- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- Gold Price Forecast: XAU/USD rebound to lose momentum below $1,920 – Confluence Detector

Gold Price Forecast: XAU/USD rebound to lose momentum below $1,920 – Confluence Detector

- Gold Price stays defensive at five-month low, keeps week-start rebound.

- Risk aversion, firmer Treasury bond yields challenge XAU/USD recovery ahead of mid-tier catalysts.

- Central bankers’ defense of hawkish policy at Jackson Hole eyed to keep Gold bears on the table.

Gold Price (XAU/USD) portrays bearish consolidation at the lowest level in five months while defending the week-start rebound amid mixed sentiment.

US Dollar’s downbeat performance allows the XAU/USD to pare previous losses at the multi-day bottom. However, the firmer Treasury bond yields and fears surrounding China, one of the world’s biggest Gold customers, prod the recovery moves amid a light calendar.

That said, the mostly upbeat US data and looming fears about the US banking industry, especially after the recent credit rating downgrade from Moody’s and the S&P Global, underpin the market’s cautious mood and the bond coupons, which in turn weigh on the Oil price. Furthermore, China’s efforts to defend the post-COVID economic recovery, via a slew of stimulus measures, fail to impress market optimists and exert downside pressure on the risk profile.

Against this backdrop, US Dollar Index (DXY) renews its intraday low near 103.20, down for the second consecutive day, as market players brace for Friday’s speech for Fed Chair Jerome Powell at the Kansas Fed’s annual event called at the Jackson Hole Symposium. Furthermore, the US 10-year Treasury bond yields refreshed the highest level since November 2007 earlier in the day to 4.36% before easing to 4.34% at the latest. On the same line, the S&P500 Futures print mild losses to reverse the previous recovery from a nine-week low.

Also read: Gold Price Forecast: XAU/USD recovery seeks daily closing above $1,891, Fedspeak eyed

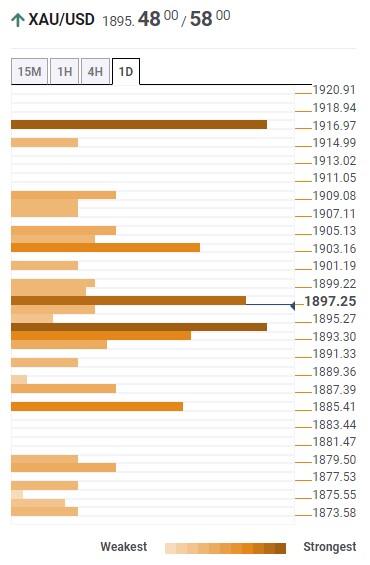

Gold Price: Key levels to watch

Our Technical Confluence indicator suggests the sluggish recovery of the Gold Price even as it recently poked the mid-tier resistance confluence surrounding $1,895 comprising Fibonacci 38.2% on one day, 100-HMA and the middle band of the Bollinger on the hourly chart.

However, a convergence of the Fibonacci 38.2% on one-week and the upper band of the Bollinger on the four-hour (4H) play prods the immediate upside of the Gold Price near the $1,900 round figure.

Following that, the previous monthly, 10-DMA and 200-HMA will together challenge the Gold buyers near $1,905.

Above all, the joins of the Pivot Point one-month S1 and the previous weekly high of around $1,920 acts as the final defense of the XAU/USD bears.

On the contrary, a downside break of the aforementioned $1,895 resistance-turned-support could quickly fetch the Gold price toward the lows marked in the previous day and during the last week around $1,885.

In a case where the XAU/USD remains bearish past $1,885, the Pivot Point one-week S1 and one-day S2, near $1,878 will hold the gate for the bear’s ride towards the early March swing high of around $1,858.

Here is how it looks on the tool

About Technical Confluences Detector

The TCD (Technical Confluences Detector) is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. If you are a short-term trader, you will find entry points for counter-trend strategies and hunt a few points at a time. If you are a medium-to-long-term trader, this tool will allow you to know in advance the price levels where a medium-to-long-term trend may stop and rest, where to unwind positions, or where to increase your position size.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.