- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

- FOMC officials all in the same mindset on patience on rates

- Still see one rate hike in 2019 but willing to be patient

- Will wait and see how businesses respond on tariffs

- Don't see inflation now decelerating away from goal

- If inflation expectations anchored, may need action

TD Securities' analysts note that the U.S. April CPI reading disappointed modestly, with a 0.1% m-o-m uptick in core running below expectations.

- Still, key components like shelter and health care were solid, with the weakness concentrated in some of the "transitory" factors as identified by the Fed. As such, this report likely keeps the Fed on the sidelines and does not increase the chance of low-inflation driven "insurance cuts" later this year.

- Headline CPI rose at a softer-than-expected 0.3% m/m in April (0.319% unrounded), with consensus and us both expecting a 0.4% increase. The gain was again primarily driven by a strong 6% rise in gasoline prices, as expected. Food prices came in a bit softer, posting a -0.1% decline lead by a -0.5% drop in the food at home category. Nonetheless, the annual headline inflation rate still increased by a tenth to 2.0% — a five-month high.

- Core CPI inflation came slightly weaker versus our and the consensus expectations, expanding 0.1% m/m (0.138% unrounded) and 2.1% y/y.

- For the Fed, the disappointment in the April CPI report is not likely to materially change the clear majority view that some significant part of recent soft inflation numbers is transitory.

- Importantly, despite the slight disappointment in this report, we would fade any inference that the Fed may be nudged toward "insurance cuts" due to weak inflation. Rather, we would need to see a run of multiple months with core PCE inflation around 1.5% in order for the FOMC to start that conversation.

- FX: Residual USD weakness post-CPI is likely to prove temporary as trade talks between the US & China remain the focal point. We retain a bearish bias for USDJPY, where a weekly close below 109.71 should open a flush towards 108.50 support.

- Says fall in inflation reflects "normal volatility"

- Trimmed mean inflation not trending up or down

- Has more confidence in his outlook for moderate growth

- Near term risks to growth have receded

- Labor market should support inflation returning to 2%, no sign of inflation pressure

- Expects sustainable growth of 2.25% GDP growth in 2019

- Says he is seeing more positive readings on China's economy due to gov't efforts

- Trade tensions and Brexit uncertainty are downside risks

Statistics Canada reported on Friday that the

value of building permits issued by the Canadian municipalities rose 2.1 percent

m-o-m in March, following a revised 5.1 percent m-o-m drop in February (originally

a 5.7 percent m-o-m decrease).

Economists had forecast a 2.8 percent advance

in March from the previous month.

According to the report, non-residential

building permits surged by 7.9 percent m-o-m in March, due to higher

construction intentions for both institutional (25.6 percent m-o-m) and

commercial (+9.8 percent m-o-m) buildings. Meanwhile, the value of industrial permits

(-15.6 percent m-o-m) declined.

At the same time, the value of residential

permits fell by 1.5 percent m-o-m as single-family permits dropped by 5.0

percent m-o-m while permits multi-family dwellings increased by 1.3 percent

m-o-m,

In y-o-y terms, building permits declined 2.4

percent in March.

U.S. stock-index futures fell on Friday amid increased worries that the U.S.-China trade dispute might linger, even as the two sides held last-minute talks to seal a deal.

Global Stocks:

Index/commodity | Last | Today's Change, points | Today's Change, % |

Nikkei | 21,344.92 | -57.21 | -0.27% |

Hang Seng | 28,550.24 | +239.17 | +0.84% |

Shanghai | 2,939.21 | +88.26 | +3.10% |

S&P/ASX | 6,310.90 | +15.60 | +0.25% |

FTSE | 7,229.04 | +21.63 | +0.30% |

CAC | 5,335.55 | +22.39 | +0.42% |

DAX | 12,052.23 | +78.31 | +0.65% |

Crude oil | $61.71 | +0.05% | |

Gold | $1,288.30 | +0.24% |

(company / ticker / price / change ($/%) / volume)

3M Co | MMM | 174.8 | -0.48(-0.27%) | 5856 |

ALCOA INC. | AA | 24.08 | -0.73(-2.94%) | 3425 |

ALTRIA GROUP INC. | MO | 51.7 | -0.29(-0.56%) | 946 |

Amazon.com Inc., NASDAQ | AMZN | 1,892.00 | -7.87(-0.41%) | 55585 |

Apple Inc. | AAPL | 197.52 | -2.43(-1.22%) | 410186 |

AT&T Inc | T | 30.32 | -0.06(-0.20%) | 17819 |

Boeing Co | BA | 351.5 | -2.63(-0.74%) | 14721 |

Caterpillar Inc | CAT | 129.75 | -1.45(-1.11%) | 5373 |

Cisco Systems Inc | CSCO | 52.56 | -0.36(-0.68%) | 12629 |

Citigroup Inc., NYSE | C | 67.22 | -0.41(-0.61%) | 11663 |

Exxon Mobil Corp | XOM | 75.7 | -0.20(-0.26%) | 6564 |

Facebook, Inc. | FB | 188.01 | -0.64(-0.34%) | 96478 |

Ford Motor Co. | F | 10.32 | 0.12(1.18%) | 307303 |

Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 11.2 | -0.08(-0.71%) | 5450 |

General Electric Co | GE | 10.02 | -0.02(-0.20%) | 139373 |

General Motors Company, NYSE | GM | 37.32 | -0.26(-0.69%) | 1411 |

Google Inc. | GOOG | 1,155.50 | -6.88(-0.59%) | 1502 |

Hewlett-Packard Co. | HPQ | 19.25 | -0.04(-0.21%) | 3838 |

Home Depot Inc | HD | 193.76 | -0.82(-0.42%) | 1050 |

HONEYWELL INTERNATIONAL INC. | HON | 169.4 | -0.99(-0.58%) | 631 |

Intel Corp | INTC | 46.31 | -0.31(-0.66%) | 70083 |

International Business Machines Co... | IBM | 134.51 | -0.83(-0.61%) | 679 |

Johnson & Johnson | JNJ | 138.32 | -0.41(-0.30%) | 733 |

JPMorgan Chase and Co | JPM | 111.81 | -0.71(-0.63%) | 3865 |

Microsoft Corp | MSFT | 124.89 | -0.61(-0.49%) | 38335 |

Nike | NKE | 82.7 | -0.28(-0.34%) | 1320 |

Pfizer Inc | PFE | 40.59 | -0.05(-0.12%) | 5301 |

Procter & Gamble Co | PG | 104 | -0.24(-0.23%) | 2110 |

Starbucks Corporation, NASDAQ | SBUX | 77.41 | -0.49(-0.63%) | 2892 |

Tesla Motors, Inc., NASDAQ | TSLA | 239 | -2.98(-1.23%) | 68141 |

The Coca-Cola Co | KO | 47.49 | 0.09(0.19%) | 3577 |

Twitter, Inc., NYSE | TWTR | 38.54 | -0.25(-0.64%) | 76487 |

United Technologies Corp | UTX | 136 | -0.86(-0.63%) | 394 |

UnitedHealth Group Inc | UNH | 239.6 | 1.63(0.69%) | 3018 |

Verizon Communications Inc | VZ | 56.5 | 0.02(0.04%) | 321 |

Visa | V | 158.79 | -1.02(-0.64%) | 8057 |

Wal-Mart Stores Inc | WMT | 99.12 | -0.42(-0.42%) | 1386 |

Walt Disney Co | DIS | 133.2 | -0.39(-0.29%) | 25476 |

Yandex N.V., NASDAQ | YNDX | 36.23 | -0.23(-0.63%) | 6664 |

Statistics Canada reported on Friday that the

number of employed people surged by 106,500 m-o-m in April, while economists

had forecast a gain of 10,000 and after an unrevised decline of 7,200 in the

previous month. That was the greatest rise in employment since February 1976.

Meanwhile, Canada's unemployment fell to 5.7

percent from 5.8 percent in March, below economists’ forecast of 5.8 percent.

According to the report, full-time employment

jumped by 73,000 in April, while part-time jobs climbed by 33,600.

In April, the number of private sector

employees rose by 83,800 (+0.7 percent m-o-m), while the number of public

sector employees grew by 22,700 (+0.6 percent m-o-m). At the same time, the

number of self-employed was unchanged last month.

Sector-wise, there were more people working

in wholesale and retail trade (+32,400), construction (+29,700), information,

culture and recreation (+13,800), "other services" (+13,800), public

administration (+9,300) and agriculture (+6,500). At the same time, employment

decreased in professional, scientific and technical services (-14,900).

On a year-over-year basis, employment grew by

426,000 (+2.3 percent), with gains in both full-time (+248,000) and part-time

(+179,000) work.

United Tech (UTX) initiated with a Neutral at Seaport Global Securities

Ford Motor (F) upgraded to Buy from Neutral at BofA/Merrill; target raised to $14

UnitedHealth (UNH) upgraded to Buy from Neutral at Citigroup; target raised to $280

The Labor Department announced on Friday the

U.S. consumer price index (CPI) rose 0.3 percent m-o-m in April after a 0.4

percent m-o-m gain in March.

Over the last 12 months, the CPI rose 2.0

percent y-o-y last month, following a 1.9 percent m-o-m advance in the 12

months through March. That was the highest rate since November 2018.

Economists had forecast the CPI to increase

0.4 percent m-o-m and 2.1 percent y-o-y in the 12-month period.

According to the report, the gasoline index continued to increase, rising 5.7 percent m-o-m and accounting for over two-thirds of the seasonally adjusted all items monthly gain. The index for energy rose 2.9 percent m-o-m, although the index for natural gas declined by 0.8 percent m-o-m and the index for electricity was flat m-o-m. Meanwhile, the food index fell by 0.1 percent m-o-m in April, its first monthly decline since June 2017.

The core CPI excluding volatile

food and fuel costs edged up 0.1 percent m-o-m in April, the same increase as

in the previous month.

In the 12 months through April, the core CPI

rose 2.1 percent after a 2.0 percent increase for the 12 months ending March.

Economists

had forecast the core CPI to rise 0.2 percent m-o-m and 2.1 percent y-o-y last

month.

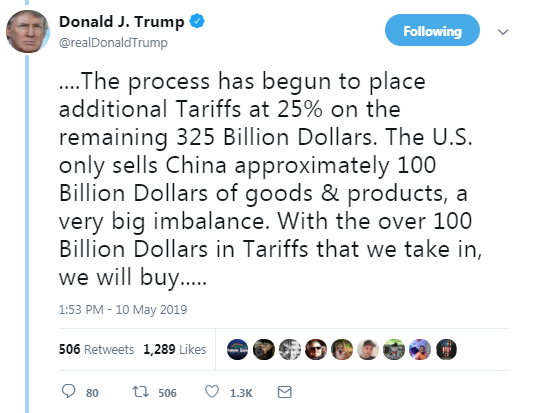

Timme Spakman, an economist covering International Trade at ING, suggests the US increase in tariffs from 10% to 25% on $200 billion of American imports from China will affect EU economies, particularly because China is likely to retaliate.

- Taking into account which European companies already have a strong presence in US and Chinese markets, our study has identified European machine makers, producers of fine instruments and chemical industries as sectors that are likely to benefit from tariffs between the US and China. However, the tariffs may also hurt European firms, as demand from the US and China for each other’s products will be supressed, with the excess supply possibly dumped on the European market. This potentially eats away at the margins of European producers.

- Reduced demand and increasing uncertainty in the US and China will also suppress business investment, which will diminish the chances of European companies exporting capital goods. On top of this, European producers of parts processed in the imports by the US from China, or by imports by China from the US may be hurt as well.

- The US had been expected to announce a decision next week on whether to impose tariffs on imported cars and auto parts, which is likely to increase EU-US tensions. Reports suggest that decision may be delayed but even so, the escalation of the conflict between the US and China will take its toll on Europe.

Analysts at TD Securities are expecting the Canadian employment to fall by 10K in April led by a pullback in full-time hiring, which has averaged 30K per month since September while the rest of the economy slowed.

- This should see the unemployment rate edges higher to 5.9% from 5.8% while wage growth for permanent employees should hold at 2.3% y/y.

- March building permits will be released alongside employment to provide an update on the outlook for construction activity, with the market looking for a 2.4% rebound after the 5.7% pullback in February.

- "Disappointing" to see the latest U.S.-China trade tension

- He is optimistic there will not be a trade war between the U.S. and China

- UK is very exposed to any downturn in global trade

- UK economy growing in line with official forecasts, even taking into account Q1 stockbuilding

- Getting rid of PM May would not solve Brexit impasse

- says the monetary policy will be neither too loose nor too tight

- says it has plenty of room, policy tools to cope with external changes

- says it is fully able to cope with domestic and external uncertainties

The president of the European Council, Donald Tusk, said the chances of the UK staying in the EU are as high as 30% as the country would be likely to reject Brexit in a second referendum, the Guardian reported, citing Tusk's interview with the Polish newspaper Gazeta Wyborcza.

He also claimed the British public had only truly debated Brexit after the 2016 referendum and there was a significant reason to believe the leave vote could be reversed.

Describing the decision by the former British prime minister, David Cameron, to call the vote as a political miscalculation, the block's official said he would expect a different result in a vote today given what had been learned about the consequences of leaving.

“The referendum was at the worst possible moment, it is the result of a wrong political calculation,” Tusk said in an interview with the Polish newspaper Gazeta Wyborcza.

“A real debate about the consequences of Brexit wasn’t had during the referendum campaign, but only after the vote. Today the result would probably look different. Paradoxically, Brexit awoke in Great Britain a pro-European movement.”

James Smith, a developed markets economist at ING, notes that stockpiling frenzy lifted UK growth during the first quarter, while some better news on consumer activity suggests underlying economic momentum could stay a little stronger heading into the summer.

- After a bumpy first quarter in UK politics, it follows that the first quarter growth figures should be equally noisy. While the 0.5% first-quarter growth figure was in line with both our own and market expectations, it masks some pretty interesting developments beneath the surface.

- PMIs had suggested that an unprecedented level of stockpiling occurred during the first quarter, despite some anecdotal signs that low warehouse vacancy rates had constrained the ability of some firms to boost inventory substantially. But in the end, inventories made a sizable contribution to quarterly growth, as firms scrambled to build up supplies of components and finished goods to insulate against potential Brexit supply chain disruption.

- Consumer spending grew by 0.7% during the first quarter, the fastest quarterly growth in two years. This is surprising, given that consumer confidence is still at rock bottom. This is slightly at odds with some other indications of first quarter spending, which had indicated that uncertainty had continued to limit big-ticket purchases. Still, the combination of rising wage growth and a solid jobs market suggests to us that consumer spending could continue to perform a little better over the coming months, particularly now that the Brexit noise has temporarily died down.

- While much of the inventory boost was offset by imports, we still think there is the potential for a correction in overall economic growth in the second quarter. Manufacturing contributed 0.2 percentage points to first-quarter GDP growth, and this is unlikely to be repeated over the coming months - especially given the uncertain outlook for global growth.

- Are clear no one benefits from trade wars

- Hope the U.S. and China will find a resolution to avoid any further escalation

- PM plans to talk to Sinn Fein in the coming days on Northern Ireland power-sharing talks

Analysts at TD Securities are expecting the U.S. headline CPI to increase by two tenths to 2.1% in April on the back of a strong 0.4% seasonally-adjusted monthly gain.

- The main driver behind the monthly gain is another sizable jump in gasoline prices. Furthermore, we anticipate core CPI inflation to register another "soft" 0.2% m/m gain (2.1% y/y), as a firm 0.2% increase in core services prices will likely offset a third consecutive monthly decline in prices in the core goods segment (which we pencil in at -0.1% m/m).

- Largely subdued April PPI inflation suggests no mounting risks of pass-through to CPI, as weak trade services inflation indicate limited pricing power by firms.

Danske Bank analysts suggest that with clouds over the Eurozone’s growth outlook clearing a little, unit labour costs rising and firms' margins being squeezed, they still see strong arguments for core inflation to reach rates of 1.3-1.4% by year-end.

“We emphasise that it will be a gradual uptrend, as the current economic environment remains fragile. Markets generally remain very sceptical about any core inflation uptick in the current economic environment, in line with the very subdued ECB pricing. In our view, current inflation market pricing remains too low and we see scope for repricing in inflation-related products, especially in H2 19. We doubt that the projected gradual rise in core inflation is enough to convince the ECB to bring rate hikes back to the table for 2020.”

According to the report from National Institute of Statistics (Istat), in March 2019, estimates of the value of retail trade decreased by 0.3%. Economists had expected a 0.3% increase. Volume was down 0.2% when compared with the previous month.

In the three months to March 2019 (Quarter 1), both value and volume of retail trade rose by 0.2% when compared with Quarter 4 2018 (Oct to Dec).

When compared with a year earlier, both value and volume of retail trade saw a decline, decreasing by 3.3% and 3.7% respectively.

Large scale distribution decreased year-on-year by 5.0%, while small scale distribution fell by 2.2%. Internet sales continued their growth, increasing by 11.1% when compared with March 2018.

Looking at the value of sales for non-food products, the strongest growth was reported for Shoes, leather goods and travel items (+5.0%), while the largest falls concerned Stationery, books, newspapers and magazines (-4.6%) and Electric household appliances, audio-video equipment (-4.2%).

France will not tolerate repeated extensions of the Brexit deadline, a French presidential adviser said, expressing hope that European elections in Britain would jolt its political parties into reaching a deal on leaving the EU.

“We must not get sucked into repeated extensions, that’s for sure,” the adviser said. “Our message is clear: a solution must have been found by October 31.”

The French adviser did not close the door on a further extension beyond Oct. 31, but made clear France would continue to argue against delaying talks repeatedly. “Maybe European elections (in Britain) will serve as a shock to reach a transpartisan deal,” the adviser said.

British long-run public inflation expectations rose back to their long-term average of 3.2% last month, while short-run inflation expectations held steady at 2.7%, a monthly Citi/YouGov survey showed .

The share of respondents who did not know where inflation was likely to head remained higher than normal, which might reflect Brexit uncertainty, Citi's economists said.

YouGov polled 2,012 adults on April 23 and April 24.

Would wait and see how economy develops in the next few months

Sees 'green shoots story' in recent euro area data

Negative rate tiering could lead to "over-engineering"

TLTRO terms should keep door open for normalisation

According to the report from Office for National Statistics, production output rose by 1.4% in Quarter 1 compared with Quarter 4 2018, due to rises from manufacturing, and mining and quarrying.

The quarterly increase of 2.2% in manufacturing is due mainly to rises of 9.4% from pharmaceuticals, 2.7% from food products, beverages and tobacco, and 3.2% from metals and metal products.

Production output rose by 0.7% between February 2019 and March 2019. Economists had expected a 0.1% increase. The manufacturing sector provided the largest upward contribution, rising by 0.9%, its third consecutive monthly rise.

In March 2019, the monthly increase in manufacturing output was due to rises in 8 of the 13 subsectors and follows a 1.0% rise in February 2019; the largest upward contribution came from pharmaceutical products, which rose by 4.0%.

In Quarter 1 2019, production output increased by 0.6% compared with Quarter 1 2018; with notable rises in manufacturing of 1.2% and mining and quarrying of 6.0%, partially offset by a fall of 5.9% from electricity and gas.

Office for National Statistics said that UK gross domestic product (GDP) in volume terms was estimated to have increased by 0.5% in Quarter 1 (Jan to Mar) 2019 having slowed to 0.2% growth in the previous quarter.

In comparison with the same quarter a year ago UK GDP increased by 1.8% to Quarter 1 (Jan to Mar) 2019; up from 1.4% in the previous period.

Growth in the services sector slowed to 0.3% in the latest quarter, while there was a noticeable pickup in growth in the production sector, driven by growth of 2.2% in manufacturing output.

Private consumption, government consumption and gross capital formation contributed positively, while net trade contributed negatively to GDP growth.

The trade deficit widened to 3.4% of nominal GDP in Quarter 1 2019; when unspecified goods are excluded, the deficit widened to 2.3% of nominal GDP – this figure gives a better indication of the underlying trade position.

Gross fixed capital formation increased by 2.1% in the latest quarter, with strong growth in government investment; business investment increased by 0.5% in Quarter 1 2019 following four quarters of contraction.

According to the report from National Institute of Statistics (Istat), in March 2019 the seasonally adjusted industrial production index decreased by 0.9% compared with the previous month. The percentage change of the average of the last three months with respect to the previous three months was +1.0.

The index measures the monthly evolution of the volume of industrial production (excluding construction). With effect from January 2018 the indices are calculated with reference to the base year 2015.

The calendar adjusted industrial production index decreased by 1.4% compared with March 2018 (calendar working days being 21 versus 22 days in March 2018).

The unadjusted industrial production index decreased by 3.1% compared with March 2018.

According to analysts at Danske Bank, in the UK, monthly GDP data for March is due out and hence will provide a full overview of GDP growth in Q1.

“GDP growth was solid in January and February, so quarterly GDP growth was probably around 0.5% q/q. This is quite high, but growth was likely supported by companies making Brexit preparations. We expect GDP growth will slow again to around 0.2% q/q in the coming quarters. In the US, we have CPI inflation for April. We expect CPI core rose +0.2% m/m in April, implying a small increase to 2.1% y/y from 2.0% y/y. The inflation data should not change the Fed being firmly on hold. Markets will today scrutinise the Trump administration's decision to raise tariffs to 25% on about USD200bn of goods. Moody's has said that a full trade war could push the US economy into recession in 2020.”

The euro zone needs to pull closer together, starting with a common backstop for its banks, if it is to win over its doubters, the European Central Bank's chief economist Peter Praet said.

With eurosceptic parties poised to gain seats at upcoming European Union elections, Praet acknowledged that the single currency's reputation had been tarnished by years of crisis.

"The notion that the euro provides stability and security has been weakened by the gaps in our governance framework. In this context it is not surprising that claims that countries would be better off outside the euro find a sympathetic audience," he said.

While any long-term fix was likely to involve "deeper fiscal integration", Praet made the case for completing the euro zone's banking union immediately with "effective institutions for public risk sharing".

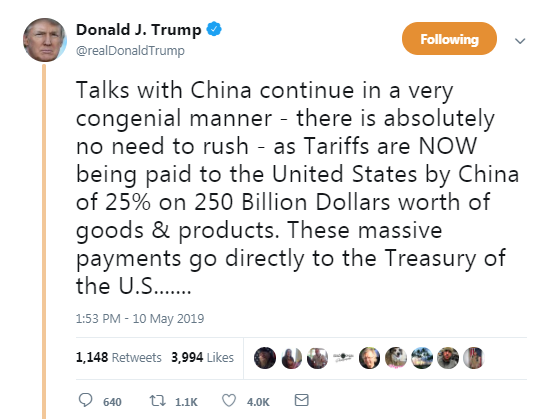

Plans by Washington to hike tariffs on $200 billion of Chinese goods could cut China's growth by 0.3% but the strengthening economy has become more resilient to external shocks, a Chinese central bank advisor said.

Ma said that China would impose corresponding countermeasures should U.S. President Donald Trump move ahead with plans to increase duties on $200 billion of Chinese goods, to 25% from 10%.

"The negative impact of this scenario on China's gross domestic production would be around 0.3 percentage points, this is within a controllable range," he said.

The Chinese stock market was also unlikely to see the same heavy sell-off it experienced last year after the trade war began, he said, adding that investors had previously been prone to overreacting due to an inability to judge the real impact of trade frictions and jitters over slowing economic growth.

He also said that the Chinese central bank had sufficient monetary policy tools to cope with current internal and external uncertainties, and would look to fine-tune policy according to changes in the country's economic situation.

According to the report from Insee, in Q1 2019, private payroll employment increased by +0.3%, at the same pace than in the previous quarter, that is +66,400 jobs after +54,000 jobs in Q4 2018. Year on year, private payroll employment rose by +0.9% (that is +173,700 jobs) after +0,8% in Q4 2018. Excluding temporary employment, it increased by +0.3% over the quarter (that is +54,300 jobs) and by +1.0% over the year (that is +185,500 jobs).

Private payroll employment increased steadily again in construction (+0.6% or +7,900 jobs in Q1 2019, after +0.5 %) and moderately in industry (+0.2% as in the previous quarter, that is +4,900 jobs). Year on year, private employment increased by 24,900 in construction and by 12,400 in industry.

In Q1 2019, in market services, private employment continued to increase strongly: +0.4% (that is +50,200 jobs), after +0.3% in Q4 2018, bringing its rise to 127,500 over a year. Excluding temporary employment, the increase was slightly lower: +0.3% (that is +38,100 jobs), after +0.4% in the previous quarter. Private employment in non-market services increased softly again over the quarter (+0.1% after +0.2%) and over a year (+0.2%).

According to the report from Insee, in March 2019, output slipped back in the manufacturing industry (−1.0% after +0.8% in January) and in the whole industry (−0.9% after a virtual stability vs -0.5% m/m expected).

Manufacturing output increased over the last quarter (+1.1%), as well as in the whole industry (+0.9%). Over the last quarter, output kept growing in most branches: in the manufacture of machinery and equipment goods (+3.2%), in “other manufacturing” (+0.8%), in the manufacture of transport equipment (+0.8%), in the manufacture of coke and refined petroleum products (+4.1%) and in the manufacture of food products and beverages (+0.2%). It was virtually stable in mining and quarrying, energy, water supply (−0.1%).

Manufacturing output of the last quarter increased compared to the same quarter a year ago (+1.3%), as well as in the whole industry (+0.5%). Over a year, quarter’s output increased sharply in the manufacture of transport equipment (+5.4%), and more moderately in “other manufacturing” (+1.0%) and in the manufacture of machinery and equipment goods (+1.9%). On the contrary, it decreased strongly in mining and quarrying, energy, water supply (−4.1%) and more moderately in the manufacture of food products and beverages (−1.2%) and in coke and refined petroleum products (−0.5%).

TD Securities analysts suggest that for the UK economy, the release of March activity data rounds out the quarter, and will be accompanied by the quarterly growth figures.

“We look for flat March m/m GDP growth (consensus: 0.0%), leaving the quarterly aggregate still at a relatively strong 0.5% q/q (consensus, BoE: 0.5%). Key to this release will be the net contribution coming from inventories and imports as we look for the impact on the economy of pre-29 March Brexit stock building. A strong net contribution on this front could be unwound in Q2.”

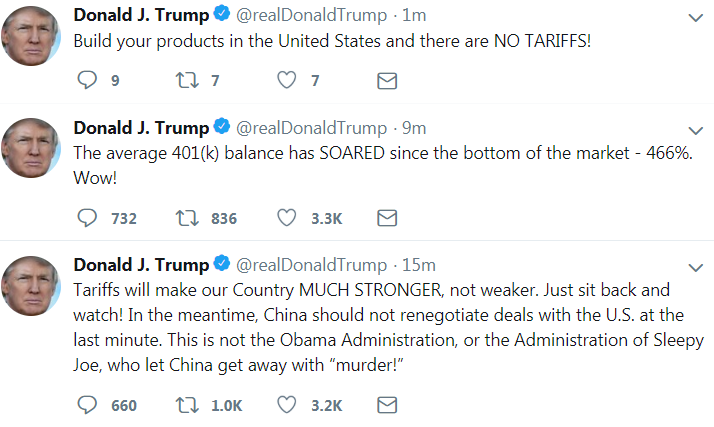

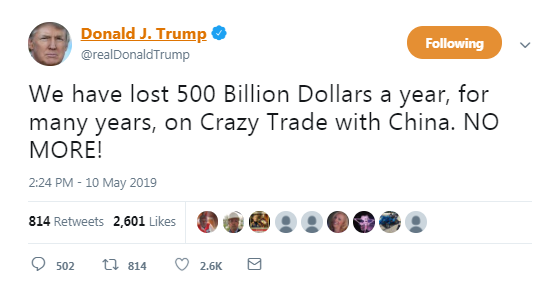

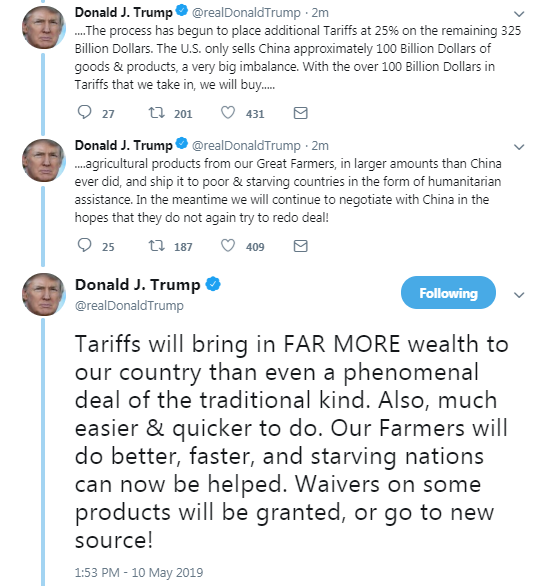

U.S. President Trump's tariff increase to 25% on $200 billion worth of Chinese goods took effect on Friday, and Beijing said it would strike back, ratcheting up tensions as the two sides pursue last-ditch talks to try salvaging a trade deal.

China's Commerce Ministry said it "deeply regrets" the U.S. decision, adding that it would take necessary countermeasures, without elaborating.

The hike comes in the midst of two days of talks between top U.S. and Chinese negotiators to try to rescue a faltering deal aimed at ending a 10-month trade war between the world's two largest economies. The China Commerce Ministry said that negotiations were continuing in Friday., and that it "hopes the US can meet China halfway, make joint efforts, and resolve the issue through cooperation and consultation".

According to the provisional data from Federal Statistical Office (Destatis), Germany exported goods to the value of 118.3 billion euros and imported goods to the value of 95.6 billion euros in March 2019. German exports were up by 1.9% and imports by 4.5% in March 2019 year on year. After calendar and seasonal adjustment, exports increased by 1.5% and imports by 0.4% compared with February 2019.

The foreign trade balance showed a surplus of 22.7 billion euros in March 2019. In March 2018, the surplus amounted to 24.6 billion euros. In calendar and seasonally adjusted terms, the foreign trade balance recorded a surplus of 20.0 billion euros in March 2019.

According to provisional results of the Deutsche Bundesbank, the current account of the balance of payments showed a surplus of 30.2 billion euros in March 2019, which takes into account the balances of trade in goods including supplementary trade items (+24.9 billion euros), services (-0.9 billion euros), primary income (+9.9 billion euros) and secondary income (-3.6 billion euros). In March 2018, the German current account showed a surplus of 29.4 billion euros.

EUR/USD

Resistance levels (open interest**, contracts)

$1.1323 (2951)

$1.1303 (1314)

$1.1279 (157)

Price at time of writing this review: $1.1225

Support levels (open interest**, contracts):

$1.1186 (3110)

$1.1156 (8131)

$1.1120 (5267)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date June, 7 is 116312 contracts (according to data from May, 9) with the maximum number of contracts with strike price $1,1200 (8131);

GBP/USD

Resistance levels (open interest**, contracts)

$1.3215 (2572)

$1.3184 (1990)

$1.3134 (968)

Price at time of writing this review: $1.3002

Support levels (open interest**, contracts):

$1.2964 (1843)

$1.2941 (2034)

$1.2883 (1810)

Comments:

- Overall open interest on the CALL options with the expiration date June, 7 is 37561 contracts, with the maximum number of contracts with strike price $1,3450 (3289);

- Overall open interest on the PUT options with the expiration date June, 7 is 37576 contracts, with the maximum number of contracts with strike price $1,2700 (4175);

- The ratio of PUT/CALL was 1.00 versus 0.99 from the previous trading day according to data from May, 9

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

| Raw materials | Closed | Change, % |

|---|---|---|

| Brent | 69.79 | -0.14 |

| WTI | 61.61 | -0.61 |

| Silver | 14.73 | -0.61 |

| Gold | 1283.354 | 0.22 |

| Palladium | 1295.37 | -1.65 |

| Index | Change, points | Closed | Change, % |

|---|---|---|---|

| NIKKEI 225 | -200.46 | 21402.13 | -0.93 |

| Hang Seng | -692.13 | 28311.07 | -2.39 |

| KOSPI | -66 | 2102.01 | -3.04 |

| ASX 200 | 26.2 | 6295.3 | 0.42 |

| FTSE 100 | -63.59 | 7207.41 | -0.87 |

| DAX | -206.01 | 11973.92 | -1.69 |

| Dow Jones | -138.97 | 25828.36 | -0.54 |

| S&P 500 | -8.7 | 2870.72 | -0.3 |

| NASDAQ Composite | -32.73 | 7910.59 | -0.41 |

| Pare | Closed | Change, % |

|---|---|---|

| AUDUSD | 0.69889 | 0.01 |

| EURJPY | 123.08 | -0.1 |

| EURUSD | 1.12174 | 0.22 |

| GBPJPY | 142.72 | -0.31 |

| GBPUSD | 1.30091 | 0.02 |

| NZDUSD | 0.65935 | 0.28 |

| USDCAD | 1.34666 | -0.06 |

| USDCHF | 1.01465 | -0.57 |

| USDJPY | 109.71 | -0.31 |

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.