- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EUR/USD bulls make a move to test key resistance as US Dollar slides ahead of US CPI

EUR/USD bulls make a move to test key resistance as US Dollar slides ahead of US CPI

- EUR/USD has run up high in a short squeeze as traders look ahead to US CPI.

- Beares are lurking with eyes on 1.0600 on the downside.

EUR/USD has been testing a critical high in the midday session on Wall Street following what had been a positive start for the day for the US Dollar. At the time of writing, EUR/USD is trading up high for the day at 1.0727 and has gained 0.4% so far following a rally from the Asian lows of 1.0655 within a 93 pip Average True Range (ATR).

Fundamentally, it's all about the Federal Reserve and positing in front of the key data event for the week ahead in the United States of America's Consumer Price Index with Retail Sales as a sideshow the following day. There are mixed outlooks for the CPI data with some analysts anticipating a hawkish outcome while others a dovish one.

Federal Reserve speakers have already been out of the gate this week with hawkish rhetoric. Fed Governor Michelle Bowman said the following:

"I expect we'll continue to increase the federal funds rate because we have to bring inflation back down to our 2% goal and in order to do that we need to bring demand and supply into better balance," Bowman said during an American Bankers Association conference in Florida.

Once at a sufficiently restrictive level, interest rates will then need to be held for "some time" to restore price stability, she added.

Bowman rounded off by saying that a very strong labour market alongside moderating inflation meant a so-called economic 'soft landing' remains possible.

Meanwhile, analysts at Brown Brothers Harriman argued that a move higher in US Treasury yields of late, (10-year rose from Thursday's low of 3.334% to a recent high of 3.755%), coincides with renewed inflation concerns and a reprising of Fed tightening expectations.

''WIRP suggests 25 bp hikes March 22 and May 3 are nearly priced in, while the odds of a third hike in June or July top out near 45%,'' the analysts said. ''Strangely enough, an easing cycle is still expected to begin in Q4 but we believe that will be corrected in the next stage of Fed repricing, which may come after CPI and Producer Price Index data this week,'' they argued.

On the other side of the narrative, analysts at TD Securities said ''TD anticipates a dovish CPI report this week, underscoring the prospects that the recent pain trade starts to reverse.''

''The latest USD correction was inspired mostly by extreme positioning and short-term risk premium, which has also started to correct,'' they noted. ''Plus, the strong employment numbers did little to rattle the Fed, which has helped reinforce the soft-landing narrative.''

''The upshot is that if CPI complies with our forecasts this week, that should kick-start a new round of broad US selling,'' the analysts at TD argued, paving the way for bullish prospects of the euro that is negatively correlated to US selling.

EUR/USD technical analysis

Meanwhile, we have the hourly chart's key resistance being tested:

We have a couple of bearish breaks of structures, BoS, on Friday and the start of the week before the move up into the shorts that had gathered over the last couple of days:

In a short squeeze, the price has burst into a new 100-pip box on the upside but this could just be a momentary pause and correction before the next major move lower.

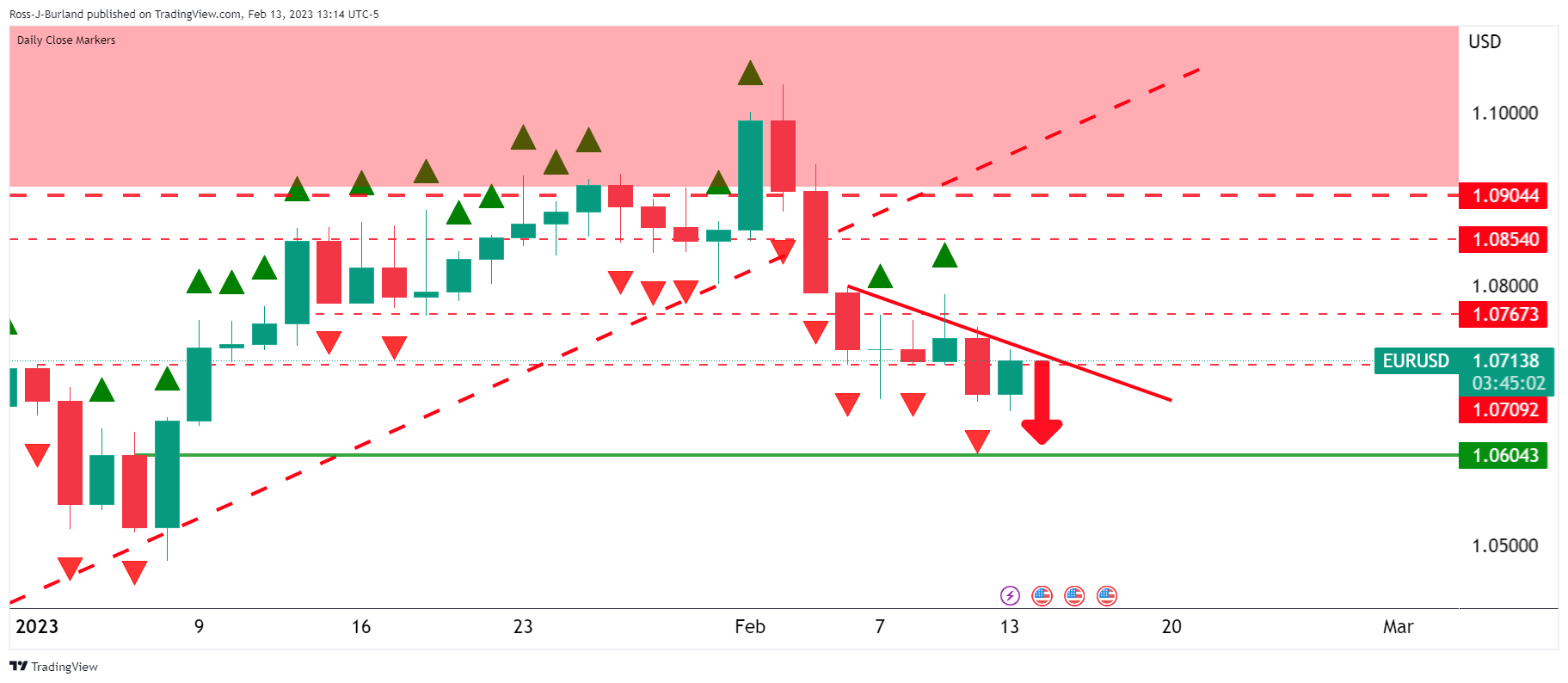

EUR/USD daily charts

While on the front side of the trend, there are p[prospects of a move lower to test the 1.0600 level for the day (s) ahead.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.