- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD approaches $1,865 hurdle as key US catalysts loom – Confluence Detector

Gold Price Forecast: XAU/USD approaches $1,865 hurdle as key US catalysts loom – Confluence Detector

- Gold price eyes the first weekly gain in five, has smooth road till $1,865 resistance confluence.

- Pullback in US Treasury bond yields, US Dollar join fresh chatters surrounding Fed policy pivot to propel XAU/USD price.

- US ISM Services PMI can direct intraday moves, Fed Chair Powell’s testimony, US NFP will be the key to clear directions.

Gold price (XAU/USD) appears well-set to print the first weekly gain in five as the metal buyers cheer a softer US Dollar. Adding strength to the bullion’s latest rebound could be the retreat in the US Treasury bond yields from multi-day highs.

The latest round of Federal Reserve (Fed) talks renew the policy pivot speculations and joined mixed US data to exert downside pressure on the US Dollar, as well as the Treasury bond yields. It’s worth noting that the impressive PMIs from China and the policymakers’ readiness to resume the trade talks between Beijing and Washington also seem to keep the Gold buyers hopeful.

However, the cautious mood ahead of the top-tier data/events and fears of the Sino-American tussle over China’s ties to Russia cap the XAU/USD’s immediate upside. That said, Friday’s US ISM Services PMI for February, expected at 54.5 versus 55.2 prior readings, will be important to watch for intraday directions. Though, major attention will be given to the next week’s Federal Reserve (Fed) Chairman Jerome Powell’s Testimony and the monthly US jobs report for February, encompassing the key Nonfarm Payrolls (NFP).

Also read: Gold Price Forecast: Will XAU/USD buyers recapture critical 21 DMA hurdle?

Gold Price: Key levels to watch

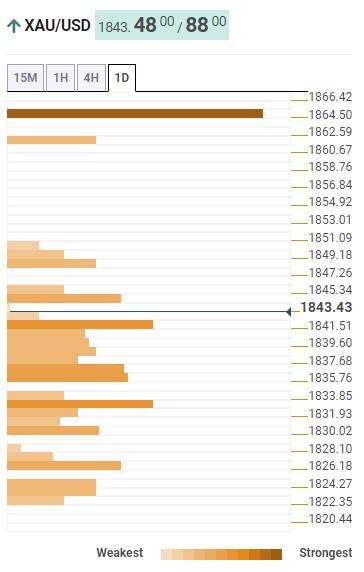

The Technical Confluence Detector shows that the Gold price grinds higher past short-term key hurdles, now supports, which in turn suggests a smooth road unless hitting the wall of resistance around $1,865 comprising Fibonacci 38.2% on one month.

That said, a convergence of the Pivot Point one-day R2, Fibonacci 161.8% on daily and the middle band of the Bollinger on one-day, close to $1,845, appears a small check for the bulls.

Also likely to act as minor resistances are the levels comprising Pivot Point one-day R3 and Pivot Point one-week R2, respectively around $1,849 and $1,862.

Alternatively, previous high on four-hour and Fibonacci 23.6% on one month timeframe together highlight $1,841 as the immediate support.

Following that, Fibonacci 23.6% on one-day and Fibonacci 61.8% on one week, around $1,833 at the attest, can act as the last defense of the Gold buyers.

It’s worth observing that 50-HMA and Fibonacci 61.8% on one-day, close to $1,835, acts as an extra filter towards the south.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.