- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD renews monthly low above $1,900, poking key support as US inflation looms

Gold Price Forecast: XAU/USD renews monthly low above $1,900, poking key support as US inflation looms

- Gold Price stays pressured at the lowest level in a month ahead of United States Consumer Price Index for July.

- XAU/USD traces firmer sentiment as China-linked fears recedes, concerns about Federal Reserve policy pivot gain acceptance.

- Economic fears surrounding China, Europe and the UK may prod XAU/USD bulls as US Dollar resists declining further.

- Upbeat US inflation can join tight labor market to recall Fed hawks and weigh on Gold Price.

Gold Price (XAU/USD) refreshes the lowest level in a month as it drops to $1,914 during the early hours of Thursday’s Asian session. In doing so, the precious metal fails to cheer positive news from China, as well as a retreat in the US Dollar ahead of the United States inflation data. The reason could be linked to the market’s fears about the global economic and banking sector's health.

Gold Price falls despite mixed concerns about China, dovish Fed bets

Gold Price remains on the back foot after declining in the last three consecutive days. In doing so, the XAU/USD justifies the market’s lack of confidence and the positioning for the United States inflation data.

It’s worth noting that Italy’s surprise tax on windfall profits of banks joined the global rating agencies’ downward revision to the US banks and financial institutions to weigh on the risk sentiment and the Gold Price the previous day. On the same line could be fears of the UK recession and slowing economic growth in China, not to forget the Dragon Nation’s geopolitical tension with the US and Japan about Taiwan.

With this, a better-than-forecast China inflation data, despite making the deflation, and the US Dollar Index (DXY) pullback from a one-month high can’t be cheered by the XAU/USD traders. An improvement in China’s Producer Price Index (PPI) for July superseded negative readings of the Consumer Price Index (CPI) for the said month. That said, CPI declines to -0.3% YoY versus -0.4% YoY expected and 0.0% prior whereas the PPI improves to -4.4% YoY compared to -4.1% YoY market forecasts and -5.4% previous readings.

The reason could be linked to the looming bankruptcy of the Dragon Nation’s biggest private real estate company, namely the Country Garden, as it has less than 30 days after initial default on paying the bond coupons in early August. Further, the recent China deflation and receding activity data join the nation’s geopolitical tussles with the US, and recently with Japan, to weigh on the economic outlook for one of the world’s biggest XAU/USD customers.

Apart from China’s economic issues, Biden Administration also signaled relief to China technology companies and tamed the previous risk-off mood initially on Wednesday. “The US plans to target only those Chinese companies that get more than 50% of revenue from the sectors including quantum computing and artificial intelligence (AI),” said Bloomberg News.

Furthermore, the increasing odds of witnessing the US Federal Reserve’s (Fed) policy pivot challenges the US Dollar bulls and should have favored the Gold Price, but could not. That said, the CME Group FedWatch Tool shows that markets are pricing in an 86.5% chance that the Fed will pause interest rate hikes at its meeting in September.

US inflation will be more important for XAU/USD after softer NFP

Given the market’s recent indecision about China and the XAU/USD’s sustained downside, the traders will closely observe the United States inflation data, per the Consumer Price Index (CPI) for July to gain clear directions. Market forecasts suggest an improvement in the headline CPI to 3.3% YoY versus 3.0% prior while the Core CPI, namely the CPI ex Food & Energy, may remain unchanged at 4.8%. Should the US inflation data print upbeat figures, the Gold Price may break the immediate key support and slide beneath the $1,900 support while downbeat outcomes could trigger the much-awaited corrective bounce.

Also read: US CPI Preview: Forecasts from 10 major banks, monthly pace should hold at 0.2%

Gold Price Technical Analysis

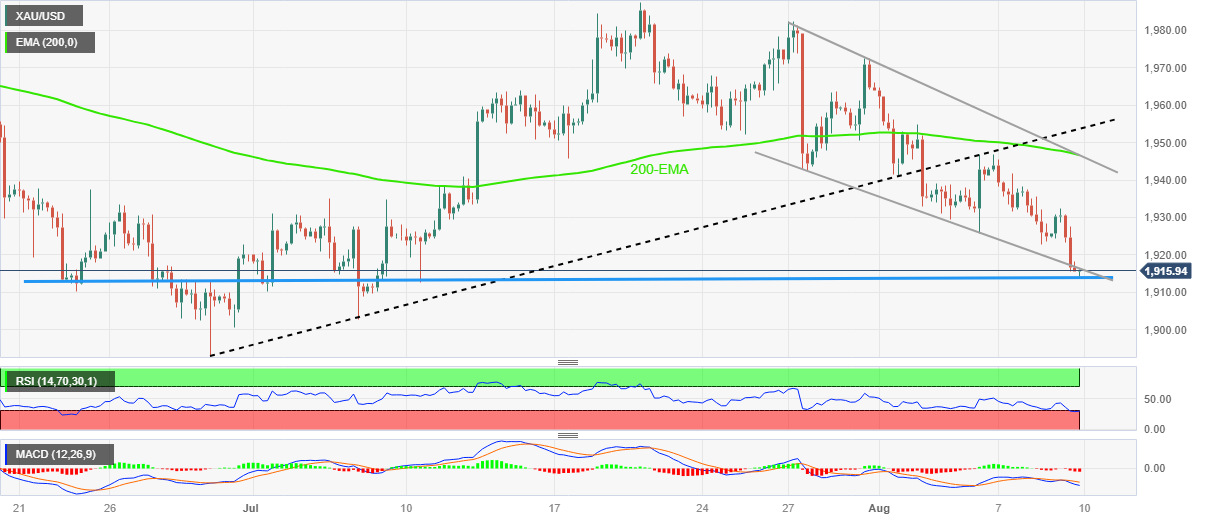

Gold Price remains on the back foot after recently breaking the bottom line of a two-week-old falling trend channel, poking a seven-week-old horizontal support zone of late.

It’s worth noting that the nearly oversold conditions of the Relative Strength Index (RSI) line, placed at 14, join the sluggish signals from the Moving Average Convergence and Divergence (MACD) indicator to challenge further downside of the XAU/USD price.

The same highlights the immediate support comprising multiple levels marked since June 22 around $1,915, which in turn could challenge the bears ahead of the pre-event consolidation.

However, a clear downside break of $1,915 won’t hesitate to direct the XAU/USD price toward June’s low of around $1,893, with the $1,900 threshold likely acting as a buffer.

Meanwhile, an upside break of the stated channel’s bottom line, close to $1,917 by the press time can propel the Gold Price towards a descending resistance line stretched from August 31, close to $1,930 by the press time.

Following that, a convergence of the 200-bar Exponential Moving Average (EMA) and the previously stated channel’s top line, close to $1,948, will be important to watch for the XAU/USD buyer’s entry.

In a case where the Gold Price crosses the $1,948 hurdle, a six-week-old previous support line surrounding $1,955 will act as the final defense of the bears.

Overall, the Gold Price hits rock bottom and may witness a dead cat bounce but the recovery hinges on the key US inflation data and the $1,955 breakout.

Gold Price: Four-hour chart

Trend: Limited downside expected

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.