- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD Index remains offered around 100.30 ahead of US data

USD Index remains offered around 100.30 ahead of US data

- The index trades in levels last seen in April 2022.

- The sell-off in the dollar accelerates post-US CPI.

- Producer Prices, weekly Claims take centre stage later.

The USD Index (DXY), which tracks the greenback vs. a basket of its main rival currencies, remains well on the defensive and tests fresh lows in the 100.30 region.

USD Index now looks at US data

The index so far retreats for the sixth consecutive session on Thursday and trades closer to the psychological support at 100.00 on the back of the persistent sell-off in the dollar, diminishing US yields across the curve and the generalized upbeat tone in the risk-linked galaxy.

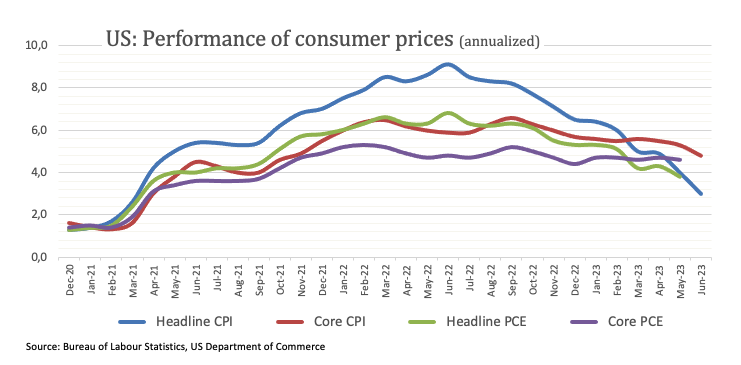

Indeed, USD has particularly accelerated its losses in response to the lower-than-expected US inflation figures during June (released on Wednesday), which in turn seem to have reignited market chatter around the likelihood that the Federal Reserve might end its tightening campaign in the near term.

In addition, the release of the Fed’s Beige Book appears to prop up the above, as it was noted that employment had increased modestly since late May and labour demand had remained healthy during the survey period. It was also reported that prices had increased at a modest pace overall, and several districts had observed some slowing in the pace of increase.

Still around US inflation, investors are expected to closely follow the publication of Producer Prices for the month of June along with the usual weekly Initial Claims.

What to look for around USD

The index continues to shed ground and gradually approaches the key support at 100.00 the figure on Thursday.

Meanwhile, the likelihood of another 25 bps hike at the Fed's upcoming meeting in July remains high and supported by the still tight US labour market and despite the persevering disinflationary pressures.

This view was further bolstered by comments from Fed Chief Powell at the June FOMC event, who referred to the July meeting as "live" and indicated that most of the Committee is prepared to resume the tightening campaign as early as next month.

Key events in the US this week: Producer Prices, Initial Jobless Claims (Thursday) – Advanced Michigan Consumer Sentiment (Friday).

Eminent issues on the back boiler: Persistent debate over a soft/hard landing of the US economy. Terminal Interest rate near the peak vs. speculation of rate cuts in late 2023/early 2024. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is down 0.16% at 100.39 and faces the next support at 100.34 (2023 low July 13) followed by 100.00 (round level) and finally 99.81 (weekly low April 21 2022). On the other hand, the breakout of 103.54 (weekly high June 30) would open the door to 104.44 (200-day SMA) and then 104.69 (monthly high May 31).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.