- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- AUD/USD stumbles on expectations for a Fed pivot after softer US inflation data

AUD/USD stumbles on expectations for a Fed pivot after softer US inflation data

- Buoyant US Dollar was the main reason for the AUD/USD’s fall.

- US inflation continues to cool down, while consumer sentiment deteriorated in March.

- TDS Analyst expects the RBA would keep rates on hold, on April’s meeting.

- AUD/USD Price Analysis: Subdued in the near term, awaiting for the RBA’s decision.

The Australian Dollar (AUD) retraces after hitting a weekly high of 0.6738, spurred on the American Dollar (USD) recovery as it got bolstered by weekly, monthly, and quarter-end flows. Wall Street is set to finish the week with gains, while US inflation data could cement the case for a pause in the Fed’s tightening cycle. The AUD/USD is trading at 0.6684, below its opening price by 0.43%.

AUD/USD dwindles below 0.6700 on a buoyant US Dollar

The Fed's preferred inflation gauge, the core PCE published by the US Department of Commerce, increased 4.6% YoY, lower than forecasts and beneath the previous month. Headline inflation was 5%, signaling that the Fed's tightening measures are still curbing inflation.

Susan Collins, President of the Federal Reserve Bank of Boston, expressed approval for the news but emphasized that the Fed still has work to accomplish.

The University of Michigan's (UoM) Consumer Sentiment on its final March reading was 62, worse than expected. At the same time, inflation expectations dropped. For the one-year horizon, American consumers forecast inflation at 3.6%, while for the 5-year horizon, inflation estimations dipped to 2.9%.

Of late, the New York Fed President John Williams said that an uncertain economic outlook and economic data would drive monetary policy. Williams expect inflation to drop to 3.5%, and the Gross Domestic Prodcut (GDP) to contract slightly before rebounding in 2024.

On inflation data, the AUD/USD reacted upwards to 0.6718 before reversing its course, fell sharply below the 0.6700 figure, and printed a daily low of 0.6670. Since then, the AUD/USD stabilized at around 0.6686.

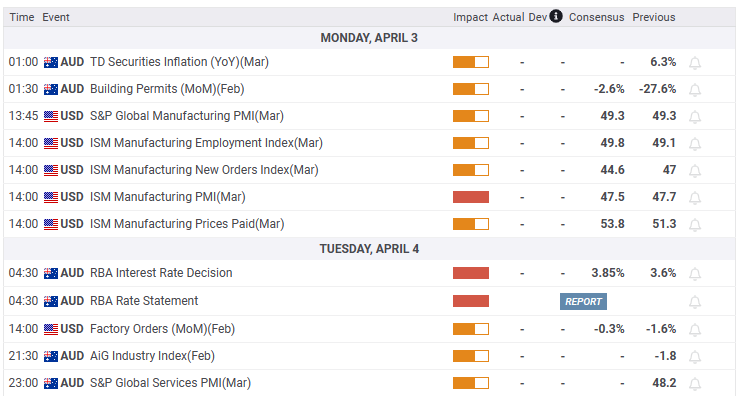

On the Australian front, inflation data would give cues regarding the Reserve Bank of Australia’s (RBA) forward path. The TD Securities Inflation for February was 6.3% YoY, and any readings below the latter can discourage the RBA from continuing to tighten monetary conditions.

TDS expects an RBA’s pause on its tightening campaign

TD Securities Analysts in a note, “The Apr meeting is a close one, with analysts mixed about the RBA decision and markets pricing in no hike from the RBA. We now expect the Bank to pause at the April meeting given the lower Jan-Feb CPI prints and uncertainty over the outlook from the banking turmoil in the near-term.”

AUD/USD Technical analysis

The AUD/USD is trading sideways, as shown by its daily chart, though tilted to the downside. For a bearish continuation, sellers need to reclaim the March 24 swing low at 0.6625, exposing the YTD lows at 0.6564. Once cleared, and the path towards November 10 at 0.6386 is on the cards. On the flip side, if buyers crack 0.6700, that could keep them hopeful that the AUD/USD could test 0.6800 in the near term.

What to watch?

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.