- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

ADP Employment Change Preview: US private sector expected to add 179K new jobs in April

- The ADP report is expected to show the US private sector added 179K jobs in April.

- A tight labour market and sticky inflation support the Fed’s tight stance.

- The US Dollar seems to have entered a consolidative phase.

On Wednesday, the United States (US) Automatic Data Processing (ADP) Research Institute is set to unveil private employment data for April. This survey offers insights into job creation within the private sector and typically precedes the official jobs report by the Bureau of Labor Statistics (BLS), which includes Nonfarm Payrolls (NFP) data and is due on May 3.

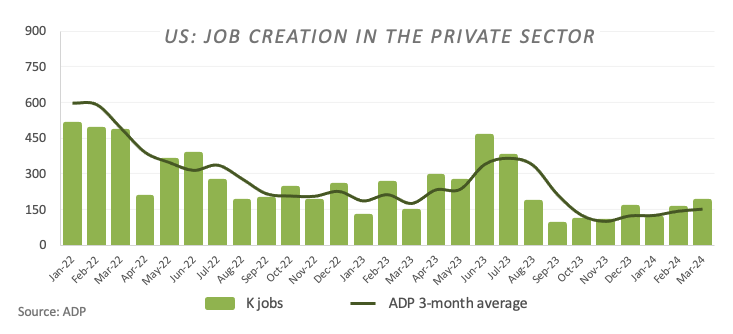

Market analysts anticipate the ADP survey to reveal the addition of 179K new positions during the last month, slightly below the 184K jobs reported in March. However, it's important to note that previous figures are subject to revisions, and while a robust ADP survey may hint at a similar trend in the NFP report, the correlation between the two reports has been inconsistent.

Nevertheless, the significance of the ADP survey is heightened by the US releasing various employment-related data in the days leading up to the Nonfarm Payrolls release. Collectively, these insights assist market participants in deciphering potential monetary policy moves by the Federal Reserve (Fed).

Many of the Federal Reserve’s (Fed) policymakers have been vocal in the past few weeks regarding the resilience of the US labour market, highlighting at the same time the good health of the whole US economy.

That said, US Treasury Secretary Janet Yellen asserted that they currently have a robust job market and see no indication that labour market conditions are contributing to inflation. Austan Goolsbee, President of the Chicago Fed, emphasized the need to assess whether strong GDP and job numbers signal overheating that might be fueling inflation, noting that not all data suggests overheating in the labour market. Fed Chair Jerome Powell remarked that the labour market is progressing towards a healthier equilibrium despite ongoing strength, and broader wage pressures are gradually easing. In addition, San Francisco Fed Mary Daly remarked that the labour market remains strong, although inflation is not declining as rapidly as it did last year.

When will the ADP Survey be released, and how could it affect the USD Index?

The upcoming release of the ADP job creation survey, scheduled for Wednesday, May 1, is anticipated to reveal an addition of 179K new positions in the private sector for April. Should the actual figure significantly exceed this estimate, it may indicate a persistently robust labour market. Coupled with rising wages, such results are likely to stimulate demand for the USD. Conversely, if job creation falls short of expectations and wages show signs of moderation, it could hurt the sentiment around the Greenback and probably exert some downside pressure on the US Dollar Index (DXY).

Speaking about techs around the USD Index (DXY), Pablo Piovano, Senior Analyst at FXStreet, argues: “If downward pressure intensifies, the USD Index (DXY) is anticipated to encounter initial support around the critical 200-day Simple Moving Average (SMA) at 104.13, followed by the April low at 103.88 (April 9). Further weakness could breach this level, leading to a test of the temporary 100-day SMA at 103.77, preceding the March low of 102.35 (March 8).”

On the other hand, Pablo notes that the resumption of bullish momentum may seek to retest the 2024 peak of 106.51 (April 16). Surpassing this level could encourage market participants to contemplate a move towards the November high at 107.11 (November 1), just prior to the 2023 top at 107.34 (October 3).

Considering the broader perspective, the prevailing constructive tone is expected to remain as long as DXY maintains its business above the 200-day SMA.

Economic Indicator

ADP Employment Change

The ADP Employment Change is a gauge of employment in the private sector released by the largest payroll processor in the US, Automatic Data Processing Inc. It measures the change in the number of people privately employed in the US. Generally speaking, a rise in the indicator has positive implications for consumer spending and is stimulative of economic growth. So a high reading is traditionally seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed May 01, 2024 12:15

Frequency: Monthly

Consensus: 175K

Previous: 184K

Source: ADP Research Institute

Traders often consider employment figures from ADP, America’s largest payrolls provider, report as the harbinger of the Bureau of Labor Statistics release on Nonfarm Payrolls (usually published two days later), because of the correlation between the two. The overlaying of both series is quite high, but on individual months, the discrepancy can be substantial. Another reason FX traders follow this report is the same as with the NFP – a persistent vigorous growth in employment figures increases inflationary pressures, and with it, the likelihood that the Fed will raise interest rates. Actual figures beating consensus tend to be USD bullish.

Employment FAQs

Labor market conditions are a key element to assess the health of an economy and thus a key driver for currency valuation. High employment, or low unemployment, has positive implications for consumer spending and thus economic growth, boosting the value of the local currency. Moreover, a very tight labor market – a situation in which there is a shortage of workers to fill open positions – can also have implications on inflation levels and thus monetary policy as low labor supply and high demand leads to higher wages.

The pace at which salaries are growing in an economy is key for policymakers. High wage growth means that households have more money to spend, usually leading to price increases in consumer goods. In contrast to more volatile sources of inflation such as energy prices, wage growth is seen as a key component of underlying and persisting inflation as salary increases are unlikely to be undone. Central banks around the world pay close attention to wage growth data when deciding on monetary policy.

The weight that each central bank assigns to labor market conditions depends on its objectives. Some central banks explicitly have mandates related to the labor market beyond controlling inflation levels. The US Federal Reserve (Fed), for example, has the dual mandate of promoting maximum employment and stable prices. Meanwhile, the European Central Bank’s (ECB) sole mandate is to keep inflation under control. Still, and despite whatever mandates they have, labor market conditions are an important factor for policymakers given its significance as a gauge of the health of the economy and their direct relationship to inflation.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.