- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold and silver prices retrace after 10% rallies, bulls still favored

Gold and silver prices retrace after 10% rallies, bulls still favored

- Gold price peaked on Monday right above $2,000 before bulls took some profit.

- Silver is following the same trend, still far from its all-time highs.

- Precious metals have benefitted from the international banking crisis.

Precious metals are continuing the retracement initiated on Monday as the financial markets try to settle down from the huge stress seen over the last few days. Gold price (XAU/USD) has pulled back to trading below $1,970 at the time of writing, from a peak above $2,000 early on Monday. Silver price action (XAG/USD) has been a bit quieter, with a relative monthly high below $23 achieved on Monday and a 1% retracement since.

UBS agreement to buy Credit Suisse and coordinated central bank action to inject liquidity into the system are the actions that have somewhat relieved the extreme risk-off mood seen since the collapse of Sillicon Valley Bank.

Gold price rally can keep going on any Federal Reserve dovish hint

Tensions are far from over, though, as the Federal Reserve interest rate decision on Wednesday is a crucial one to understand how the biggest central bank in the world understands the dilemma between combating relentless inflation and alleviating the stress the international banking system is suffering.

Institutional market strategists believe that precious metals, particularly Gold, have more room to continue rallying, as any dovish hints in the FOMC statement and projections (also known as the dot plot) will provide a bullish impetus for the bright metal. ANZ Bank analysts write:

“Despite banking regulators rushing to shore up market confidence, the uncertain macro backdrop continues to entice buying.”

“All eyes now shift to the Fed’s two-day meeting. Any dovish commentary should help support the precious metals sector.”

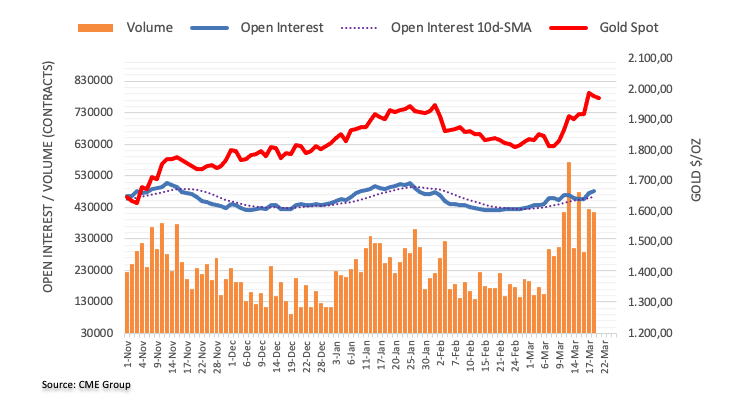

Gold trading volume on the rise

The huge rally (around 10% in the span of a week) seen in Gold price has been highlighted by surging open interest and volume in the futures markets. According to data from the CME Group, the volume of contracts negotiated rose from levels around 13K in the first week of March to an average above 40K in the past seven trading days.

Silver price technical outlook is also bullish

Silver price has not made the same headlines as its brightest counterpart in Gold, but the second-highest traded metal has also profited from the banking crisis. The technical scenario in XAG/USD remains with bullish potential intact despite the recent retracement. Haresh Menghani, Market Analyst at FXStreet, writes:

“The recent breakout through the $21.65-$21.70 confluence resistance was seen as a fresh trigger for bullish traders. Furthermore, a subsequent move and acceptance above the 50% Fibonacci retracement level of the recent sharp pullback from a multi-month peak further add credence to the constructive outlook. This, along with bullish oscillators on 4-hour and daily charts, suggests that the path of least resistance for the XAG/USD is to the upside.

Hence, any subsequent dip towards the overnight swing low, around the $22.20 area, which coincides with the 50$ Fibo. level, could be seen as a buying opportunity.”

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.