- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

- USD/JPY pulls back as trade tensions stir market uncertainty

USD/JPY pulls back as trade tensions stir market uncertainty

- USD/JPY declines from highs of 155.86, settling at 154.51 amid tariff-induced volatility.

- ISM Manufacturing PMI rises, signaling robust business activity despite global trade fears.

- Bank of Japan maintains optimistic outlook, ready to navigate Trump’s protectionist policies.

The USD/JPY retreated from daily highs of 155.86 hit after US President Donald Trump advanced on its protectionist policies, enacting tariffs in Canada, Mexico, and China. Initially, the Greenback rose, but as fears faded, the pair dipped below its opening price by 0.44% and traded at 154.51.

Yen strengthens after initial drop as Trump's new tariffs unsettle markets

Market participants seem worried, as portrayed by global equities trading in the red. US President Trump applied 25% tariffs on Canada and Mexico and 10% to China. US-North American partners vowed retaliatory measures, while the latter, would challenge this policy at the World Trade Organization (WTO).

At the time of writing, the ISM Manufacturing PMI for January increased by 50.9, exceeding forecasts of 49.8. It was up from December 49.2, an indication of improvement in business activity. Digging deeper into the data, the sub-component of prices paid advanced from 52.5 to 54.9, while the employment index improved from 45.4 in December to 50.3.

In the meantime, during the Asian session, the Bank of Japan revealed its January meeting Summary of Opinions. Some of the members added that inflation expectations are heightening as prices rise above the 2% inflation target, and others said that hiking rates would be sufficiently neutral. Policymakers stated that Japan’s economy is resilient and can navigate through protectionist policies implemented by Trump.

This week, the US economic docket will feature Fed speakers, JOLTS Job Orders data, and Factory Orders on February 4. In Japan, the schedule is light with the Jibun Bank Services PMI final release for January.

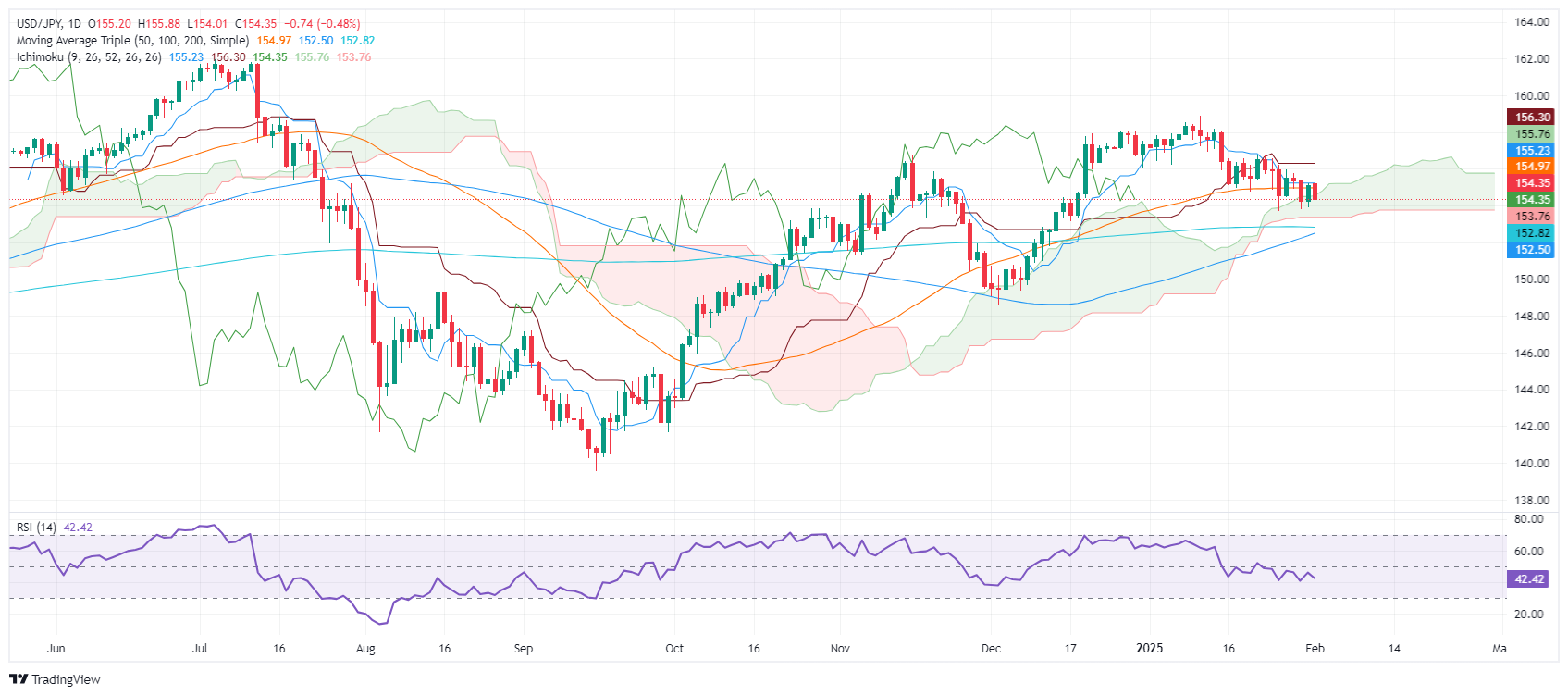

USD/JPY Price Analysis: Technical outlook

The USD/JPY is forming a ‘bearish candle’ with a long upper shadow, an indication that the pair is not finding acceptance within the 154.78-155.88 range. This is bearish, as seen by price action, with the pair extending its downtrend inside the Ichimoku Cloud (Kumo). Sellers are eyeing the next support at Senkou Span B at 153.76.

On further weakness, the next support would be the 200-day Simple Moving Average (SMA) at 152.83

On the other hand, if buyers achieve a daily close above 155.00, look for further upside. Key resistance is found at the Senkow Span A at 155.76.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.69% | 0.16% | -0.48% | -0.48% | 0.70% | 0.30% | -0.34% | |

| EUR | -0.69% | -0.21% | 0.08% | -0.09% | 0.39% | 0.70% | 0.06% | |

| GBP | -0.16% | 0.21% | -0.86% | 0.12% | 0.61% | 0.91% | 0.28% | |

| JPY | 0.48% | -0.08% | 0.86% | -0.12% | 1.32% | 1.54% | 0.67% | |

| CAD | 0.48% | 0.09% | -0.12% | 0.12% | 0.19% | 0.78% | 0.15% | |

| AUD | -0.70% | -0.39% | -0.61% | -1.32% | -0.19% | 0.30% | -0.43% | |

| NZD | -0.30% | -0.70% | -0.91% | -1.54% | -0.78% | -0.30% | -0.63% | |

| CHF | 0.34% | -0.06% | -0.28% | -0.67% | -0.15% | 0.43% | 0.63% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.