- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- GBP/USD advances amid US holiday, Fed and BoE’s rate hike speculations

GBP/USD advances amid US holiday, Fed and BoE’s rate hike speculations

- GBP/USD advances in choppy trading, leveraging previous economic data and US market closure for Independence Day.

- US and UK economic indicators suggest continuing challenges, with manufacturing activity in both nations signaling recession.

- Interest rate hikes from the Fed and BoE loom large, potentially favoring GBP in the short term but posing risks for long-term stability.

GBP/USD marched higher amid a choppy trading session, as Wall Street remained closed in observance of the Independence Day of the United States (US). The absence of economic data in the UK and the US left traders leaning on last Monday’s data and the latest week’s upbeat news about the US economy. At the time of writing, the GBP/USD trades at 1.2715 after hitting a daily low of 1.2681.

Pound Sterling strength faces challenges on economic data, interest rates expectations

A risk-on impulse underpinned the GBP/USD throughout Tuesday’s dull trading session. The greenback remained pressured, though printed gains of 0.09%, as shown by the US Dollar Index (DXY), which measures the American Dollar (USD) value against a basket of six currencies at 103.063.

The US/UK economic dockets kicked off the week on Monday with PMI releases. The US ISM Manufacturing PMI June report plunged sharply, showing that manufacturing activity remained in recessionary territory for the eighth straight month. On the same tone, UK’s S&P Global/CIPS Manufacturing PMI for the same period dropped from May 47.1 to 46.5, the lowest through in the year and one of the weakest level since the 2008-09 financial crisis.

Last week’s US economic data was mixed, as the Federal Reserve’s (Fed) preferred inflation gauge, the Core PCE, softened a tick, a sign welcomed by the US central bank. Nevertheless, Durable Good Orders are rising, Consumer Confidence is improving, and the Gross Domestic Product (GDP) for Q1 is crushing the latest report, suggesting the Fed still has work to do.

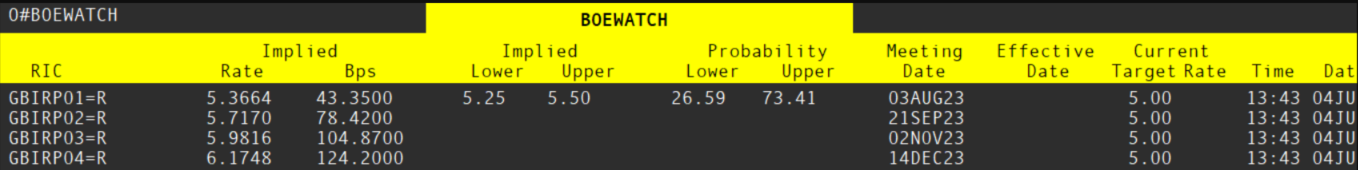

Market participants expect a 25 bps rate hike, as the CME FedWatch Tool shows, with odds at 87.4%. Regarding the Bank of England (BoE), money market futures odds for a 50 bps interest rate increase are at 73.41%, according to Refinitiv.

Source: Refinitiv

Given the backdrop, the GBP/USD would trade volatile, as the interest rate differential could favor the Pound Sterling (GBP). Based on that premise, the GBP/USD could hit 1.3000. Nonetheless, due to the market’s reaction to UK CPI data and the BoE 50 bps rate hike, higher rates could tip the UK economy into a recession, weakening the GBP in the medium to long term.

GBP/USD Price Analysis: Technical outlook

The GBP/USD uptrend remains intact after briefly piercing below the 20-day Exponential Moving Average during the last five trading days. As of writing, the GBP/USD exchange rate sits above the 20-day EMA at 1.2659, acting as dynamic support during the last three trading days, with the major bouncing toward the current spot price.

For the GBP/USD to extend its gains, the pair must reclaim the June 27 daily high of 1.2759, so the major could threaten 1.2800. Once broken, the year-to-date (YTD) high of 1.2848 would be up for grabs. If Pound Sterling (GBP) buyers gather strength, they can challenge 1.2900, followed by 1.3000. Conversely, the GBP/USD first support would be 1.2700. A breach of the latter will expose the confluence of a solid support area, with the 20-day EMA and the May 10 daily high, each at 1.2659/79, respectively, followed by June’s 29 swing low of 1.2591.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.