- Phân tích

- Tin tức và các công cụ

- Tin tức thị trường

Tin tức thì trường

| Raw materials | Closing price | % change |

| Oil | $68.75 | -1.43% |

| Gold | $1,229.10 | +0.14% |

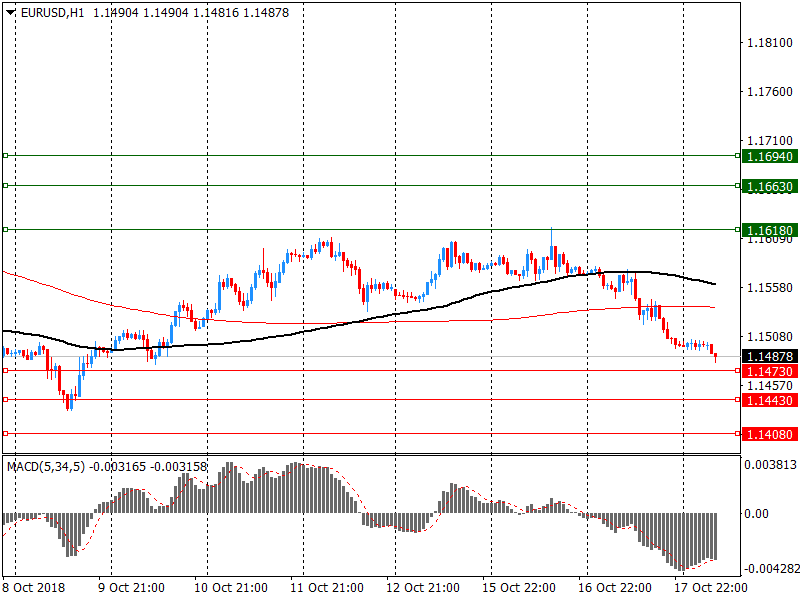

| Index | Change items | Closing price | % change |

| Nikkei | -182.96 | 22658.16 | -0.80% |

| TOPIX | -9.23 | 1704.64 | -0.54% |

| CSI 300 | -73.86 | 3044.39 | -2.37% |

| KOSPI | -19.20 | 2148.31 | -0.89% |

| FTSE 100 | -27.61 | 7026.99 | -0.39% |

| DAX | -125.82 | 11589.21 | -1.07% |

| CAC 40 | -28.16 | 5116.79 | -0.55% |

| DJIA | -327.23 | 25379,45 | -1,27% |

| S&P 500 | -40,43 | 2768,78 | -1,44% |

| NASDAQ | -157,56 | 7485,14 | -2,06% |

| Pare | Closed | % change |

| EUR/USD | $1,1455 | -0,38% |

| GBP/USD | $1,3018 | -0,64% |

| USD/CHF | Chf0,99534 | +0,09% |

| USD/JPY | Y112,18 | -0,45% |

| EUR/JPY | Y128,61 | -0,75% |

| GBP/JPY | Y146,053 | -1,09% |

| AUD/USD | $0,7091 | -0,24% |

| NZD/USD | $0,6538 | -0,13% |

| USD/CAD | C$1,30575 | +0,28% |

Major US stock indices dropped significantly, as weak profit and loss reports of industrial companies raised concerns about rising costs and the impact of tariffs, which added to concerns about higher borrowing costs after comments in the Fed's minutes.

The focus was also on US data, which showed that the initial applications for unemployment benefits in the US fell last week, and the number of repeat requests fell to a level that was last fixed in 1973, which implies a further tightening of market conditions labor. The initial applications for unemployment benefits fell last week, taking into account seasonal fluctuations by 5,000 to 210,000, data from the Ministry of Labor showed. Economists had forecast a decline in the number of complaints to 212,000.

Meanwhile, in September, the Conference Board's leading indicators index (LEI) for the USA increased by 0.5% to 111.8 (2016 = 100), after increasing by 0.4% in August and by 0.7% in July. The leading economic index now significantly exceeds the previous peak at 102.4, set in March 2006.

Oil prices fell on Thursday, as the fourth weekly increase in US crude stocks indicated adequate supply, while Saudi-US tensions and a drop in Iranian exports supported prices.

Most of the components of DOW finished trading in the red (24 of 30). Caterpillar Inc. shares turned out to be an outsider. (CAT, -3.92%). The growth leader was Verizon Communications Inc. (VZ, + 1.30%).

All sectors of the S & P recorded a decline. The largest decline was shown by the technology sector (-2.0%)

At the time of closing:

Dow 25,379.45 -327.23 -1.27%

S & P 500 2,768.78 -40.43 -1.44%

Nasdaq 100 7,485.14 -157.56 -2.06%

U.S. stock-index futures fell on Thursday, as investors continued to digest the minutes from the last Fed meeting, which showed that officials generally agreed to raise rates further, possibly above levels assessed to prevail in the long-run.

Global Stocks:

| Index/commodity | Last | Today's Change, points | Today's Change, % |

| Nikkei | 22,658.16 | -182.96 | -0.80% |

| Hang Seng | 25,454.55 | -7.71 | -0.03% |

| Shanghai | 2,486.42 | -75.20 | -2.94% |

| S&P/ASX | 5,942.40 | +3.30 | +0.06% |

| FTSE | 7,054.96 | +0.36 | +0.01% |

| CAC | 5,163.96 | +19.01 | +0.37% |

| DAX | 11,705.31 | -9.72 | -0.08% |

| Crude | $68.74 | | -1.45% |

| Gold | $1,228.80 | | +0.11% |

(company / ticker / price / change ($/%) / volume)

| 3M Co | MMM | 202.5 | -0.43(-0.21%) | 308 |

| ALCOA INC. | AA | 38.33 | 1.63(4.44%) | 57623 |

| ALTRIA GROUP INC. | MO | 61.03 | 0.41(0.68%) | 1636 |

| Amazon.com Inc., NASDAQ | AMZN | 1,820.20 | -11.53(-0.63%) | 26234 |

| American Express Co | AXP | 104.45 | 0.11(0.11%) | 2174 |

| Apple Inc. | AAPL | 219.1 | -2.09(-0.94%) | 230123 |

| AT&T Inc | T | 32.5 | -0.07(-0.21%) | 10576 |

| Barrick Gold Corporation, NYSE | ABX | 12.83 | 0.11(0.86%) | 12200 |

| Boeing Co | BA | 363.84 | -1.66(-0.45%) | 4988 |

| Caterpillar Inc | CAT | 141.06 | -0.28(-0.20%) | 6095 |

| Chevron Corp | CVX | 116.59 | -0.70(-0.60%) | 16280 |

| Cisco Systems Inc | CSCO | 46.28 | 0.34(0.74%) | 22775 |

| Citigroup Inc., NYSE | C | 69.55 | -0.29(-0.42%) | 2100 |

| Exxon Mobil Corp | XOM | 81.06 | -0.44(-0.54%) | 448 |

| Facebook, Inc. | FB | 158.89 | -0.53(-0.33%) | 33218 |

| FedEx Corporation, NYSE | FDX | 225 | 1.54(0.69%) | 961 |

| Ford Motor Co. | F | 8.74 | -0.02(-0.23%) | 11675 |

| Freeport-McMoRan Copper & Gold Inc., NYSE | FCX | 12.24 | -0.16(-1.29%) | 75709 |

| General Electric Co | GE | 12.18 | -0.01(-0.08%) | 103298 |

| Goldman Sachs | GS | 227 | -1.28(-0.56%) | 2661 |

| Google Inc. | GOOG | 1,116.00 | 0.31(0.03%) | 2130 |

| Home Depot Inc | HD | 185.1 | -0.07(-0.04%) | 9480 |

| Intel Corp | INTC | 45.81 | -0.08(-0.17%) | 10703 |

| International Business Machines Co... | IBM | 133.5 | -0.55(-0.41%) | 14285 |

| Johnson & Johnson | JNJ | 139.36 | -0.10(-0.07%) | 1131 |

| JPMorgan Chase and Co | JPM | 109.31 | -0.52(-0.47%) | 11178 |

| McDonald's Corp | MCD | 166.84 | 0.07(0.04%) | 629 |

| Merck & Co Inc | MRK | 72 | 0.18(0.25%) | 12652 |

| Microsoft Corp | MSFT | 110.6 | -0.11(-0.10%) | 26797 |

| Nike | NKE | 77.23 | 0.75(0.98%) | 21221 |

| Pfizer Inc | PFE | 44.4 | -0.17(-0.38%) | 2630 |

| Procter & Gamble Co | PG | 80.95 | -0.19(-0.24%) | 1944 |

| Starbucks Corporation, NASDAQ | SBUX | 58.9 | -0.20(-0.34%) | 4633 |

| Tesla Motors, Inc., NASDAQ | TSLA | 268.52 | -3.26(-1.20%) | 28973 |

| Travelers Companies Inc | TRV | 126.5 | 0.06(0.05%) | 5155 |

| Twitter, Inc., NYSE | TWTR | 29.45 | -0.10(-0.34%) | 4125 |

| UnitedHealth Group Inc | UNH | 267.2 | -0.10(-0.04%) | 358 |

| Visa | V | 143.11 | 0.66(0.46%) | 4700 |

| Wal-Mart Stores Inc | WMT | 96.19 | -0.37(-0.38%) | 312 |

| Walt Disney Co | DIS | 116.5 | -0.63(-0.54%) | 1950 |

| Yandex N.V., NASDAQ | YNDX | 35.32 | -0.56(-1.56%) | 11151 |

"The labor market was quite strong in the month of September," said Ahu Yildirmaz, vice president and co-head of the ADP Research Institute. "Although the goods producing sector struggled this month, we saw significant growth in many industries. Trade, for example, continued its steady growth adding the most jobs the sector has seen all year."

In the week ending October 13, the advance figure for seasonally adjusted initial claims was 210,000, a decrease of 5,000 from the previous week's revised level. The previous week's level was revised up by 1,000 from 214,000 to 215,000. The 4-week moving average was 211,750, an increase of 2,000 from the previous week's revised average. The previous week's average was revised up by 250 from 209,500 to 209,750.

Regional manufacturing activity continued to grow in October, according to results from this month's Manufacturing Business Outlook Survey. The survey's broad indicators for general activity, new orders, shipments, and employment remained positive and near their readings in September. The firms reported continued growth in employment and an increase in the average workweek this month. Expectations for the next six months remained optimistic.

The diffusion index for current general activity edged down slightly, from 22.9 in September to 22.2 this month.

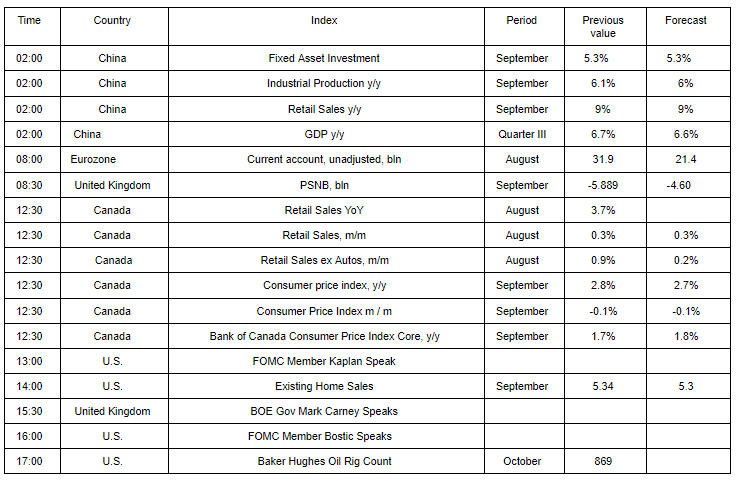

Travelers (TRV) reported Q3 FY 2018 earnings of $2.54 per share (versus $0.91 in Q3 FY 2017), beating analysts' consensus estimate of $2.26.

The company's quarterly revenues amounted to $6.882 bln (+5.5% y/y), generally in-line with analysts' consensus estimate of $6.835 bln.

TRV fell to $124.80 (-1.3%) in pre-market trading.

Oil continues to decline, and it is now down by 10 per cent from its October highs, effectively entering correction territory. It was trading at 0.7 per cent lower on Thursday and was seen near 69.60 USD, where the 100-day moving average stands.

This is the main support for today's trading and if it is removed, the bearish trend could be confirmed with the next target at 67.20 USD, where the 200-day moving average converged with previous lows.

Oil has also broken below the short-term bullish trend line, which confirmed the bearish bias for the near term.

The resistance is located at 71.00 USD today and if the price jumps above this level, we could see a retest of the broken trend line at 72.00 USD. However, if the price breaks below the mentioned 100-day average, stop losses could be hit, which may quickly send oil lower.

Disclaimer:

Analysis and opinions provided herein are intended solely for informational and educational purposes and don't represent a recommendation or an investment advice by TeleTrade. Indiscriminate reliance on illustrative or informational materials may lead to losses

The bullion is currently having trouble breaching the 100-day moving average, which is currently near 1,225 USD. So far, all attempts to push the price up have been unsuccessful and each time the price jumped above this level, gold was sold-off and declined back below 1,225 USD.

The commodity was trading at 1,220 USD during the London session on Thursday and it was down by 0.15 per cent.

The Dollar resumed its uptrend and now seems to be gaining against the Euro and the Yen - which might be considered negative for gold. Therefore, as long as the price remains below the 100-day average at 1,225 USD, the outlook seems neutral.

Bulls need to push the price beyond this level to attack the current swing highs at 1,232 USD. The next target for bulls might be at 1,240 USD, where previous strong support of swing lows is located.

On the downside, the intraday support might be at Friday's lows at 1,216 USD and if this does not hold, we could see further decline toward the key zone near 1,210 USD, where previous highs converged with the broken trend line of the consolidation triangle.

If the price remains above, bulls could still be at an advantage, however, gold needs to push above 1,232 USD to confirm the bullish bias.

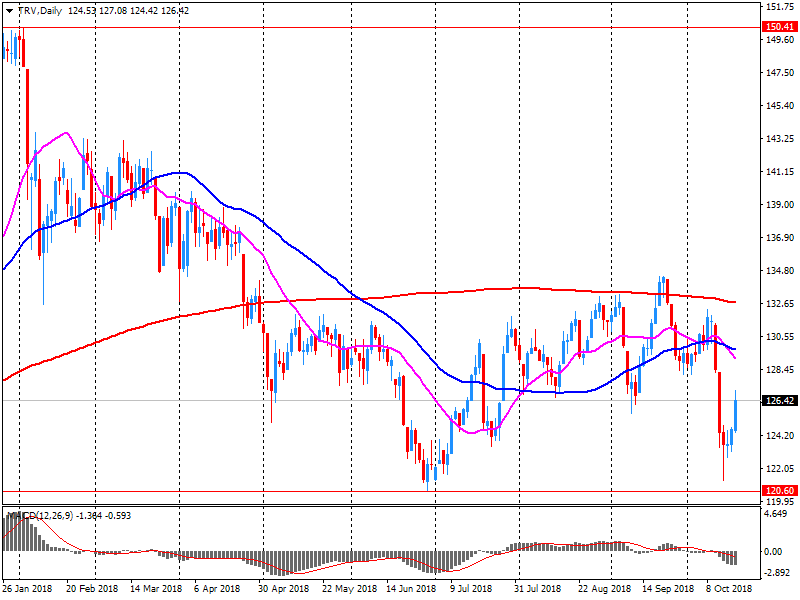

Alcoa (AA) reported Q3 FY 2018 earnings of $0.63 per share (versus $0.72 in Q3 FY 2017), beating analysts' consensus estimate of $0.34.

The company's quarterly revenues amounted to $3.390 bln (+14.4% y/y), beating analysts' consensus estimate of $3.351 bln.

AA rose to $38.90 (+5.99%) in pre-market trading.

-

Would be good if someone form Germany stood for top ECB job

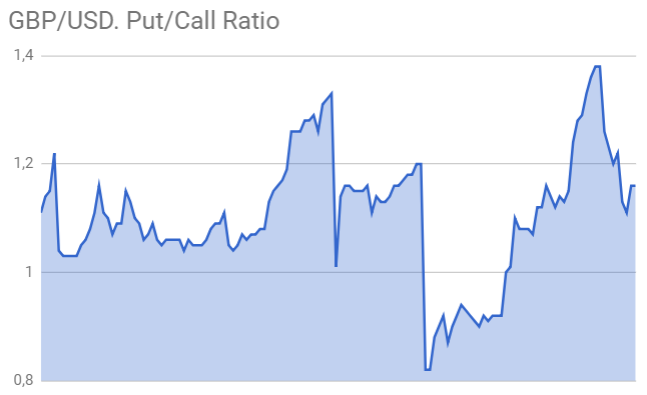

Chris Beauchamp at IG wrote: "Despite a disappointing session in Asia, European markets have seen further buying pressure this morning, as the recovery from the lows continues. Dollar strength following on from last night's Fed minutes has arisen as the bank looks to maintain, and even increase, the pace of tightening, if only to give itself the room for manoeuvre necessary if the economy turns southwards in the coming two years. Markets appear to be viewing the Brexit negotiations with the same exhaustion as everyone else, as both sides play for time.

The risk of wandering into a 'no deal' scenario is still on the rise, with each missed deadline adding to the impression that neither side really knows what they want. Equity markets continue to digest the leap higher from Tuesday, but the put/call ratio continues to climb, indicating that investors have yet to start buying the dip in earnest.

The recent strength in UK consumer spending has come to a close, as retail sales fall 0.8% for September. But with sterling already down sharply over the past two days thanks to the weaker CPI figure and Brexit concerns the impact of this morning's reading has been muted."

In the three months to September 2018, the quantity bought in retail sales increased by 1.2% when compared with the previous three months, with strong sales in "other stores" and online retailing.

The increase of 3.9% for the quantity of goods bought in "other stores" for the three months to September 2018 was the largest overall contributor to the growth in total retail sales, due largely to strong growth in watches and jewellery stores.

In September 2018, the quantity bought declined by 0.8% when compared with August 2018, due mainly to a large fall of 1.5% in food stores; the largest decline in food store sales since October 2015.

When compared with September 2017, the quantity bought in September 2018 increased by 3.0%, with growth across all sectors except department stores.

Online sales as a proportion of all retailing fell slightly to 17.8% in September 2018 from the 18.0% reported

in August 2018, yet food stores and clothing stores both reported record proportions of internet retail at 5.8% and 18.2% respectively.

-

Still Some Issues Remaining On Backstop

-

Could Not Accept Intial EU Proposal

Japan posted a merchandise trade surplus of 139.6 billion yen in September, according to rttnews.

That exceeded expectations for a deficit of 45.1 billion yen following the 444.6 billion yen shortfall in August.

Exports were down 1.2 percent on year, shy of forecasts for an increase of 2.3 percent following the 6.6 percent gain in the previous month.

Imports advanced an annual 7.0 percent versus forecasts for a jump of 13.7 percent after climbing 15.4 percent a month earlier.

-

Staff Projected Slightly Lower Unemployment Rate Over Medium Term

-

Staff Saw Natural Unemployment Rate As 'A Bit Lower' Than Previously Assumed

-

Staff Saw Only 'Small Net Effect' On GDP From China Tariff Dispute

-

Expected GDP Growth 'A Little Slower' In Second Half of 2018 Than First Half

-

Saw Risks to GDP, Unemployment Forecasts as Balanced

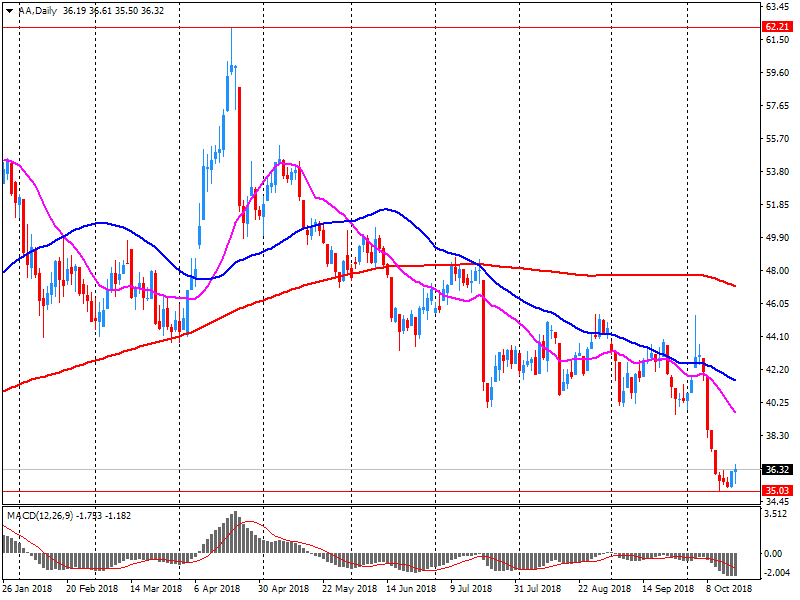

EUR/USD

Resistance levels (open interest**, contracts)

$1.1694 (1940)

$1.1663 (2048)

$1.1618 (544)

Price at time of writing this review: $1.1488

Support levels (open interest**, contracts):

$1.1473 (3344)

$1.1443 (2994)

$1.1408 (3826)

Comments:

- Overall open interest on the CALL options and PUT options with the expiration date November, 19 is 79849 contracts (according to data from October, 17) with the maximum number of contracts with strike price $1,1600 (4430);

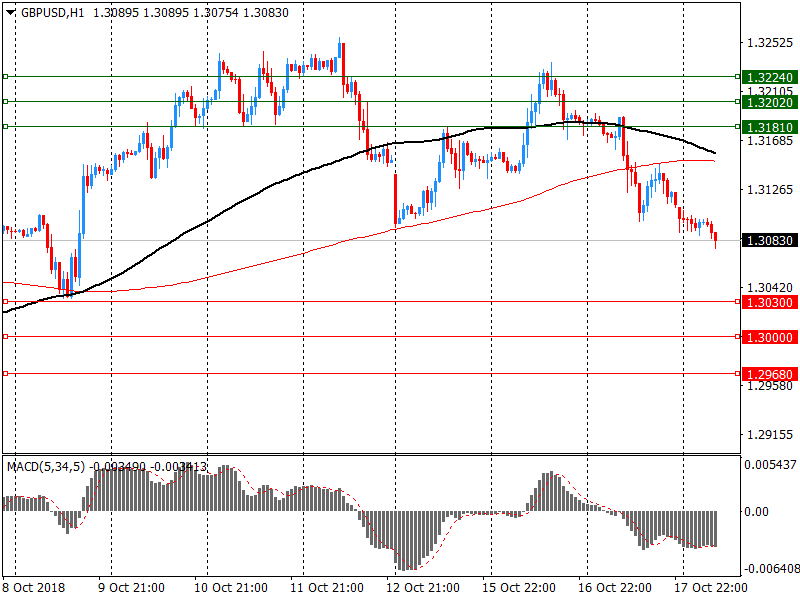

GBP/USD

Resistance levels (open interest**, contracts)

$1.3224 (802)

$1.3202 (388)

$1.3181 (621)

Price at time of writing this review: $1.3083

Support levels (open interest**, contracts):

$1.3030 (512)

$1.3000 (2041)

$1.2968 (1895)

Comments:

- Overall open interest on the CALL options with the expiration date November, 19 is 23343 contracts, with the maximum number of contracts with strike price $1,3500 (3405);

- Overall open interest on the PUT options with the expiration date November, 19 is 27741 contracts, with the maximum number of contracts with strike price $1,3000 (3069);

- The ratio of PUT/CALL was 1.19 versus 1.16 from the previous trading day according to data from October, 17

* - The Chicago Mercantile Exchange bulletin (CME) is used for the calculation.

** - Open interest takes into account the total number of option contracts that are open at the moment.

-

Some Officials Saw Trade Policy as Source of Uncertainty for Growth, Inflation

-

Some Officials Saw Possible Risks To Financial Stability

-

Some Officials Noted Financial Stress in Emerging Markets as Risk to Economy

-

Officials Generally Judged Economy to be Evolving as Anticipated

-

A Few Officials See Rates Becoming Modestly Restrictive For A Time

-

A Couple Officials Opposed Restrictive Policy Without Clear Signs of Overheating, Rising Inflation

-

A Number of Officials See Fiscal Stimulus Effects Fading Over Coming Years

-

A Few Officials Saw Higher Interest Rates Behind Weak Residential Investment

After one and a half years of continuous growth offoreign trade, Swiss Exports declined in the third quarter of 2018 compared to the previous record-high quarter by 2.9 percent. Nevertheless, they remained above the 54 billion franc mark. Imports sank at a high level of 1.5 percent, which corresponds to 768 million Swiss francs. The trade balance resulted in a surplus of 3.5 billion francs. After six quarters of positive growth, exports in the third quarter of 2018 were seasonally adjusted down 2.9 percent on the previous quarter (real: - 2.3 percent).

Trend estimates (monthly change):

Employment increased 26,400 to 12,640,800.

Unemployment decreased 10,500 to 688,500.

Unemployment rate remained steady at 5.2%.

Participation rate remained steady at 65.6%.

Monthly hours worked in all jobs increased 2.8 million hours (0.2%) to 1,755.7 million hours.

Seasonally adjusted estimates (monthly change):

Employment increased 5,600 to 12,636,300. Full-time employment increased 20,300 to 8,654,400 and part-time employment decreased 14,700 to 3,981,900.

Unemployment decreased 37,200 to 665,800. The number of unemployed persons looking for full-time work decreased 38,000 to 449,700 and the number of unemployed persons only looking for part-time work increased 900 to 216,100.

Unemployment rate decreased by 0.3 pts to 5.0%.

Participation rate decreased by 0.2 pts to 65.4%.

Monthly hours worked in all jobs increased 6.2 million hours (0.4%) to 1,757.5 million hours.

As reported by the Federal Statistical Office, the selling prices in wholesale trade increased by 3.5% in September 2018 from the corresponding month of the preceding year. In August 2018 and in July 2018 the annual rates of change were +3.8% and +3.6%, respectively.

From August 2018 to September 2018 the index rose by 0.4%.

© 2000-2026. Bản quyền Teletrade.

Trang web này được quản lý bởi Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

Thông tin trên trang web không phải là cơ sở để đưa ra quyết định đầu tư và chỉ được cung cấp cho mục đích làm quen.

Giao dịch trên thị trường tài chính (đặc biệt là giao dịch sử dụng các công cụ biên) mở ra những cơ hội lớn và tạo điều kiện cho các nhà đầu tư sẵn sàng mạo hiểm để thu lợi nhuận, tuy nhiên nó mang trong mình nguy cơ rủi ro khá cao. Chính vì vậy trước khi tiến hành giao dịch cần phải xem xét mọi mặt vấn đề chấp nhận tiến hành giao dịch cụ thể xét theo quan điểm của nguồn lực tài chính sẵn có và mức độ am hiểu thị trường tài chính.

Sử dụng thông tin: sử dụng toàn bộ hay riêng biệt các dữ liệu trên trang web của công ty TeleTrade như một nguồn cung cấp thông tin nhất định. Việc sử dụng tư liệu từ trang web cần kèm theo liên kết đến trang teletrade.vn. Việc tự động thu thập số liệu cũng như thông tin từ trang web TeleTrade đều không được phép.

Xin vui lòng liên hệ với pr@teletrade.global nếu có câu hỏi.