- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 01:30 | Australia | RBA Financial Stability Review | |||

| 05:00 | Japan | Consumer Confidence | March | 38.4 | |

| 06:00 | Germany | Current Account | February | 16.6 | |

| 06:00 | Japan | Prelim Machine Tool Orders, y/y | March | -30.1% | |

| 06:00 | Germany | Trade Balance (non s.a.), bln | February | 13.9 | |

| 06:00 | United Kingdom | Manufacturing Production (MoM) | February | 0.2% | 0.1% |

| 06:00 | United Kingdom | Industrial Production (YoY) | February | -2.9% | -2.9% |

| 06:00 | United Kingdom | Manufacturing Production (YoY) | February | -3.6% | -4% |

| 06:00 | United Kingdom | Industrial Production (MoM) | February | -0.1% | 0.1% |

| 06:00 | United Kingdom | GDP m/m | February | 0% | 0.1% |

| 06:00 | United Kingdom | GDP, y/y | February | 0.6% | |

| 06:00 | United Kingdom | Total Trade Balance | February | 4.2 | |

| 08:00 | Eurozone | Eurogroup Meetings | |||

| 09:00 | OPEC | OPEC Meetings | |||

| 12:30 | U.S. | Continuing Jobless Claims | March | 3029 | 8000 |

| 12:30 | U.S. | Initial Jobless Claims | April | 6648 | 5250 |

| 12:30 | U.S. | PPI excluding food and energy, m/m | March | -0.3% | 0% |

| 12:30 | U.S. | PPI excluding food and energy, Y/Y | March | 1.4% | 1.2% |

| 12:30 | U.S. | PPI, y/y | March | 1.3% | 0.5% |

| 12:30 | U.S. | PPI, m/m | March | -0.6% | -0.4% |

| 12:30 | Canada | Employment | March | 30.3 | -350 |

| 12:30 | Canada | Unemployment rate | March | 5.6% | 7.2% |

| 13:00 | United Kingdom | NIESR GDP Estimate | March | 0.2% | |

| 14:00 | U.S. | Wholesale Inventories | February | -0.5% | -0.5% |

| 14:00 | U.S. | Reuters/Michigan Consumer Sentiment Index | April | 89.1 | 75 |

FXStreet reports that strategists at TD Securities apprise that the energy market continues to be whipsawed by potential production cut expectations.

“The OPEC+ meeting is still set to go ahead tomorrow, with the cartel's analysis indicating demand is set to contract 11.9m bpd in Q2. As such, some delegates have stated a 10m bpd cut is on the table, but they also state no cuts is also a possibility, keeping the range of outcomes very wide.”

“G20 energy ministers are set to meet on Friday to discuss market stability, and the Texas RRC will meet on April 14th. While all of this does offer some optimism that a cut can be done, it remains unlikely that OPEC+ will cut double digits on their own and without commitments from other key producers such as the US.”

“With front-month contangos over $5/bbl for WTI, and not much better for Brent, the prospect of rolling long positions becomes extremely expensive and is likely to provide another bearish lean as investment demand and bottom picking flows could very well decrease.”

FXStreet reports that Robert Kavcic, a Director and Senior Economist at the bank of Montreal, recaps the data released by Canada regarding Housing Starts. USD/CAD is sitting at 1.4029.

“Canadian housing starts fell to 195,200 annualized units in March, from 210,600 in the prior month, a still-solid level of activity.”

“Canadian building permits fell 7.3% in February. The level of residential permits was 250k annualized, which was a still-heated level heading into the downturn.”

“Residential construction activity isn’t getting completely shut down like some other sectors of the economy. But rules in some provinces have stopped new activity, while others working with preventative measures in place will still see output down meaningfully through the second quarter.”

The U.S. Energy Information Administration (EIA) revealed on Wednesday that crude inventories jumped by 15.177 million barrels in the week ended April 3. Economists had forecast a surge of 9.271million barrels.

At the same time, gasoline stocks climbed by 10.497 million barrels, while analysts had expected a gain of 4.333 million barrels. Distillate stocks rose by 0.476 million barrels, while analysts had forecast an increase of 1.0446 million barrels.

Meanwhile, oil production in the U.S. reduced by 600,000 barrels a day to 12.400 million barrels a day.

U.S. crude oil imports averaged 5.9 million barrels per day last week, down by 173,000 thousand barrels per day from the previous week.

- But adds that city should "double down" on efforts to suppress the pandemic

- We're now seeing some leveling off. Something has started to move

- We have to be careful not to take this initial information and make more of it than we should

- What we've seen in these last few days is that social distancing, shelter-in-place, these are ideas that make a huge difference

- Says global trade was down 0.1% in 2019

- Expects rebound in 2021 of 21-24%

- Sees exports from Asia and North America to be hit hardest in 2020 and sees declines especially steep on sectors with complex value chains

- Expects coronavirus-related deaths could be fewer than previously forecast

- Says they are preparing plans to ease back into normal activity if coronavirus mitigation efforts are successful

- There is tremendous demand for U.S. Treasuries

- There is no plan for 50-year bond

- We will be selling 20-year and 30-year Treasury bonds

- We will borrow across the curve for coronavirus

- We hope to tell small businesses we won't run out of money

- Actively working on Main Street lending facility with Fed, hope to have announcement this week

- Economy opening will be based on medical conditions

FXStreet reports that Lee Sue Ann, Economist at UOB Group, reviewed the latest decision by the RBA at its monthly monetary policy meeting.

“As expected, the Reserve Bank of Australia (RBA) left the official cash rate (OCR) on hold… at a record-low of 0.25%.”

“To recap, the RBA had decided to take interest rates to a record-low, buy government bonds (QE) in a bid to reduce national funding costs and extend a AUD90bn credit line to banks to lend to small businesses.”

“Since QE begun on 20 March, the RBA has bought around AUD36bn buying state government bonds on the secondary market in a move that has pushed down interest rates on that debt.”

“The RBA reiterated its commitment to ‘doing what it can to support jobs, incomes and businesses as Australia deals with the coronavirus’. For now, we hold the view of the OCR staying put at 0.25%, and QE will remain for at least some time. This will continue to provide support for the government’s fiscal policy, which involves about AUD$80bn of measures including cash payments to small businesses and loan guarantees.”

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 145.5 | 0.90(0.62%) | 12333 |

| ALCOA INC. | AA | 7.15 | 0.12(1.71%) | 14104 |

| ALTRIA GROUP INC. | MO | 38.85 | 0.37(0.96%) | 9754 |

| Amazon.com Inc., NASDAQ | AMZN | 2,021.00 | 9.40(0.47%) | 31675 |

| American Express Co | AXP | 89.3 | 1.72(1.96%) | 12323 |

| AMERICAN INTERNATIONAL GROUP | AIG | 23.8 | 0.54(2.32%) | 2690 |

| Apple Inc. | AAPL | 261.73 | 2.30(0.89%) | 340813 |

| AT&T Inc | T | 29.75 | 0.19(0.64%) | 169304 |

| Boeing Co | BA | 146.23 | 4.65(3.28%) | 572343 |

| Caterpillar Inc | CAT | 123 | 1.08(0.89%) | 6637 |

| Chevron Corp | CVX | 82.01 | 1.09(1.35%) | 21335 |

| Cisco Systems Inc | CSCO | 41 | 0.36(0.89%) | 39098 |

| Citigroup Inc., NYSE | C | 42.1 | 0.85(2.06%) | 67981 |

| E. I. du Pont de Nemours and Co | DD | 38 | 0.74(1.99%) | 390 |

| Exxon Mobil Corp | XOM | 41.72 | 0.48(1.16%) | 176904 |

| Facebook, Inc. | FB | 170.77 | 1.94(1.15%) | 71543 |

| FedEx Corporation, NYSE | FDX | 121.5 | 5.55(4.79%) | 16454 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 7.72 | 0.13(1.71%) | 119309 |

| Ford Motor Co. | F | 4.85 | 0.14(2.97%) | 412535 |

| General Electric Co | GE | 7.19 | 0.16(2.28%) | 598530 |

| General Motors Company, NYSE | GM | 21.6 | 0.30(1.41%) | 31351 |

| Goldman Sachs | GS | 168.5 | 2.48(1.49%) | 17825 |

| Google Inc. | GOOG | 1,198.37 | 11.86(1.00%) | 7630 |

| Hewlett-Packard Co. | HPQ | 15.35 | 0.23(1.52%) | 3484 |

| Home Depot Inc | HD | 194.55 | 2.26(1.18%) | 12579 |

| HONEYWELL INTERNATIONAL INC. | HON | 140.92 | 5.68(4.20%) | 300 |

| Intel Corp | INTC | 58.77 | 0.37(0.63%) | 44361 |

| International Business Machines Co... | IBM | 116 | 1.06(0.92%) | 12022 |

| Johnson & Johnson | JNJ | 138.66 | 1.18(0.86%) | 10044 |

| JPMorgan Chase and Co | JPM | 92.1 | 1.46(1.61%) | 135363 |

| McDonald's Corp | MCD | 176.11 | 0.52(0.30%) | 15975 |

| Merck & Co Inc | MRK | 78.9 | 0.34(0.43%) | 5881 |

| Microsoft Corp | MSFT | 165.4 | 1.91(1.17%) | 295470 |

| Nike | NKE | 84.66 | 0.50(0.59%) | 178877 |

| Pfizer Inc | PFE | 33.8 | 0.19(0.57%) | 13543 |

| Procter & Gamble Co | PG | 113.03 | 0.26(0.23%) | 16257 |

| Starbucks Corporation, NASDAQ | SBUX | 69.55 | 0.84(1.22%) | 17262 |

| Tesla Motors, Inc., NASDAQ | TSLA | 553 | 7.55(1.38%) | 275599 |

| The Coca-Cola Co | KO | 46.96 | 0.45(0.97%) | 26909 |

| Twitter, Inc., NYSE | TWTR | 26.39 | 0.78(3.05%) | 112311 |

| UnitedHealth Group Inc | UNH | 250 | 1.96(0.79%) | 6654 |

| Verizon Communications Inc | VZ | 57.25 | 0.27(0.47%) | 24339 |

| Visa | V | 170.24 | 1.65(0.98%) | 36784 |

| Wal-Mart Stores Inc | WMT | 122.26 | 0.27(0.22%) | 14242 |

| Walt Disney Co | DIS | 100.8 | -0.44(-0.43%) | 127994 |

| Yandex N.V., NASDAQ | YNDX | 35.07 | 0.57(1.65%) | 1170 |

Walt Disney (DIS) downgraded to Equal Weight from Overweight at Wells Fargo

Twitter (TWTR) upgraded to Mkt Perform from Underperform at Bernstein; target raised to $29

Statistics Canada announced on Wednesday that its flash estimates showed the value of building permits issued by the Canadian municipalities plunged 23.2 percent y-o-y in March.

According to the report, Ontario (-50.5 percent y-o-y), Quebec (-39.1percent y-o-y) and British Columbia (-26.8 percent y-o-y) recorded the strongest declines, likely reflecting provincial measures put in place mid-month to slow the spread of COVID-19.

The value of residential permits tumbled 34.6 percent y-o-y in March, while the value of non-residential building permits fell 7.4 percent y-o-y.

The Canada Mortgage and Housing Corp. (CMHC) reported on Wednesday the seasonally adjusted annual rate of housing starts was at 195,174 units in March, down 7.3 percent from un upwardly revised 210,574 units in February (originally 210,069 units).

Economists had forecast an annual pace of 180,000 for March.

According to the report, urban starts declined 7.3 percent m-o-m last month to 182,553 units, as multiple urban starts plunged by 13.4 percent m-o-m to 124,073 units, while single-detached urban starts rose by 8.8 percent m-o-m 58,480 units. At the same time, rural starts were estimated at a seasonally adjusted annual rate of 12,621 units, down 7.0 percent m-o-m.

- PM is stable and responding to virus treatment

- PM remains in intensive care

- Dominic Raab is deputizing for Johnson in all areas

GBP rose against most other major currencies in the European session on Wednesday supported by the reports that the UK's Prime Minister Boris Johnson, who is fighting coronavirus in hospital in intensive care, is "in a stable condition". However, the pound traded little changed against the U.S. dollar, which saw increased demand as markets' optimism that the COVID-19 crisis was slowing abated.

"I understand the Prime Minister is in a stable condition," the junior health minister Edward Argar told Sky News this morning. "He's comfortable and in good spirits. He has - in the past - had some oxygen but he's not on ventilation." Later, the PM's spokesman said that Johnson remained in intensive care but was stable and responding to virus treatment.

On the contrary, the UK's data on job vacancies were the drag on GBP. The latest Recruitment and Employment Confederation (REC)/KPMG's report revealed that permanent staff vacancies fell at the steepest rate since 2009 in March as firms canceled or postponed plans to take on new staff. Temp billings were also hit. Great uncertainty over the outlook underpinned the first reduction in overall vacancies for over a decade, the report noted.

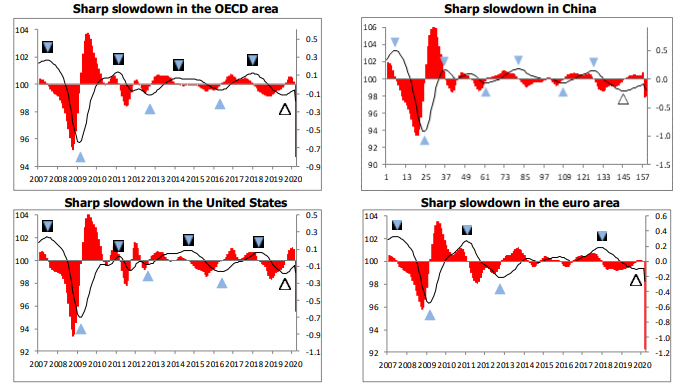

- Says its Composite Leading Indicators (CLIs) showed that almost all major economies had declined into "Sharp slowdown"; India was the only exception as it had entered a mere "Slowdown"

- Notes CLIs are not yet able to anticipate the end of the slowdown, especially as it is not yet clear how long, nor indeed severe, lock-down measures are likely to be

- Describes outbreak of coronavirus in Europe as "very concerning"

- Urges governments to give "very careful consideration" before relaxing measures to control its spread

- Says that dramatic rise in cases across Atlantic skews what remains very concerning picture in Europe

- Can also increase asset purchase volumes or even look for new instruments

- Can even consider the use of OMT

- It would be irresponsible if EU countries leave ECB alone in virus fight

Meanwhile, the number of Covid-19-linked deaths rose by 757 (also largest daily advance in four days) to 14,555.

- Europe has made significant progress in its response to the virus crisis

- Even talks in Brussels, there was progress

- It seems they did not manage to agree in the final stretch of text

- And also on one of the mechanisms

- Glass is 3/4 full and there is everything ECB has already done

- We will have "obligation" to keep rates low for a long period of time

- Nothing is excluded in principle from intellectual debate about more radical policy measures but such theories can only be envisaged if there is major downside risk to inflation

FXStreet reports that EUR/AUD is comfortably above its long term average. Both Australia and the Eurozone are facing recession due to the coronavirus pandemic so Australia has lost its long-standing growth advantage, per Westpac Institutional Bank.

"EUR/AUD price action in March and into early April indicates that global risk appetite is the main driver of the pair short term. As such, it will be difficult for AUD to sustain rebounds."

"Australia reported a current account surplus of A$10.2bn over 2019, 0.5% of GDP. Q2 and Q3 (then Q4) were the first consecutive surpluses since 1973. Lower surpluses seem assured in coming months, but still, this is unusually supportive of AUD on crosses."

"Multi-week, EUR/AUD may avoid retesting its March highs near 2.00 but a push back towards 1.85 seems likely."

FXStreet reports that S&P has moved Australia's rating outlook to 'Negative'. Analysts at Westpac Institutional Bank would not expect this to evolve into a full downgrade.

"In a move similar to their actions on 7 July 2016, S&P has today revised its outlook for Australia's sovereign long term debt rating from Stable to Negative."

"S&P noted that 'the negative outlook reflects our view that Australia faces fiscal and economic risks that are tilted toward the downside'."

"In our view, there will not be any major re-pricing of Australia's risk-reward profile. The initial responses in both bonds and the currency seem to concur, as both have been muted, with yields across the curve basically unchanged and the AUD/USD cross lower by around 30 ticks."

eFXdata reports that Credit Agricole Research discusses CHF outlook and maintains a structural long EUR/CHF position* through year-end targeting a move towards 1.15.

"The CHF has been stabilising for most of the past few weeks, regardless of speculative buying interest remaining high as implied by our FX positioning gauge. After all, it appears that the SNB stepping up FX intervention has been successful so far in offsetting increased safe haven buying as driven by coronavirus-related uncertainty," CACIB notes.

"Weakening fundamentals as for instance reflected in further slowing inflation developments are putting the central bank in a comfortable position to stick to an aggressive monetary policy stance in the foreseeable future. However, sustainably improving global risk sentiment is needed in order to trigger lasting CHF downside. In the meantime, the SNB's policy stance should continue to act as backstop. Such conditions should still leave risk reward in favour of long-term oriented EUR/CHF longs. Hence, we stick to our trade recommendation," CACIB adds.

FXStreet reports that economists at ANZ Bank recap the outlook for the US unemployment rate.

"The St Louis Fed predicts potential job losses of over 46m for 2020. This would translate to a 32.1% unemployment rate, which would be the highest ever. Currently, the peak stands at 24.9%, which occurred in 1933 during the Great Depression."

"An alternate official estimate by the CBO is far more conservative; it estimates unemployment will exceed 10% in Q2."

"The Job Quality Index suggests that around 37m American workers are at risk. This represents around 23% of the workforce. On the other hand, a report from the Brookings Institute suggests around 24m workers are at risk, which is over 15% of the workforce. If all of these workers were stood down, the unemployment rate would rise to roughly 27% (Job Quality Index) and 19% (Brookings Institute)."

"The COVID-19 shock could result in the pool of unemployed rising by 25m. This would result in the unemployment rate rising to just under 20% in Q2."

FXStreet reports that in light of the recent price action, FX Strategists at UOB Group now believe USD/CNH could head to the 7.0350 level in the next weeks.

24-hour view: "The sudden lurch in USD that hit a low of 7.0492 was unexpected. The sharp and rapid decline appears to be running ahead of itself and further weakness in USD appears unlikely. From here, USD could edge slightly higher but any advance is viewed as part of a 7.0550/7.0900 range."

Next 1-3 weeks: "While we noted yesterday (07 Apr, spot at 7.1055) that the 'prospect for a break of 7.1700 continues to diminish', the sudden and sharp drop in USD that sent it tumbling to 7.0492 came as a surprise. The breach our 'strong support' level at 7.0550 (low of 7.0492) indicates that last month's 7.1652 high could remain as a top for a while more. In other words, the risk from here has shifted to the downside. Only a move back above 7.1120 would indicate our view for USD to move to 7.0350 is wrong."

-

Q1 GDP likely shrank by 1.9%

-

Q2 GDP estimated to contract by 9.8%

-

On the year, German economy likely to shrink by 4.2%

-

But government measures should fuel an expansion of 5.8% in 2021

Bloomberg reports that according to the Bank of France, the French economy shrank the most since World War II in the first quarter, and the outlook for the rest of the year is souring significantly amid the confinement to limit the spread of the coronavirus.

The central bank's estimate of a 6% slump is the latest indicator of the severity of the shock to European economies from a simultaneous collapse in demand and supply. Such a GDP drop from one quarter to the next would be comparable only to the 5.3% recorded around the strikes of May 1968.

Like the country's statistics agency Insee, the Bank of France had to change its way of measuring to try to get a grasp on the tumult. It used high-frequency data -- including card transactions and requests for unemployment benefits -- to corroborate the results of its monthly survey of 8,500 businesses.

In industry, the sharpest declines in activity were in the automotive and machine-making sectors, while hotels and restaurants were the hardest hit in services. Overall, the central bank said the loss of activity in one week of confinement is around 32%. Insee had estimated 35%.

The Bank of France survey also showed that factories are running at just 56% of capacity -- a record low -- down from 78% in February.

FXStreet reports that crude oil prices fell on doubts about the ability of oil producers to reach agreement on production cuts, per ANZ Bank.

"Saudi Arabia and Russia continue to hammer out a deal. Reports suggest they are focused on a three-month cut to output, although volumes have not been discussed. What is clear is that the US must be involved."

"President Trump said he hasn't been approached by OPEC yet. But following his meeting with oil executives over the weekend, the likelihood of them agreeing to a voluntary cut to output looks unlikely."

"The market is coming to view that even with a sizeable cut to global supply, the market will remain in a significant surplus following the collapse in demand."

According to the report from KPMG and REC, the outbreak of Coronavirus Disease 2019 (COVID-19) had a detrimental impact on staff recruitment across the UK in March. The latest UK Report on Jobs survey signalled that permanent placements and temp billings both fell at the steepest rates since 2009 as firms cancelled or postponed plans to take on new staff. Great uncertainty over the outlook underpinned the first reduction in overall vacancies for over a decade. Weaker demand for staff also led to a softening of pay pressures, with both permanent and temporary pay rising at slower rates. The availability of staff continued to decline, but at the weakest rate since mid-2013 amid reports of increased redundancies. The report is compiled by IHS Markit from responses to questionnaires sent to a panel of around 400 UK recruitment and employment consultancies.

After rising in the prior three months, permanent staff placements declined sharply in March, with the rate of reduction the sharpest since February 2009.

Vacancy trends also deteriorated during March as the pandemic hit firms' appetite for staff. Demand for both permanent and temporary workers fell for the first time since the global financial crisis in 2009. Permanent staff vacancies fell at a quicker pace than temporary job openings, but rates of contraction were mild in both cases.

FXStreet reports that the 106.92 mark is viewed as an interim low for the USD/JPY pair and Karen Jones, Team Head FICC Technical Analysis Research at Commerzbank, predicts a recovery.

"We continue to regard the 106.92 recent low as an interim low. We favour recovery and look for a retest of the 111.88/112.23 February high and 2017-2020 down channel, which we suspect will again hold.

"Initial support is the 108.31 accelerated uptrend and the 106.92 1st April low. A slide back below 106.27, the 50% retracement, is required to alleviate immediate upside pressure for focus to revert back to 104.46, the August low."

| Time | Country | Event | Period | Previous value | Forecast | Actual |

|---|---|---|---|---|---|---|

| 05:00 | Japan | Eco Watchers Survey: Current | March | 27.4 | 27.6 | 14.2 |

| 05:00 | Japan | Eco Watchers Survey: Outlook | March | 24.6 | 38.1 | 18.8 |

During today's Asian trading, the US dollar rose moderately against the euro and the Japanese yen. Investors again switched to the assets of the "safe haven", which supports the us currency.

The ICE Dollar index, which shows the value of the dollar against six major world currencies, rose by 0.41% compared to the previous day.

Market participants continue to follow the news regarding measures taken to limit the effects of COVID-19 coronavirus infection.

The EU will allocate more than 15 billion euros to help fight coronavirus around the world, European Commission President Ursula von der Leyen said yesterday.

The US Senate is working on additional measures to support small businesses, which were seriously damaged by the coronavirus crisis, the Hill newspaper reported.

Bloomberg reports that even with a record stimulus package, Japan's economy is heading toward a record contraction of 25% this quarter following Prime Minister Shinzo Abe's declaration of a state of emergency in Tokyo, Osaka and some other parts of the country, according to Goldman Sachs.

The call to stay at home, while not legally binding, will also push down consumer spending by 25% on an annualized quarter-on-quarter basis and further reduce business spending, Goldman Sachs economists Naohiko Baba and Yuriko Tanaka wrote in a note. They also see exports plunging 60% in the quarter.

The forecast is the latest dismal assessment of the hit Japan's economy will take as activity is scaled back by the virus pandemic, with the emergency declaration covering almost half of the nation's output.

The measures in Japan are of a different dimension from the lockdowns imposed in Europe and the U.S. given that most measures don't carry legal force and with public transport, financial services and food stores continuing, the economists said.

"However, we expect the explicit declaration of a state of emergency to meaningfully change the behavior of individuals, business owners and event organizers. We expect a change in how people act, including stepped-up business suspensions and people refraining significantly more from activities outside the home," they wrote.

"After 16h of discussions we came close to a deal but we are not there yet. I suspended the Eurogroup & continue tomorrow. My goal remains: A strong EU safety net against fallout of covid19 (to shield workers, firms & countries) & commit / to a sizeable recovery plan," - tweeted Mario Centeno, Eurogroup president.

-

CNBC reports that the central Chinese city of Wuhan - where the coronavirus was first reported - started allowing people to leave for the first time since it was locked down on Jan. 23 to contain the outbreak.

-

China's National Health Commission (NHC) reported 62 new cases and two deaths as of April 7.

-

Tesla will cut pay for all of its employees and furlough all hourly workers until May 4, when it intends to resume production of electric cars

-

President Donald Trump blamed the World Health Organization for getting "every aspect" of the coronavirus pandemic wrong and threatened to withhold funding from the international organization.

-

Global cases: More than 1,426,000

-

Global deaths: At least 81,865

-

Most cases reported: United States (396,223), Spain (141,942), Italy (135,586), France (110,065) and Germany (107,663).

FXStreet reports that while the outlook on Cable remains tilted to the downside, the move is forecasted to be within a broad side-lined theme, noted FX Strategists at UOB Group.

24-hour view: "Our view for GBP to 'dip towards 1.2150' was incorrect as it rebounded sharply from a low of 1.2166 (overnight high of 1.2383). Despite the relatively strong bounce, upward momentum has not improved by much. However, GBP could edge above the overnight high but any advance is viewed as part of a 1.2250/1.2420 range (a sustained rise above 1.2420 is not expected)."

Next 1-3 week: "There is not much to add to the update from Monday (06 Apr, spot at 1.2230). As highlighted, the 'the immediate risk from here is tilted to the downside but any weakness is viewed as part of a broad 1.1950/1.2420 range'. GBP dropped to 1.2166 yesterday (07 Apr) before rebounding quickly. After the strong bounce, GBP could test the top of the expected at 1.2420 but for now, the prospect for a sustained rise above 1.2420 is not high."

EUR/USD

Resistance levels (open interest**, contracts)

$1.1046 (685)

$1.1021 (611)

$1.0986 (484)

Price at time of writing this review: $1.0878

Support levels (open interest**, contracts):

$1.0832 (1185)

$1.0806 (1668)

$1.0776 (1816)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date May, 8 is 62505 contracts (according to data from April, 7) with the maximum number of contracts with strike price $1,0600 (3061);

GBP/USD

Resistance levels (open interest**, contracts)

$1.2473 (128)

$1.2436 (156)

$1.2410 (203)

Price at time of writing this review: $1.2334

Support levels (open interest**, contracts):

$1.2279 (244)

$1.2244 (299)

$1.2198 (569)

Comments:

- Overall open interest on the CALL options with the expiration date May, 8 is 13197 contracts, with the maximum number of contracts with strike price $1,2600 (816);

- Overall open interest on the PUT options with the expiration date May, 8 is 15201 contracts, with the maximum number of contracts with strike price $1,2850 (1073);

- The ratio of PUT/CALL was 1.15 versus 1.13 from the previous trading day according to data from April, 7

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 30.85 | -3.92 |

| WTI | 23.14 | -8.68 |

| Silver | 14.97 | 0 |

| Gold | 1647.95 | -0.66 |

| Palladium | 2164.22 | 0.75 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | 373.88 | 18950.18 | 2.01 |

| Hang Seng | 504.17 | 24253.29 | 2.12 |

| KOSPI | 31.72 | 1823.6 | 1.77 |

| ASX 200 | -34.5 | 5252.3 | -0.65 |

| FTSE 100 | 122.06 | 5704.45 | 2.19 |

| DAX | 281.53 | 10356.7 | 2.79 |

| CAC 40 | 92.13 | 4438.27 | 2.12 |

| Dow Jones | -26.13 | 22653.86 | -0.12 |

| S&P 500 | -4.27 | 2659.41 | -0.16 |

| NASDAQ Composite | -25.98 | 7887.26 | -0.33 |

| Time | Country | Event | Period | Previous value | Forecast |

|---|---|---|---|---|---|

| 05:00 | Japan | Eco Watchers Survey: Current | March | 27.4 | |

| 05:00 | Japan | Eco Watchers Survey: Outlook | March | 24.6 | |

| 05:45 | Switzerland | Unemployment Rate (non s.a.) | March | 2.5% | 2.8% |

| 12:15 | Canada | Housing Starts | March | 210 | 180 |

| 12:30 | Canada | Building Permits (MoM) | February | 4% | -4.5% |

| 14:30 | U.S. | Crude Oil Inventories | April | 13.834 | 10.133 |

| 18:00 | U.S. | FOMC meeting minutes |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.6165 | 1.39 |

| EURJPY | 118.404 | 0.47 |

| EURUSD | 1.08896 | 0.9 |

| GBPJPY | 134.095 | 0.42 |

| GBPUSD | 1.23318 | 0.86 |

| NZDUSD | 0.59698 | 0.77 |

| USDCAD | 1.40031 | -0.74 |

| USDCHF | 0.96966 | -0.83 |

| USDJPY | 108.734 | -0.42 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.