- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold finds support at $1,950, volatility to continue as market awaits central bankers’ next move

Gold finds support at $1,950, volatility to continue as market awaits central bankers’ next move

- Gold price settles around $1,950 after extending retracement on Monday.

- Bright metal volatility is here to stay in the short term.

- Balance between inflation, growth and financial stress will shape Gold market.

Gold price has settled around $1,950 in a quiet start to Tuesday trading. The bright metal extended its retracement on Monday on another volatile day, dipping to $1,944 before closing at $1,957, losing more than 1% on the day. It was the seven consecutive day where Gold price range moved over 1%, either up or down.

Things look a lot calmer now, although a sneaky busy Tuesday economic docket could shake things up again. Central bank bosses Andrew Bailey (Bank of England) and Christine Lagarde (European Central Bank) scheduled to speak at different events and the publication of the CB Consumer Confidence in the United States. The banking sector seems to have stopped providing big headlines, but the debate among policymakers on whether to tighten or ease the monetary policy amid sticky inflation figures will likely keep the market guessing and swinging.

What’s next for Gold in a volatile market?

The surging volatility seen recently in financial markets could be here to stay as expectations over future interest rates remain unclear. All central bankers, most notably the US Federal Reserve (Fed), refused to indicate a clear path for their monetary policy in their recent meetings, and the market is trying to figure out what that means.

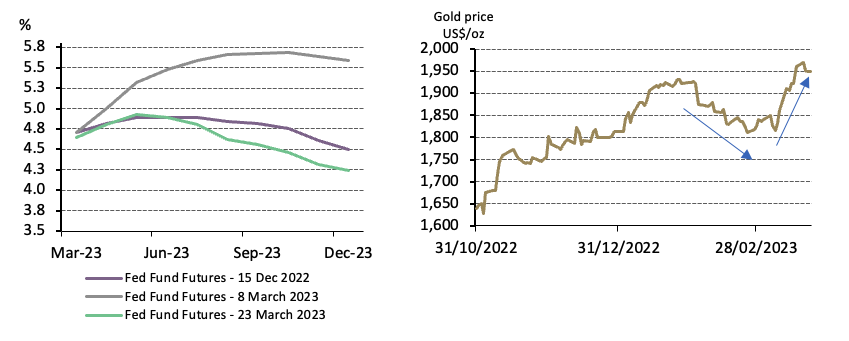

Gold price reacting to recent fluctuations in interest rates (Source: World Gold Council)

Jeremy de Pessemier, Asset Allocation Strategist at the World Gold Council (WGC), analyzes the implications of this blurry scenario for Gold price in an article published on the WGC website. De Pessemier says that while it is “unknown” for “how long the Fed will hold rates at elevated levels”, the US central bank “is under a lot of pressure to fight inflation” and “avoid a replay of 1970s.”

The World Gold Council strategist also acknowledges, though, that “getting inflation down to 2% is causing economic and financial damage”, which makes him write that “we may be close to the peak of central bank hawkishness”. If this is true, Gold price would be supported, “particularly if accompanied by a mild recession.” De Pessemier believes determining “the extent to which the crisis of the past week causes banks to tighten credit” is “a key issue” to understand what market we will live in.

His analysis concludes that short-term developments in “growth and inflation” will determine the immediate moves of Gold price. Regardless of that, de Pessemier also points to a long-term bullish scenario for the precious metal:

“Longer term, gold has a key role as a strategic long-term investment and as a mainstay allocation in a well-diversified portfolio. While investors have been able to recognise much of gold’s value during times of market stress, the structural dynamics pointing towards a low-growth, low-yield environment should also be supportive for the precious metal.”

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.