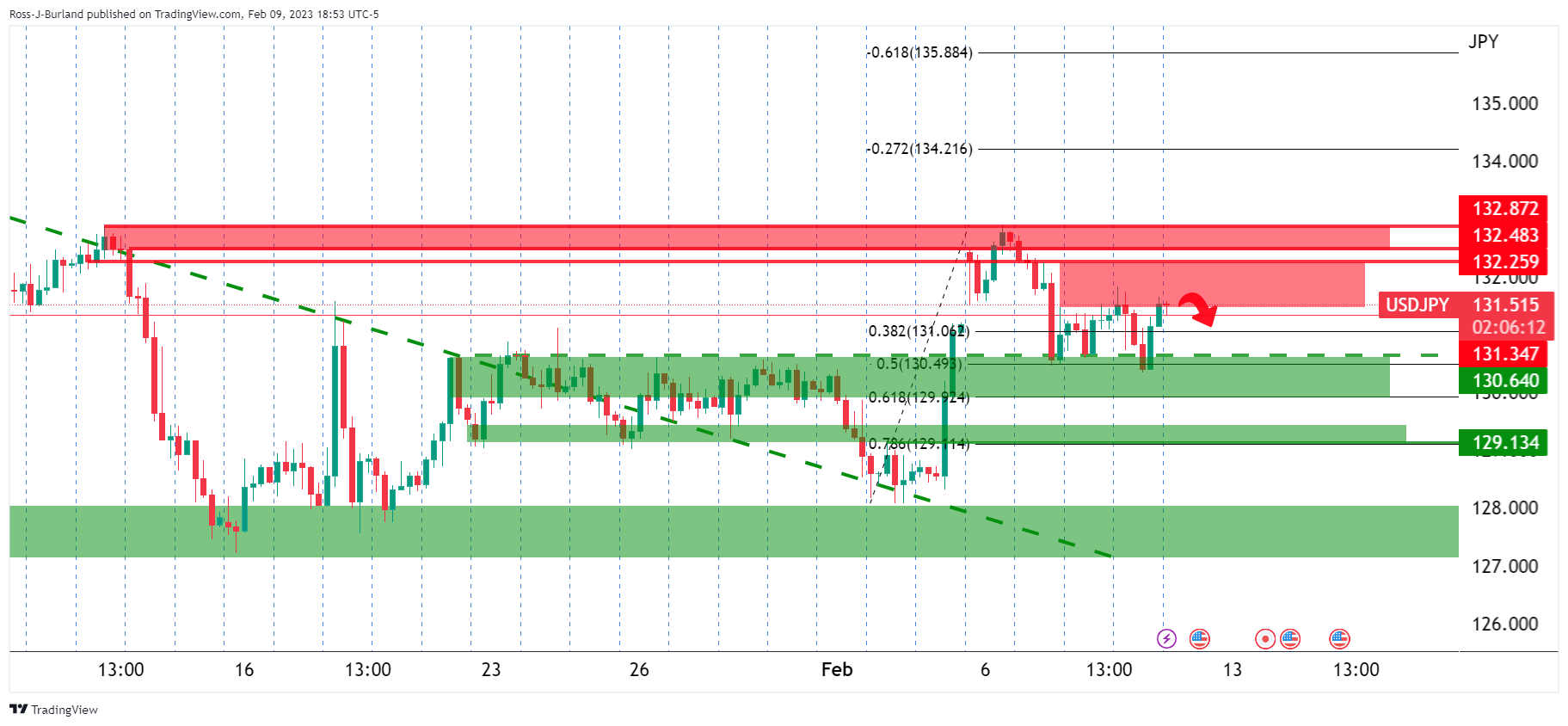

USD/JPY is travelling in a sideways fashion between 131.34 and 131.57 but is leaning bearish in a chop below the highs of February as markets look ahead to the next catalyst for the US Dollar.

The greenback came to life in the US cash open on Wall Street and US equities tanked. This was despite the gap between two- and 10-year yields staying inverted at -82.3 bps, after steepening to -87.5 bps earlier in the session. The two-year rose 3.4 basis points to 4.488% after hitting an almost 10-week high of 4.514%.

However, markets are coming to some sense that the show is not over getting inflation down to the Fed's 2% target could easily take more than a year, something that Federal Reserve officials have continued to warn in various speeches since Fed's chairman Jerrome Powell mentioned that disinflation was started to be a theme in economic data.

A higher-than-expected US Jobless claims number did not keep the greenback down for long as the prospects of a tight labour market keep nervous investors on the sidelines waiting for next week's Consumer Price Index.

State unemployment benefits rose 13,000 to a seasonally adjusted 196,000 for the week ended Feb. 4, data showed. However, this is still well below the 250k a year prior. Economists polled by Reuters had forecast 190,000 claims for the latest week.

Before next week's data, we will get Friday's slew of numbers including the University of Michigan Consumer Sentiment Survey that could move the needle in markets that are more than ever data-dependent right now.

Meanwhile, next week's CPI is looming and is expected to show headline inflation for January at 0.5% MoM and core inflation running at 0.3% MoM. ''If these numbers are achieved this would result in an easing of core inflation from 5.7% to 5.4% YoY and headline inflation from 6.6% to 6.2%,'' the analysts at ANZ Bank explained, noting also Retail Sales and manufacturing data er due.

''If we continue to see strength in these data, then it will be very difficult for Federal Reserve policymakers to signal anything other than a further tightening of monetary policy.''

USD/JPY technical analysis

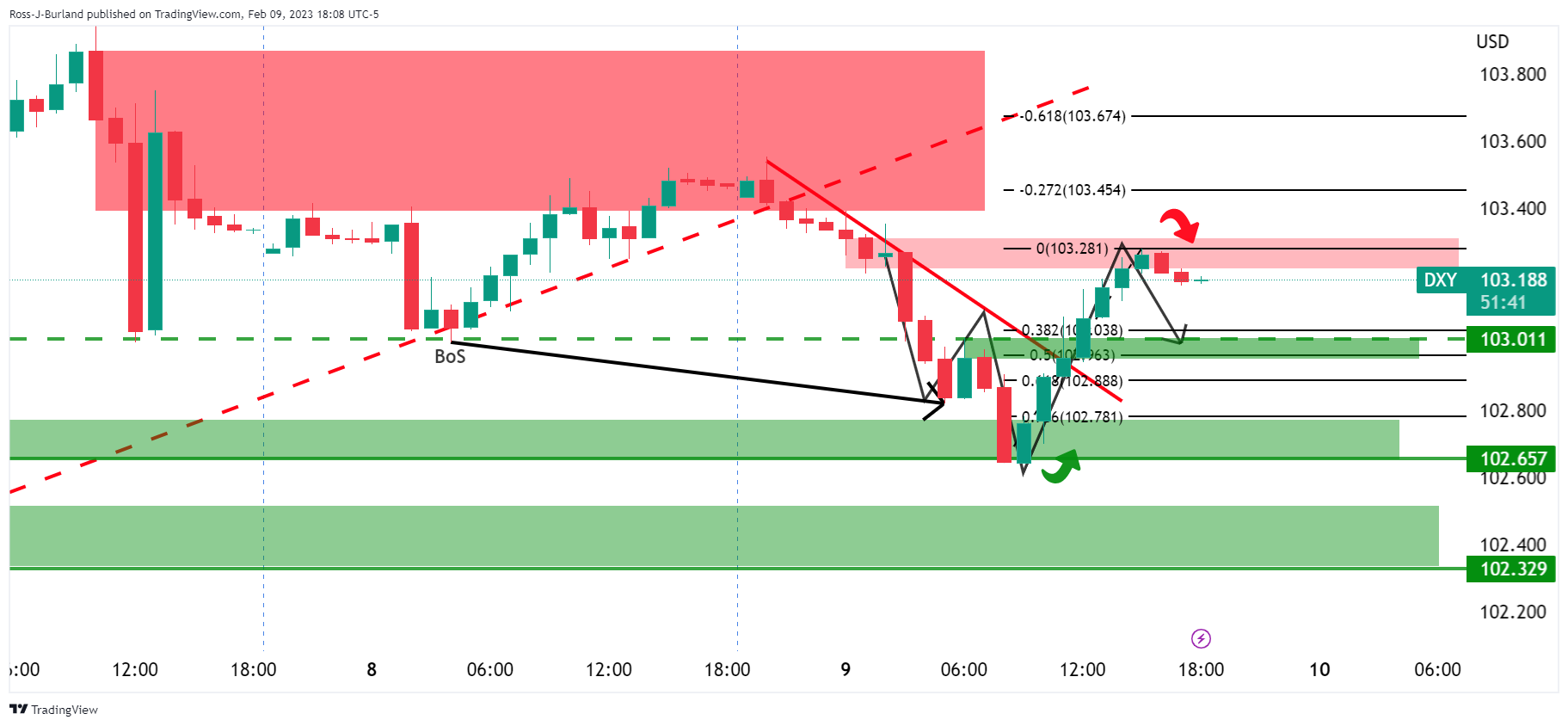

The DXY is a W-formation on the charts which is a reversion pattern that would be expected to pull in the price for the near term. this leaves the outlook temporarily, at least, for USD/JPY as follows:

The price has bust through a structure but there is a lack of conviction while below prior resistance for the week, so far. Nevertheless, there are prospects of a move 131.00 while below 131.80. On the other hand, a break there and a follow-through above 132.00 could see the starting balance for the day favourable for further strength in London with 132.20/50 eyed:

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.