- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- GBP/USD slides as UK business activity weakens, the safety of the USD favored

GBP/USD slides as UK business activity weakens, the safety of the USD favored

- GBP/USD pair falls 0.42% to trade at 1.2567 as the UK's S&P Global/CIPS Composite PMI drops to 48.6, entering contraction territory for the first time since January.

- Despite weaker-than-expected PMIs, the UK’s central bank is expected to raise rates 25-bps.

- US Factory Orders beat estimates but remained in recessionary territory and might influence Fed officials’ decision at the upcoming meeting.

The Pound Sterling (GBP) erased Monday’s gains against the Greenback (USD) after business activity entered recessionary territory in the UK. That alongside global services PMIs coming weaker than expected, favored flows toward safe-haven assets. Hence, the GBP/USD is trading at 1.2567 down 0.42%, after hitting a daily high of 1.2631.

Pound Sterling drops amid gloomy UK PMI data, global economic slowdown

During the European session, the UK S&P Global/CIPS Composite PMI slumped to 48.6 in August from 50.8 in July, its lowest reading since January, dragged downward by a falling Services PMI, which printed 49.5, below the 50 threshold that separates expansion/contraction territory. In the meantime, data from China and the Eurozone (EU) highlighted most global economies are decelerating.

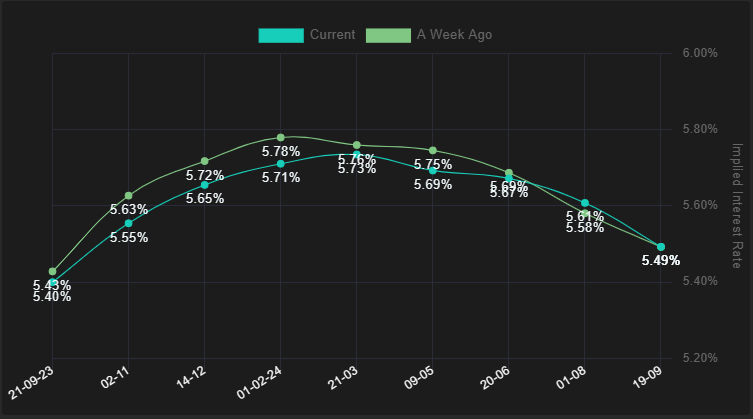

Even though the data suggests economic conditions would not warrant an additional rate hike by the Bank of England (BoE), money market futures expect a 25-bps rate hike, as shown by interest rate probabilities. Chances lie at 87% the BoE would raise the Bank Rate for the fifteen times, since Andrew Bailey and Co began its tightening cycle in December 2021. As shown by the bottom picture, market participants estimate the BoE will hike again in early 2024.

Bank of England: Interest rate probabilities

Source: Financialsource

Across the pond, August Factory Orders in the United States (US) came in at -2.1%, better than the estimated -2.5%, according to the US Department of Commerce. This follows four straight months of increases. The impact of 525 bps of tightening by the Federal Reserve continues to cool the US economy. Traders expect that the Fed will not raise rates at the upcoming meeting but still see a possible increase in November.

In central bank news, Fed Governor Christopher Waller noted that the Fed has space to decide the next interest rate decision. Later, the Cleveland Fed President Loretta Mester said the Fed would not continue to tighten monetary policy until inflation hits 2%, nor wait until it gets there, to lower rates.

US Treasury bond yields are moderately rising, with the 10-year Treasury note yielding 4.263%, gaining six basis points and underpinning the Greenback (USD). The US Dollar Index (DXY), a measure of the buck’s value against a basket of peers, advances 0.60%, up at 104.777, the highest level since March 13 of last year.

In upcoming events, the US ISM Non-Manufacturing PMI release for August is anticipated to show a minor slowdown from 52.7 to 52.5. Similarly, the S&P Global Services PMI is likely to exhibit a comparable trend, with estimates at 51, compared to July’s 52.3. If both readings align with expectations, this could exert pressure on the US Dollar. Such outcomes might reinforce the Federal Reserve’s pause in September and diminish the likelihood of an additional interest rate increase in November.

GBP/USD Technical Levels

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.