- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD nurtures bearish bias below $1,940 – Confluence Detector

Gold Price Forecast: XAU/USD nurtures bearish bias below $1,940 – Confluence Detector

- Gold Price remains below the key resistance confluence despite the corrective bounce, eyes third weekly loss.

- Indecision about major central banks’ next moves, China woes keep XAU/USD rebond in check.

- Expectations of easing inflation pressure in US allowed Fed to tease policy pivot and favored Gold Price recovery.

- Additional signals of easing US price pressure, FOMC Minutes eyed for clear directions.

Gold Price (XAU/USD) licks its wounds at the lowest level in a month, snapping a four-day downtrend as markets reassess previous fears of higher interest rates and geopolitical concerns about China. Also allowing the XAU/USD to lick its wounds at the multi-day low is the US Dollar’s failure to defend late Thursday’s corrective bounce, as well as dicey US Treasury bond yields.

The Unimpressive US inflation data allowed the Fed policymakers to cheer the victory over price pressure while Reserve Bank of Australia (RBA) Governor Philip Lowe defends the latest pause in the monetary policy by citing fears of higher unemployment. Further, the latest Reuters polls about the Reserve Bank of New Zealand (RBNZ) and the European Central Bank (ECB) were also in favor of marking no interest rate changes in the next monetary policy meetings.

Elsewhere, the Chinese policymakers’ sustained defense of the Yuan also favors the market’s confidence that the Asian leader will overcome the economic fears, which in turn underpinned the latest cautious optimism and Gold Price.

It’s worth noting, that the light calendar and cautious mood ahead of the US PPI, the Michigan Consumer Sentiment Index also tests the Gold buyers ahead of the next week’s Federal Open Market Committee (FOMC) monetary policy meeting minutes.

Also read: Gold Price Forecast: XAU/USD could correct before targeting key 200 DMA support

Gold Price: Key levels to watch

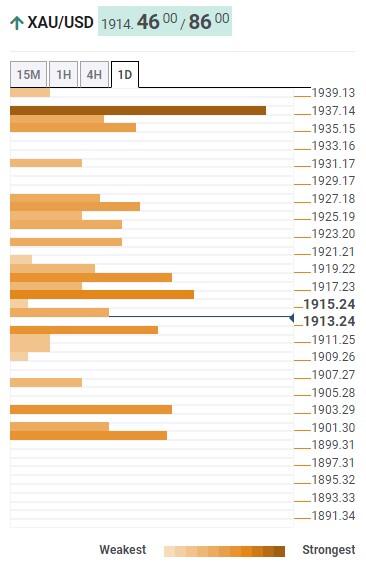

As per our Technical Confluence indicator, the Gold Price remains well below the $1,939 resistance confluence comprising Pivot Point one-day R2, Fibonacci 23.6% on one-week and 10-DMA. The same joins the market’s cautious mood to challenge the XAU/USD rebound ahead of the mid-tier US data and events.

That said, Pivot Point one-month S1 and Fibonacci 23.6% on one-day restrict immediate upside of the Gold Price near $1,918. Following that, the Fibonacci 38.2% level will also limit the XAU/USD recovery near $1,920.

It’s worth noting that the convergence of the previously weekly low and the 5-DMA, close to $1,928, also restricts the Gold Price upside.

On the flip side, the lower band of the Bollinger on one-day, around $1,910, restricts the immediate downside of the XAU/USD.

In a case where the Gold sellers break the $1,910 support, the previous monthly low around $1,905 will test the XAU/USD bears before directing them to the $1,900 support confluence including the 200-SMA, Pivot Point one-day and one-week S2.

It should be observed that the XAU/USD may witness a clear fall towards June’s low of near $1,893 on breaking $1,900 key support.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.