- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY continues to climb amid falling US bond yields, awaiting US CPI

USD/JPY continues to climb amid falling US bond yields, awaiting US CPI

- USD/JPY climbs to 143.53 despite weakening US Dollar across FX and declining US Treasury bond yields.

- Inflation anticipation: Wall Street is on standby for July’s CPI, expected to remain steady at 0.2% MoM.

- Mixed Fed signals stir the market, with officials hinting at tightening and others suggesting a steady rate path.

USD/JPY advances for three straight days, climbing 0.11%, despite falling US Treasury bond yields and overall US Dollar (USD) weakness across the FX board, ahead of inflation data release from the United States (US). At the time of writing, the USD/JPY exchanges hands at 143.53 after hitting a low of 142.98.

Uncertainty over the Federal Reserve’s stance and Japanese monetary policy dynamics to dictate USD/JPY direction

Wall Street trades with minuscule losses amidst a light US economic docket as traders brace for July’s inflation data. The Consumer Price Index (CPI) is expected to remain unchanged compared to June’s 0.2% MoM, while market analysts foresee a dip to 3% from 3.3% YoY. Core CPI is estimated to print 0.2% MoM as the prior month’s release, and YoY is projected to stay at 4.8% as June’s.

Aside from this, the shrinkage of the trade deficit slightly boosted the greenback, but mixed messages from US Federal Reserve (Fed) officials, keep investors uncertain about the Fed’s forward path. Even though Fed Governor Michelle Bowman stressed the need for additional tightening, more policymakers are taking a more cautious or neutral approach, as Philadelphia Fed President Patrick Harker. He commented the Fed is at a stage where it could leave rates unchanged, barring an abrupt change in the direction of recent economic data.

Monetary policy expectations on the Fed show money market traders expect no change to the Federal Funds Rate (FFR), with odds at 86.5%, as shown by the CME FedWatch Tool.

The US Dollar Index (DXY), a gauge of the buck’s value against a basket of six currencies, is losing some traction, down by 0.11%, at 102.430, undermined by falling UST bond yields. The US 10-year benchmark note rate is 4.00%, down two basis points.

The lack of economic data in Japan would keep traders leaning toward US Dollar dynamics, as well as recent data from the Bank of Japan (BoJ), as most members of the BoJ expressed an opinion about the Yield Curve Control (YCC). Even though there was some chatter about normalizing monetary policy, most BoJ’s members remain on the dovish side of the spectrum.

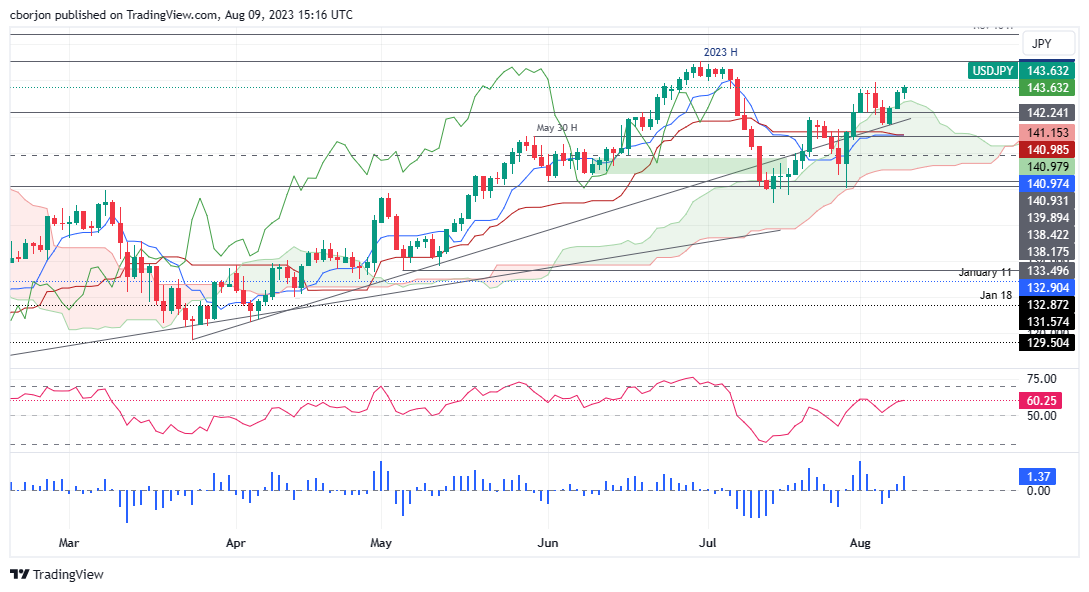

USD/JPY Price Analysis: Technical outlook

The USD/JPY found support around the top of the Ichimoku Cloud (Kumo), briefly pierced on Monday. However, a ‘tweezers bottom and harami’ pattern exacerbated a recovery toward current exchange rates. In addition, the Tenkan-Sen is about to cross above the Kijun-Sen line, seen as a bullish signal, while the Chikou Span is still below the price action. That said, the USD/JPY is bullishly biased, and it might test the year-to-date (YTD) high at 145.07, but firstly it would need to surpass key resistance levels, like the psychological 144.00 figure. Conversely, if the major drops inside the Kumo, it could test the current week’s low of 141.50.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.