- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY holds steady amid US housing data, Japanese intervention woes

USD/JPY holds steady amid US housing data, Japanese intervention woes

- US housing starts rebound in July, though rising mortgage rates may hinder sector recovery.

- Japan’s Q2 GDP growth doubles expectations, but concerns over China’s economic slowdown loom.

- USD/JPY’s upward momentum may be limited by potential Japanese intervention and BoJ’s anticipated policy normalization.

USD/JPY aims higher but remains trading within a narrow range as threats of a possible intervention by Japanese authorities loom. Housing data from the United States (US) shows the construction sector stabilizing after the US Federal Reserve (Fed) lifted rates aggressively, dampening house demand. The USD/JPY is exchanging hands at 145.85 after hitting a daily low of 145.30.

Positive housing data from the US meets robust Japanese GDP growth, keeping the pair in a tight range

The US Census Bureau revealed that housing starts jumped at a 3.9% rate of 1.452 million in July, crashing June’s -11.7% plunge, which was downward revised from -8%. Although data is encouraging, higher mortgage rates for 30-year hitting 6.96% over the last week, can curtail the sector’s recovery. At the same time, Building Permits rose 0.1% in July, above June’s -3.7% slide.

Even though the data was positive, the Greenback failed to gain traction as expected, as shown by the US Dollar Index (DXY) losing 0.02% at 103.187. Consequently, the USD/JPY uptrend was capped at spot price, as the US 10-year Treasury bond yield is unchanged at 4.211%.

On the Japanese front, the latest Gross Domestic Product (GDP) report for Q2 2023 smashed estimates of 3.1%, with the economy growing at an outstanding 6%, doubling forecasts, as reported on August 14. Furthermore, as reported by the Reuters Tankan Index, business activity shows an improvement from July’s 3 reading to 12 in August. Although the report was positive, many firms remain cautious about the economic outlook, as slowing growth in China could dent demand for Japanese products. Traders should be aware that China is Japan’s largest partner.

Given the backdrop, the USD/JPY trades sideways, as the US and Japan have posted solid data. Though, expectations for monetary policy normalization of the Bank of Japan (BoJ) could favor the Japanese Yen (JPY) in the medium term. In the meantime, further USD/JPY upside is expected, but intervention jitters could cap the pair’s uptrend.

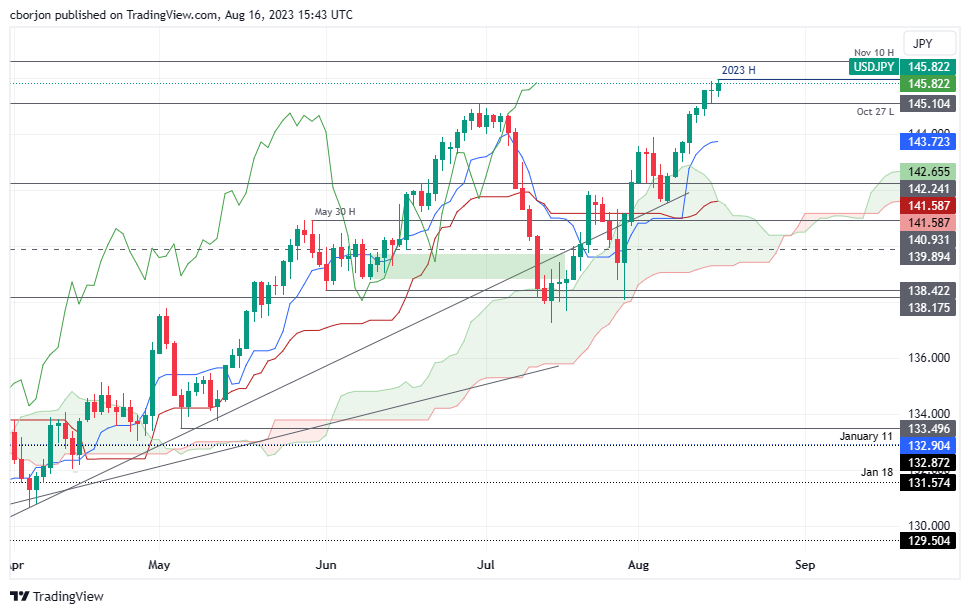

USD/JPY Price Analysis: Technical outlook

The USD/JPY daily chart portrays the pair peaking around current exchange rates after hitting a year-to-date (YTD) high of 145.94, shy of the 146.00 figure. A breach of the latter will expose higher resistance levels above the 146.00 mark, like the November 10 daily high at 146.59, followed by the November 8 high of 146.94, before reaching 147.00. Conversely, the USD/JPY first support would be today’s low of 145.30, followed by the August 15 low of 145.10, before sliding to the 145.00 figure.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.