- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- EUR/USD trims Wednesday’s gains, down below 1.0600

EUR/USD trims Wednesday’s gains, down below 1.0600

- EUR/USD tumbles below 1.0600 as US T-bond yields stay above 4%.

- US employment data reiterated the tightness of the labor market, warranting further Fed action.

- EUR/USD Price Analysis: Neutral biased, though approaches the 100 and 200-DMAs.

The EUR/USD loses traction in the mid-North American session and trades below its opening price by 0.83%, below the 1.0600 mark. Reasons like unemployment claims in the United States (US) easing triggered investors’ reaction, that perhaps their inflation view is wrong, sending US bond yield skyrocketing. Hence, the US Dollar (USD) strengthened to the Euro (EUR) detriment. At the time of writing, the EUR/USD trades at 1.0575.

The US Department of Labor (DoL), revealed that the number of people who filed for unemployment benefits for the first time in the week ending on February 25 was 190K, which was lower than the 195K predicted by experts. The market reacted negatively, sending US Treasury bond yields above the 4% threshold and underpinning the US Dollar.

The EUR/USD tumbled below 1.0600 on the initial reaction following US Initial Jobless Claims data, while the US Dollar rallied. At the time of typing, the US Dollar Index (DXY), a measure of the buck’s value vs. a basket of six currencies, advances 0.73%, at 105.141.

On the Euroarea inflationary figures were unveiled. The Harmonised Index of Consumer Prices (HICP), rose 8.5% YoY, above the previous month’s 8.6%. However, the reading missed the market expectations of 8.2%. Excluding volatile items, the so-called core inflation, on its annual reading, printed at 5.6%, higher than the previous and expected 5.3%.

Even though figures were higher than expected, investors had already priced in a 50 bps rate hike by the European Central Bank (ECB) as announced by its President Christine Lagarde in its last meeting presser. However, recent data have ECB policymakers split on what signal the bank should send to the markets.

Meanwhile, the Federal Reserve (Fed) and the ECB are expected to raise rates. The former would likely hike 25 bps, as shown by money market futures, but further data to be revealed ahead of March’s meeting could put into discussion a 50 bps rate hike. On the European side, the ECB is leaning toward 50 bps, though recent data could open the door for higher rates.

EUR/USD Technical analysis

After rallying toward the weekly high of 1.0691, the EUR/USD plunges, erasing almost its Wednesday gains. The EUR/USD clashed with the 20 and 50-day Exponential Moving Averages (EMAs) at 1.0664 and 1.0657, respectively, and has reached a daily low of 1.0576. Albeit the EUR/USD pair turned south, its bias remains neutral, but a daily close below 1.0600 could pave the way for further downside.

Therefore, the EUR/USD first support would be the March 2 daily low of 1.0576. Break below, and the 100-day EMA at 1.0550 would be tested by sellers ahead of falling to the 200-day EMA at 1.0533. Conversely, the EUR/USD first resistance would be the psychological 1.0600 figure. Once conquered, the Euro could appreciate toward the confluence of the 50/20-day EMA at 1.0657/1.0665, followed by a test of 1.0700.

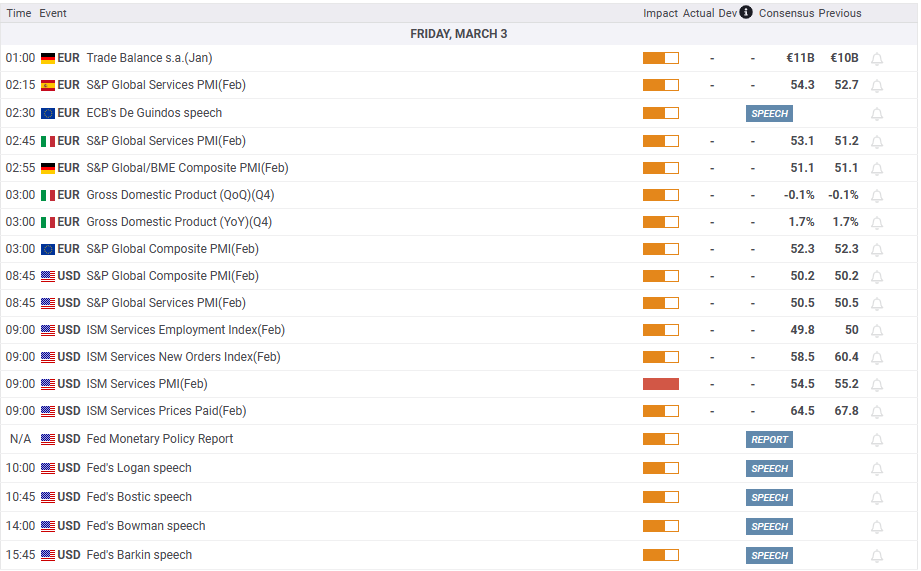

What to watch?

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.