- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD bears eye $1,880, await US inflation clues and Fed’s Powell – Confluence Detector

Gold Price Forecast: XAU/USD bears eye $1,880, await US inflation clues and Fed’s Powell – Confluence Detector

- Gold Price remains depressed at the lowest levels in three months, prods key support with intact bearish bias.

- Hawkish central bank clues, US-China tension and mostly upbeat US data favor XAU/USD sellers.

- Fed Chair Powell’s speech, US GDP and Core PCE data eyed for clear directions.

- Gold price may consolidate around $1,900 on price-positive data but recovery appears elusive.

Gold Price (XAU/USD) remains pressured at the lowest levels since mid-March as bears take a breather after a three-day downtrend ahead of Federal Reserve (Fed) Chairman Jerome Powell’s speech in Madrid. In doing so, the XAU/USD also takes clues from the mixed headlines about the US-China ties as US Treasury Secretary Janet Yellen ‘hopes’ to visit China to re-establish contacts but also showed readiness to take actions to protect national security interests even at economic cost. Elsewhere, major central bankers’ defense of higher rates, including Fed Chair Powell, joins the previous firmer US data to bolster the hawkish Fed bets and exert additional downside pressure on the Gold Price. It’s worth noting that doubts about the economic health of one of the world’s biggest XAU/USD customers, namely China, also keeps the metal bears hopeful.

Amid these plays, the US stock futures struggle and the Asia-Pacific shares grind higher amid cautious mood ahead of Fed Chair Powell’s speech. Also important to watch is the revised version of the US Gross Domestic Product (GDP) for the first quarter (Q1) 2023 and second-tier employment data.

Also read: Gold Price Forecast: $1,885 remains in sight for XAU/USD sellers amid a Bear Cross

Gold Price: Key levels to watch

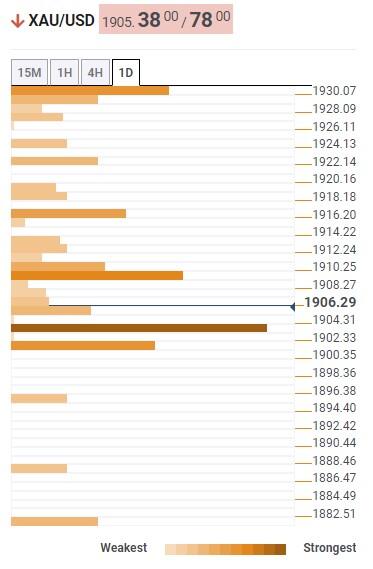

As per our Technical Confluence Indicator, Gold bears occupy the driver’s seat and has a final bumper around $1,900 to cross before witnessing a free ride towards the $1,880.

That said, a convergence of the previous monthly low and the Pivot Point one-month S1 together constitute $1,903 as the key support.

Following that, Pivot Point one-day and one-week S1 highlights $1,900 as another filter towards the south before directing the Gold Price to Pivot Point one-week S2, around $1,882.

On the contrary, Fibonacci 38.2% on one-day joins previous weekly low to highlight $1,910 as immediate upside hurdle for the XAU/USD bulls.

Also acting as a short-term resistance for the Gold Price is the Pivot Point one-day R1 and 5-DMA, around $1,918.

In a case where the XAU/USD remains firmer past $1,918, the odds of witnessing a run-up towards the $1,930 resistance confluence, encompassing 200-HMA and Pivot Point one-day R3, can’t be ruled out.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.