- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- NZD/USD bulls look to a test of the 0.62s while above 0.6150

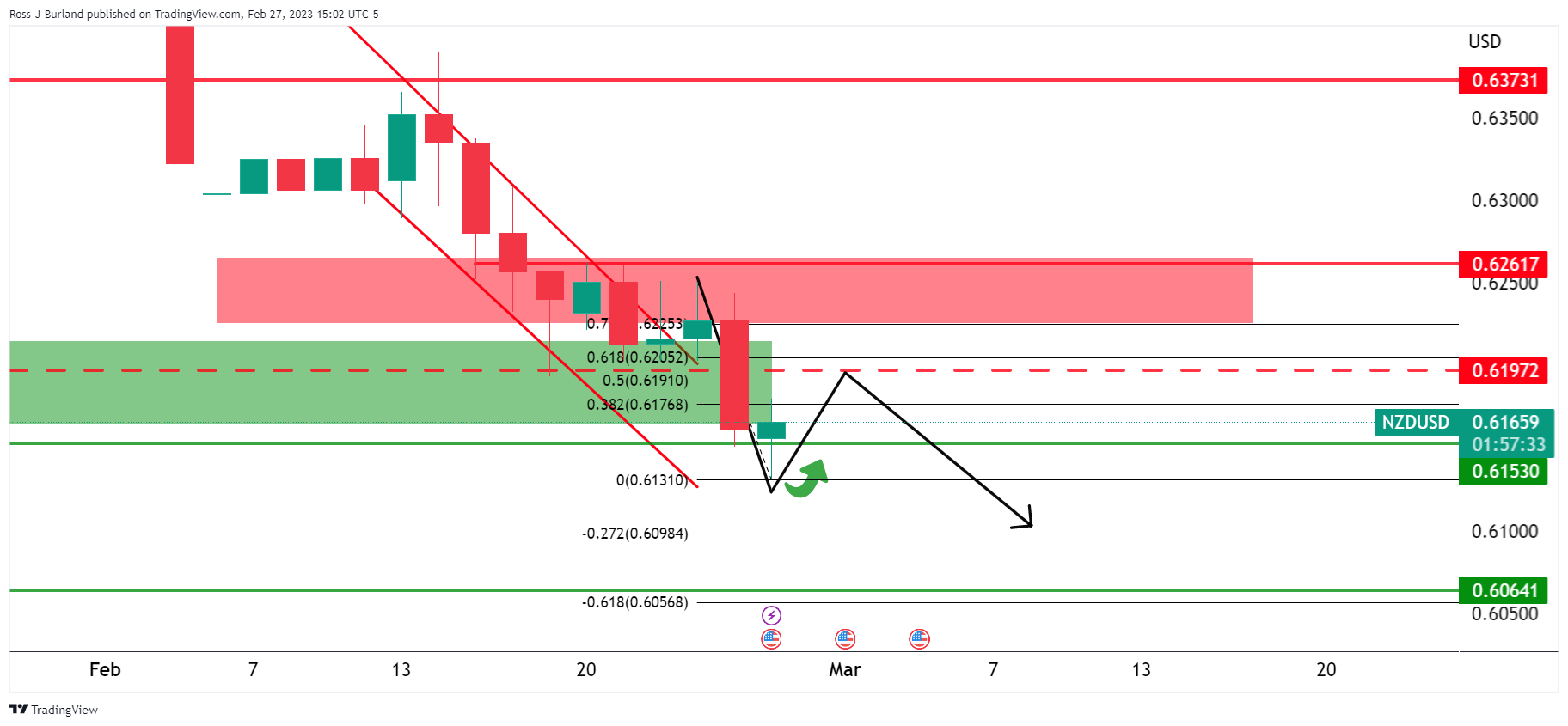

NZD/USD bulls look to a test of the 0.62s while above 0.6150

- NZD/USD bulls come up for air as the US Dollar gives back some ground.

- A triangle is a bearish feature on the hourly chart but that does not invalidate the bullish corrective bias.

NZD/USD is attempting to make a comeback from Friday's sell-off which was a continuation of the bearish cycle from the 0.65s printed at the turn of the month. The pair have traded between a low of 0.6131 and a high of 0.6179 with sights set on a break into the 0.62s for the days ahead.

Analysts at ANZ Bank argued that the price action was mostly noise, but said ''the bounce in equities and risk appetite did see the USD DXY slip back.''

''We may well see more volatility into month end given that US asset markets were one of the poorer performers (implying that rebalancing flows into USD),'' the analysts said. ''But that depends on how today goes.''

''Meanwhile, in the background, a 3-way tug-of-war of NZD views is playing out between those citing rebuild activity, those concerned about the disruption to exports and impact on Crown finances, and those expecting a USD rebound. So, it’s a bit messy,'' the analysts added.

The US Dollar has been out in front for several days based on the script being flipped with regard to the narrative surrounding the Federal Reserve. However, data on Monday put a halt on a slew of inflationary positive data which enabled a correction to occur in risk appetite, which has been so far supportive of the Kiwi to start the week.

The US data on Friday showed US consumer spending increased by the most in nearly two years in January, while inflation accelerated, adding to market fears the Fed could continue raising interest rates. However, today's Commerce Department's Durable Goods report, which covers everything from air fryers to helicopters, showed a whopping 54.6% plunge in commercial aircraft/parts. This led to the US-made merchandise numbers falling by 4.5% in January, steeper than the 4.0% decline analysts expected and a reversal from December's downwardly revised 5.1% increase and the greenback dropped heavily.

More important US data coming up

For the meanwhile, traders will instead be looking to the ISM surveys. Data already released point to a rebound for the ISM mfg index in Feb following five months of consecutive declines that saw the series drop to a post-Covid low of 47.4 in Jan, analysts at TD Securities said.

''Separately, we look for the ISM services index to stabilize around its current level after the notable Dec-Jan zigzag in the series. We might revise our projection as more data is released next week.''

NZD/USD technical analysis

The price is accumulating bids near 0.6150 is what is regarded as a support area. If this were to continue, then there will be prospects of a move towards the prior structure near 0.6200 for the days ahead:

The triangle is a bearish feature on the hourly chart but that does not invalidate the bullish corrective bias until the fact. 0.6150 is key in this regard.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.