- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY soars past 141.00 as BoJ expected to stick to dovish stance, weakening the JPY

USD/JPY soars past 141.00 as BoJ expected to stick to dovish stance, weakening the JPY

- Japan’s Consumer Price Index (CPI) for June reports a YoY increase of 3.3%, slightly above the previous 3.2% figure, but falls short of the anticipated 3.5%.

- Reuters report on BoJ’s monetary stance causes USD/JPY to break away from the 140.00 range seen through most of the Asian session.

- The USD/JPY uptrend could continue based on interest rate differentials, but next week’s Fed and BoJ decisions are eyed.

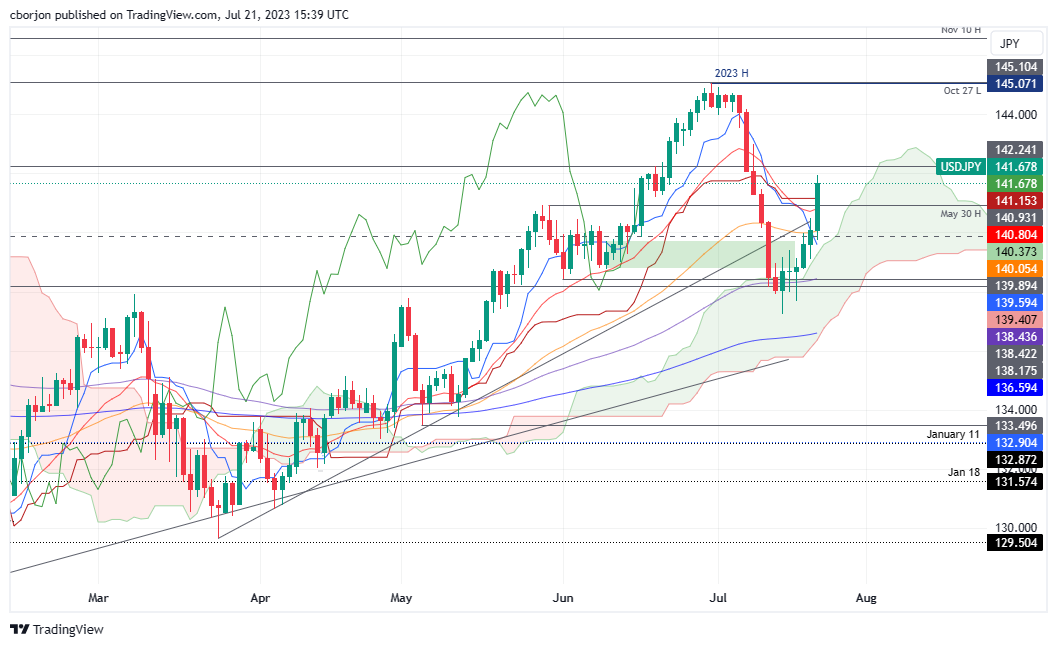

USD/JPY rallied back above the 141.00 figure after rumors the Bank of Japan (BoJ) would not change its Yield Curve Control (YCC) emerged, spurring an upward reaction in the USD/JPY due to Japanese Yen (JPY) softness. The USD/JPY is exchanging hands at 141.71 after diving as low as 139.74.

Reports of the BoJ's commitment to its dovish stance fuel USD/JPY rally, despite Japanese inflation data exceeding estimates

News emerging during the Asian session spurred JPY’s weakness on Reuters sources, saying the BoJ would stick to its YCC program and maintain its dovish stance. That comes after an earlier report that in Japan exceeded estimates by a tick, seen by traders as data that could trigger a reaction by the BoJ. The Consumer Price Index (CPI) for June came at 3.3% YoY, above the prior’s 3.2% reading but failed to overcome forecasts of 3.5%. Core CPI rose by 3.3% YoY, aligned with projections and above May’s number.

The USD/JPY seesawed around 140.00 throughout most of the Asian session before the Reuters report surfaced.

On the US front, data revealed during the week showed the economy is still resilient, despite Retail Sales slowing to 0.2%, below May’s 0.5%. Thursday’s US Initial Jobless Claims report for the week ending July 15 posted 228K unemployment fillings, below the 239K estimated, sparking fears the US Federal Reserve (Fed) might react to the numbers and increase rates past the following week’s monetary policy decision.

The CME FedWatch Tool, which tracks interest rate probabilities for the Fed, sees a 99.8% chance of a quarter of a percent hike on July 26, while for September, expects no change, and for November, odds moved from below 20% last week’s, to 28.0% as of writing.

To conclude, given the interest rate differentials, the USD/JPY uptrend might continue in the near term. But next week’s could be volatile, with the Fed and the BoJ set to deliver an update on their monetary policy. A hawkish surprise by the BoJ could rock the markets sharply, while the Fed is expected to maintain its “higher for longer” bias.

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, the USD/JPY pair is set to continue upward biased, reclaiming during the session the Tenkan and Kijun-Sen level, with traders setting their eyes on the 142.00 mark. A breach of that level would expose last November’s 22 daily high at 142.24, followed by the top of the Ichimoku Cloud (Kumo) at 142.83, ahead of 143.00. Conversely, if USD/JPY drops below the Kijun-Sen level of 141.15, further downward action is expected, with the 20-day Exponential Moving Average (EMA) lying at 140.80, on top of the Senkou Span A level at 140.37.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.